Individual Fund

Guarantee Fund

(ULIF-048-05/02/10-GRTFND-107)

MONTHLY UPDATE MAY 2025

|

AS ON 30TH APRIL 2025 |

The portfolio will consist of equity, debt and money

market instruments. Asset allocation decisions will be

taken to protect investors.

Date of Inception

05th February 2010

AUM (in Lakhs)

468.25

NAV

32.3430

Fund Manager

Equity : Hemant Kanawala

Debt : Manoj Bharadwaj

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 37.5% (Nifty);

Debt - 62.5% (Crisil Composite Bond)

Modified Duration

Debt & Money

Market Instruments : 0.57

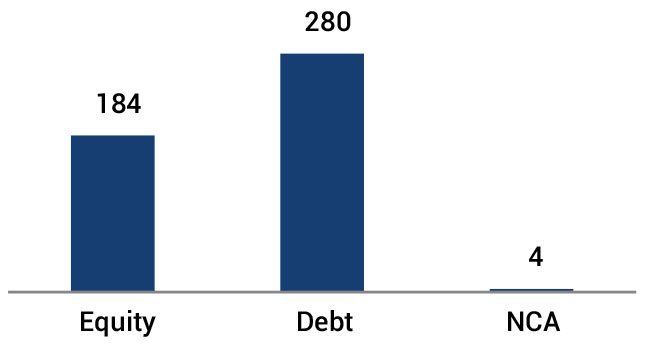

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 00 - 75 | 39 |

| Gsec / Debt | 00 - 100 | 12 |

| MMI / Others | 00 - 100 | 49 |

Performance Meter

| Guarantee Fund (%) | Benchmark (%) | |

| 1 month | 1.0 | 2.4 |

| 3 months | 1.1 | 3.6 |

| 6 months | 0.2 | 3.6 |

| 1 year | 5.7 | 9.8 |

| 2 years | 11.3 | 11.6 |

| 3 years | 8.6 | 9.8 |

| 4 years | 9.0 | 9.3 |

| 5 years | 11.2 | 11.8 |

| 6 years | 8.2 | 10.2 |

| 7 years | 8.1 | 10.0 |

| 10 years | 7.9 | 9.5 |

| Inception | 8.0 | 9.5 |

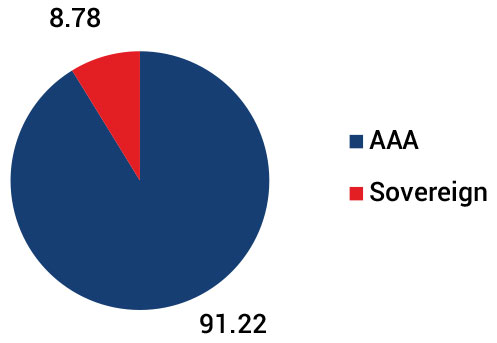

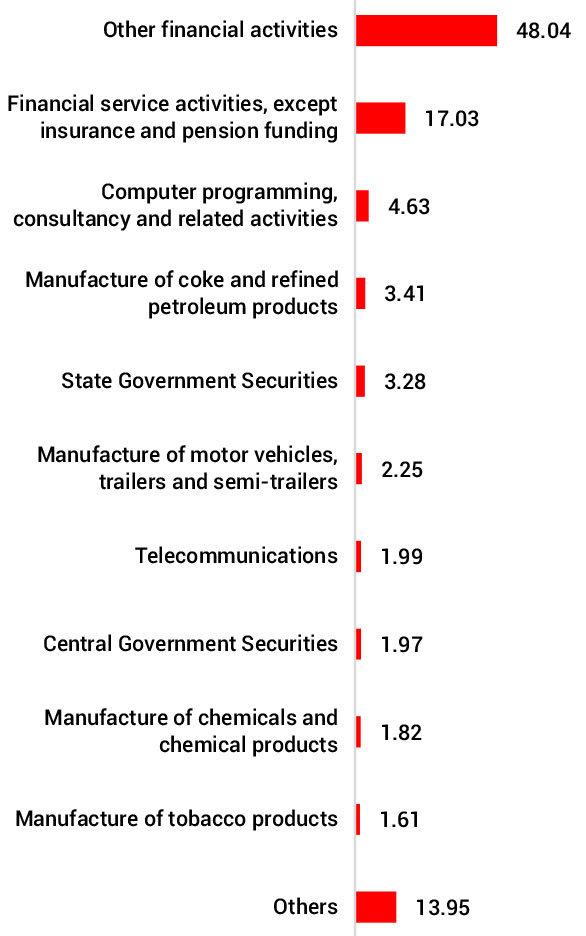

| Holdings | % to Fund |

| Equity | 39.38 |

| HDFC Bank Ltd. | 3.79 |

| Reliance Industries Ltd | 3.41 |

| ICICI Bank Ltd. | 3.07 |

| Infosys Ltd. | 2.06 |

| Bharti Airtel Ltd. | 1.99 |

| I T C Ltd. | 1.61 |

| Larsen And Toubro Ltd. | 1.60 |

| Tata Consultancy Services Ltd. | 1.34 |

| Mahindra & Mahindra Ltd | 1.08 |

| Axis Bank Ltd. | 1.03 |

| State Bank of India. | 0.92 |

| Hindustan Unilever Ltd | 0.90 |

| Sun Pharmaceuticals Ltd | 0.88 |

| National Thermal Power Corporation Ltd | 0.78 |

| ETERNAL LIMITED | 0.77 |

| Bajaj Finance Ltd | 0.66 |

| Maruti Suzuki India Ltd | 0.65 |

| Power Grid Corporation of India Ltd | 0.65 |

| HCL Technologies Ltd | 0.61 |

| Bharat Electronics Ltd. | 0.60 |

| Others | 10.99 |

| G-Sec | 5.26 |

| 7.40% GOI 2035 - 09.09.35 | 0.29 |

| 8.44% RJ SDL - 27.06.2028 | 0.28 |

| 8.32% KA SDL - 06.02.2029 | 0.25 |

| 8.52% KA SDL - 28.11.2028 | 0.24 |

| 8.26% MH SDL -02.01.2029 | 0.23 |

| 6.83% GOI - 19.01.39 | 0.21 |

| 7.20% GJ SDL - 14.06.2027 | 0.19 |

| 8.27% TN SDL - 13.01.2026 | 0.19 |

| 7.18% GOI - 24.07.2037 | 0.16 |

| 8.83% GOI - 12.12.2041 | 0.16 |

| Others | 3.07 |

| Corporate Debt | 6.55 |

| 7.85% PFC - 03.04.2028 | 6.55 |

| MMI | 48.04 |

| NCA | 0.77 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.