Individual Fund

Classic Opportunities Fund

(ULIF-033-16/12/09-CLAOPPFND-107)

MONTHLY UPDATE MAY 2025

|

AS ON 30TH APRIL 2025 |

Aims to maximize opportunity for you through long-term capital growth, by holding a significant portion in a diversified and flexible mix of

large / medium sized company equities

Date of Inception

16th December 2009

AUM (in Lakhs)

13,35,711.38

NAV

66.0167

Fund Manager

Equity : Hemant Kanawala

Debt : Manoj Bharadwaj

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 100% (BSE 200)

Modified Duration

Debt & Money

Market Instruments : 0.01

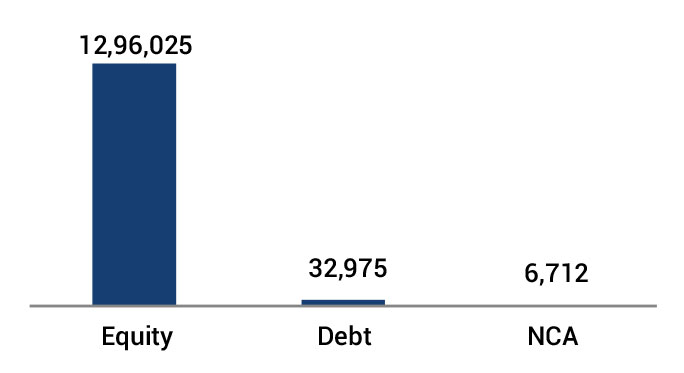

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 75 - 100 | 97 |

| Gsec / Debt | 00 - 25 | 0 |

| MMI / Others | 00 - 25 | 3 |

Performance Meter

| Classic Opportunities Fund (%) | Benchmark (%) | |

| 1 month | 2.9 | 3.3 |

| 3 months | 1.3 | 2.7 |

| 6 months | -3.6 | -1.5 |

| 1 year | 5.4 | 5.7 |

| 2 years | 20.1 | 19.2 |

| 3 years | 14.7 | 13.5 |

| 4 years | 15.2 | 14.8 |

| 5 years | 21.4 | 21.5 |

| 6 years | 14.8 | 14.3 |

| 7 years | 12.9 | 12.8 |

| 10 years | 12.8 | 12.3 |

| Inception | 13.1 | 11.3 |

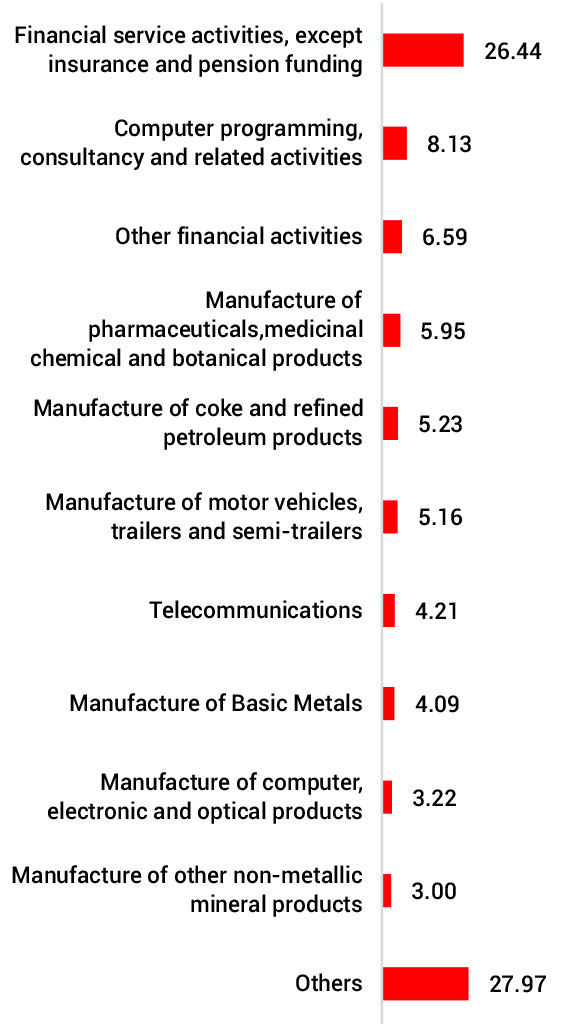

| Holdings | % to Fund |

| Equity | 97.03 |

| ICICI Bank Ltd. | 6.83 |

| HDFC Bank Ltd. | 6.57 |

| Bharti Airtel Ltd. | 4.21 |

| Infosys Ltd. | 3.93 |

| Reliance Industries Ltd | 2.99 |

| Axis Bank Ltd. | 2.84 |

| I T C Ltd. | 2.52 |

| Larsen And Toubro Ltd. | 2.51 |

| State Bank of India. | 2.40 |

| Mahindra & Mahindra Ltd | 2.01 |

| Sun Pharmaceuticals Ltd | 1.97 |

| National Thermal Power Corporation Ltd | 1.95 |

| Bajaj Finance Ltd | 1.73 |

| Tech Mahindra Ltd. | 1.63 |

| Maruti Suzuki India Ltd | 1.56 |

| Power Finance Corporation Ltd | 1.56 |

| ETERNAL LIMITED | 1.53 |

| Bharat Electronics Ltd. | 1.51 |

| Oil & Natural Gas Corporation Ltd | 1.50 |

| Varun Beverages Ltd | 1.48 |

| Others | 43.80 |

| MMI | 2.47 |

| NCA | 0.50 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.