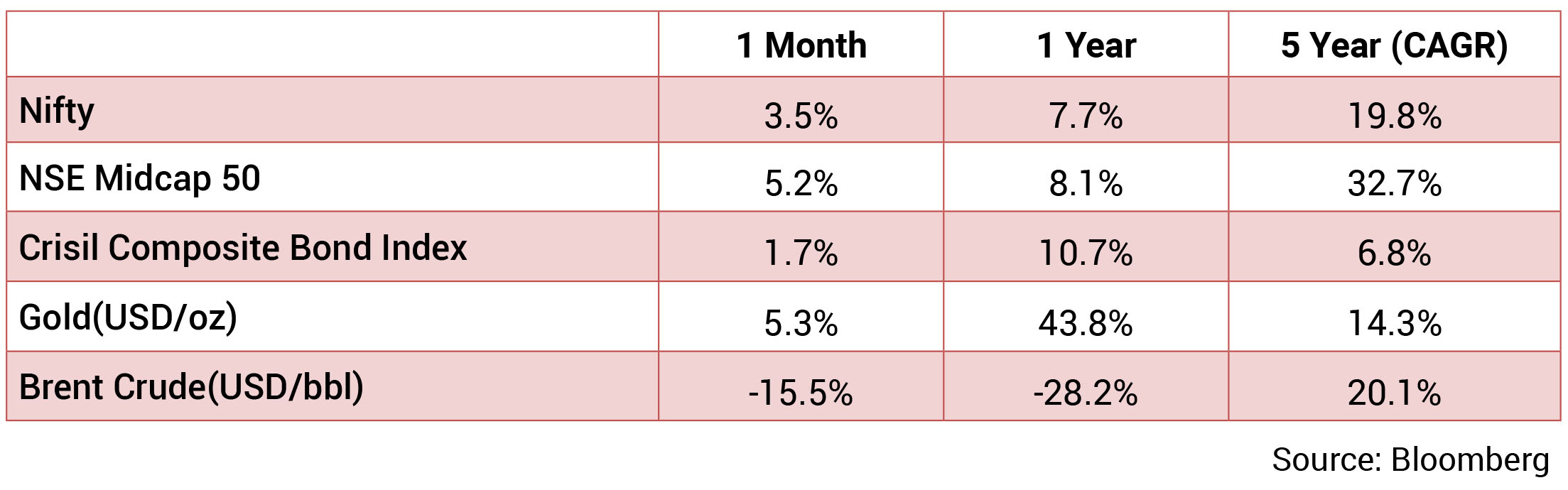

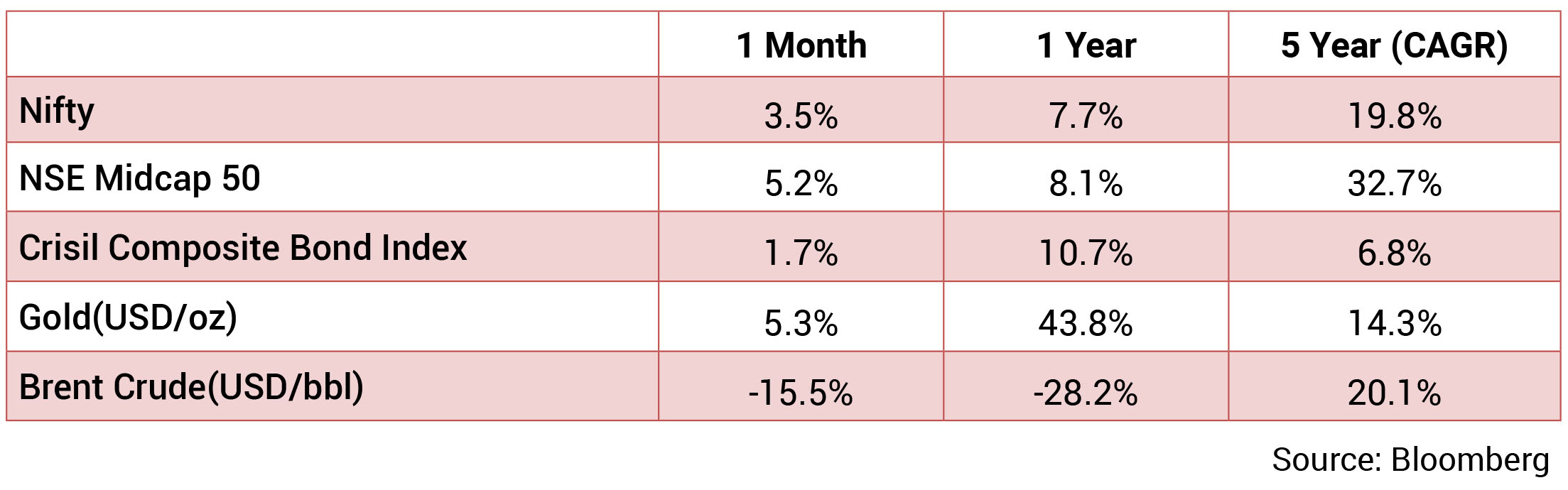

In April, global equities experienced volatility but ended the month slightly positive, with the MSCI World Index rising

0.8% month-over-month, amid ongoing tariff tensions and eventual de-escalation. Among major regions, Japan

and India emerged as top performers, gaining 5.2% and 4.8%, respectively, while China and the USA struggled,

with losses of 4.5% and 0.8%, respectively. Nifty 50 was up 3.5%, closing the month at 24,334 (YTD +2.9%). The

outperformance was supported by Trump’s tariff pause, second interest-rate cut & ongoing cash injections by

RBI - which wiped out a liquidity deficit in the financial system, weaker USD, falling oil prices, foreigners’ growing

optimism about India’s domestic demand and faster economic growth despite the global trade war. However,

heightened uncertainty relating to India-Pakistan tensions weighed on markets over the last one week. Large-caps

rose by 3.4%, while small/mid-caps rose by 1.1%/4.4%, respectively. Majority of the sectors ended the month in the

green except IT and Materials.

Indian benchmark 10-year treasury yields averaged 6.40% in April (much lower than the Mar average of 6.67%). On month-end values, the 10Y yield was lower and ended the month at 6.36% (down 22bps MoM). The U.S. 10Y yield closed the month at 4.16% (6bps lower MoM). INR appreciated 1.1% over the month and ended the month at 84.49/ USD, with one-year depreciation at 1.2% now. Oil prices were down by 18% in Apr, following a rise of 5% in Mar. Brent currently trades at $61, having ended at $74.7 as of end-Mar.

Global markets were volatile, driven largely by developments in U.S. trade policy. Early in the month, President Trump announced a set of tariffs that were broader and more punitive than anticipated, sparking concerns about a potential escalation into a full-scale trade war. These policy shifts created significant uncertainty across global financial markets, impacting stocks, bonds, and currencies alike. Equity markets experienced sharp swings as investors weighed the potential economic fallout, while bond yields fluctuated in response to shifting risk sentiment. Currency markets also responded, with the U.S. dollar experiencing periods of both strength and weakness as investors reassessed the economic and geopolitical landscape. Gold was the big beneficiary of April’s uncertainty, marking a new all-time high at $3,500.

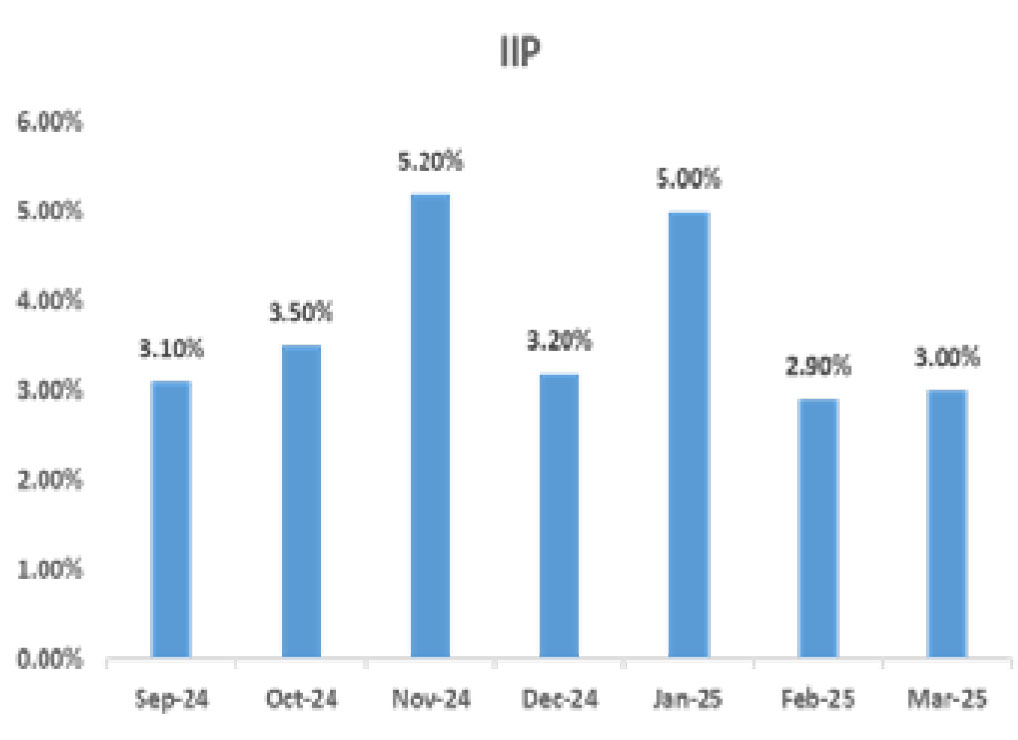

The Indian economy continues to show resilience amid global challenges, supported by strong sectoral performance and improving consumption trends. IMF in its economic outlook slashed growth projections for most countries, including India, in the backdrop of trade tensions fueled by US-imposed tariffs and global uncertainty. India’s growth forecast has been cut only by 0.3 percentage points to 6.2 per cent from 6.5 per cent for the FY25-26. Government spending has picked up significantly in recent months, providing a further fillip to growth. Key sectors, including construction, financial services, and trade, continue to thrive as pillars of economic resilience. Various high-frequency indicators of economic activity point towards a sustained momentum in growth during Q4 as well.

Indian benchmark 10-year treasury yields averaged 6.40% in April (much lower than the Mar average of 6.67%). On month-end values, the 10Y yield was lower and ended the month at 6.36% (down 22bps MoM). The U.S. 10Y yield closed the month at 4.16% (6bps lower MoM). INR appreciated 1.1% over the month and ended the month at 84.49/ USD, with one-year depreciation at 1.2% now. Oil prices were down by 18% in Apr, following a rise of 5% in Mar. Brent currently trades at $61, having ended at $74.7 as of end-Mar.

Global markets were volatile, driven largely by developments in U.S. trade policy. Early in the month, President Trump announced a set of tariffs that were broader and more punitive than anticipated, sparking concerns about a potential escalation into a full-scale trade war. These policy shifts created significant uncertainty across global financial markets, impacting stocks, bonds, and currencies alike. Equity markets experienced sharp swings as investors weighed the potential economic fallout, while bond yields fluctuated in response to shifting risk sentiment. Currency markets also responded, with the U.S. dollar experiencing periods of both strength and weakness as investors reassessed the economic and geopolitical landscape. Gold was the big beneficiary of April’s uncertainty, marking a new all-time high at $3,500.

The Indian economy continues to show resilience amid global challenges, supported by strong sectoral performance and improving consumption trends. IMF in its economic outlook slashed growth projections for most countries, including India, in the backdrop of trade tensions fueled by US-imposed tariffs and global uncertainty. India’s growth forecast has been cut only by 0.3 percentage points to 6.2 per cent from 6.5 per cent for the FY25-26. Government spending has picked up significantly in recent months, providing a further fillip to growth. Key sectors, including construction, financial services, and trade, continue to thrive as pillars of economic resilience. Various high-frequency indicators of economic activity point towards a sustained momentum in growth during Q4 as well.

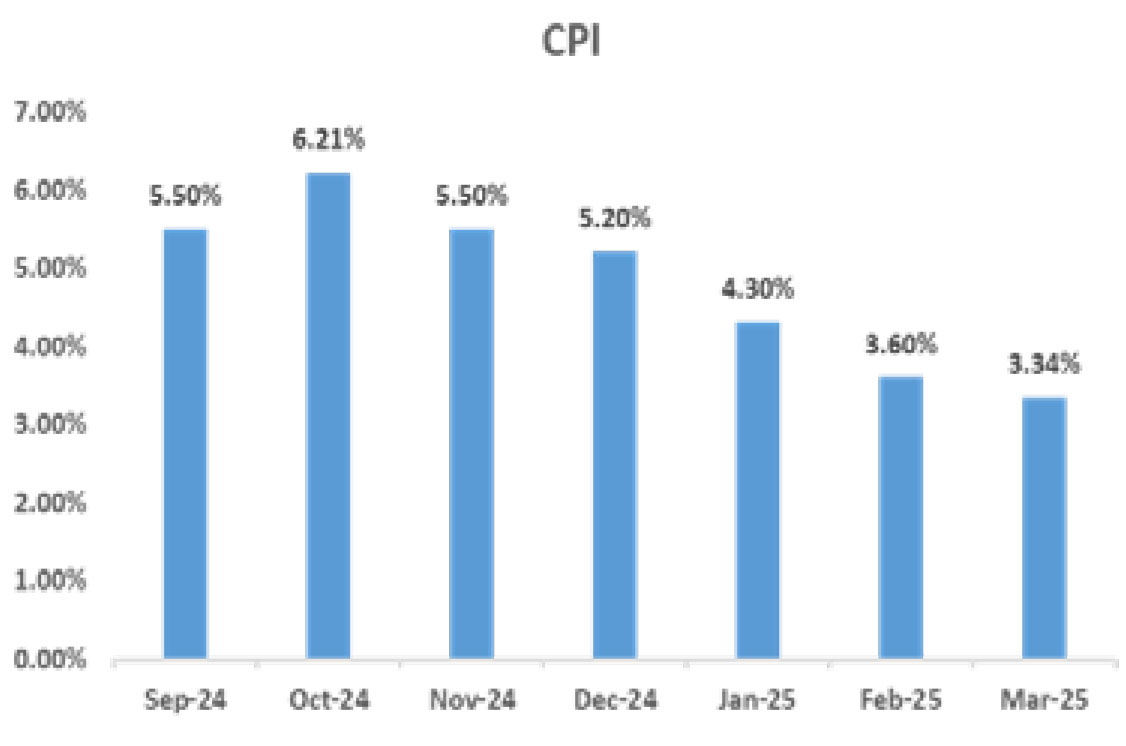

CPI: India’s CPI for March recorded a nearly six-year low of 3.3% YoY, signaling easing inflationary pressures. Sequentially,

headline prices remained flat, with food prices contracting by 0.4% m/m in March. The decline in food prices was broad-based,

led by a sharp 6% m/m drop in vegetable prices. This softness in food prices was partly attributed to expectations of a healthy

rabi crop, which should help keep food price momentum contained. Wheat prices, which had previously risen due to production

concerns, stabilized in March as expectations for good wheat production grew. On a YoY basis, food inflation eased to 2.9% in

March, down from 3.8% in February. Meanwhile, core inflation rose to 4.0% YoY in March, driven primarily by higher gold prices.

Trade: India’s trade deficit widened significantly to $21.54 billion in March, up from a three-year low of $14.05 billion in February. Merchandise exports for FY25 reached $437.42 billion, slightly surpassing the previous year’s $437.07 billion. Meanwhile, goods imports rose to $720.24 billion in FY25, up from $678.21 billion in FY24. In March alone, goods exports amounted to $41.97 billion, while imports stood at $63.51 billion, compared to $36.91 billion in exports and $50.96 billion in imports in February. This sharp rise in the trade deficit was primarily driven by a significant increase in imports, particularly in March.

BOP: The Balance of Payments (BOP) deficit surged to a historical high of US$37.7bn in Q3, driven by significant capital outflows. Net capital flows turned negative at -US$26.8bn, with outflows in Foreign Portfolio Investments (FPI) and Foreign Direct Investments (FDI), banking capital, and other capital. FPI outflows were primarily in equities due to rising UST yields and risk-off sentiment following the change in the US government. Banking capital outflows were linked to NOSTRO accounts, foreign currency loans to residents and non-residents, and related assets. Other capital outflows, amounting to US$11.7bn, included export receipt timing, India’s subscription to international institutions, and SDR allocations. FDI flows, usually stable, turned negative due to higher repatriation and Indian investments abroad. This sharp rise in outflows contributed to pressure on the INR, despite the current account deficit remaining low.

Trade: India’s trade deficit widened significantly to $21.54 billion in March, up from a three-year low of $14.05 billion in February. Merchandise exports for FY25 reached $437.42 billion, slightly surpassing the previous year’s $437.07 billion. Meanwhile, goods imports rose to $720.24 billion in FY25, up from $678.21 billion in FY24. In March alone, goods exports amounted to $41.97 billion, while imports stood at $63.51 billion, compared to $36.91 billion in exports and $50.96 billion in imports in February. This sharp rise in the trade deficit was primarily driven by a significant increase in imports, particularly in March.

BOP: The Balance of Payments (BOP) deficit surged to a historical high of US$37.7bn in Q3, driven by significant capital outflows. Net capital flows turned negative at -US$26.8bn, with outflows in Foreign Portfolio Investments (FPI) and Foreign Direct Investments (FDI), banking capital, and other capital. FPI outflows were primarily in equities due to rising UST yields and risk-off sentiment following the change in the US government. Banking capital outflows were linked to NOSTRO accounts, foreign currency loans to residents and non-residents, and related assets. Other capital outflows, amounting to US$11.7bn, included export receipt timing, India’s subscription to international institutions, and SDR allocations. FDI flows, usually stable, turned negative due to higher repatriation and Indian investments abroad. This sharp rise in outflows contributed to pressure on the INR, despite the current account deficit remaining low.

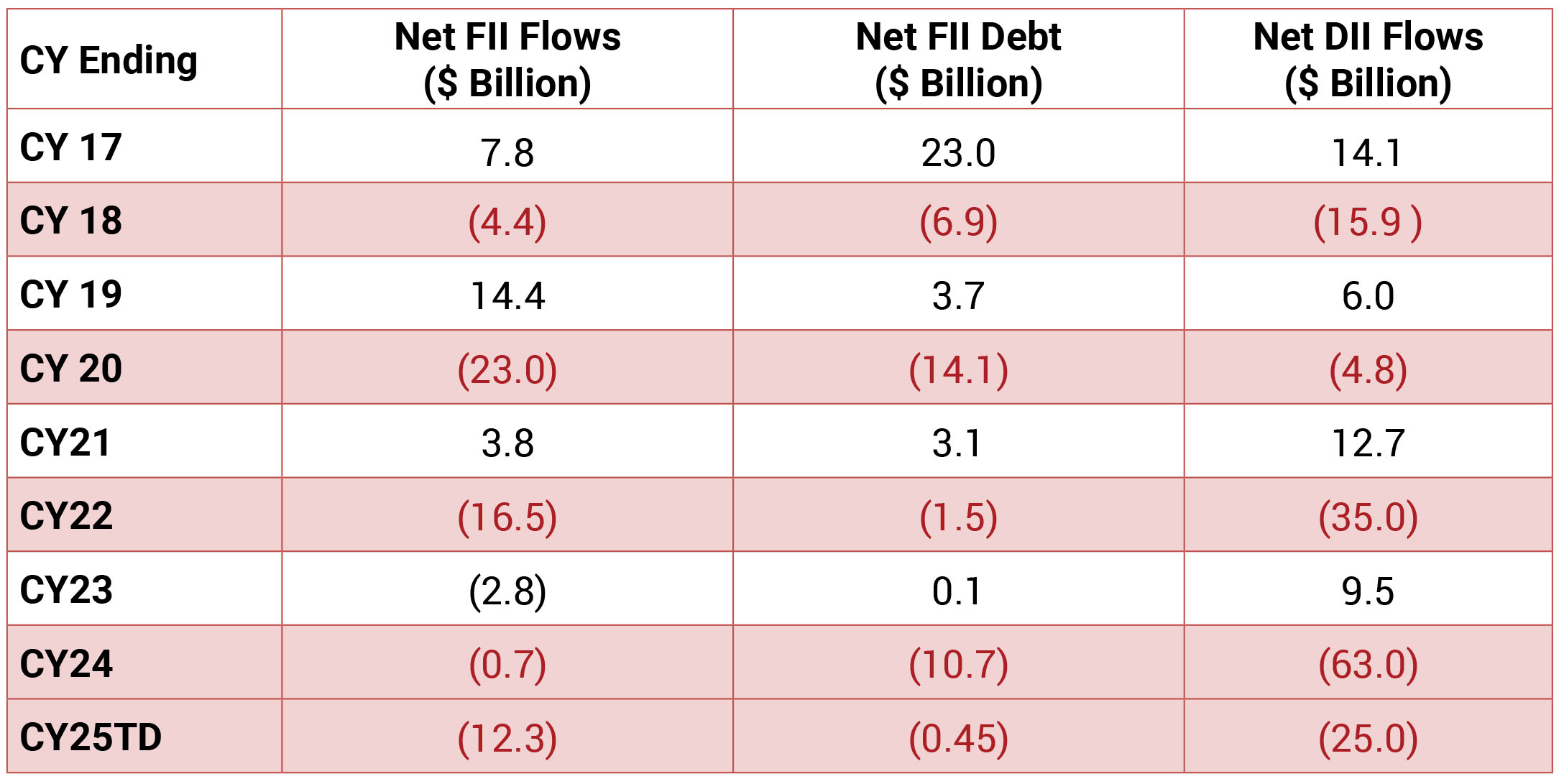

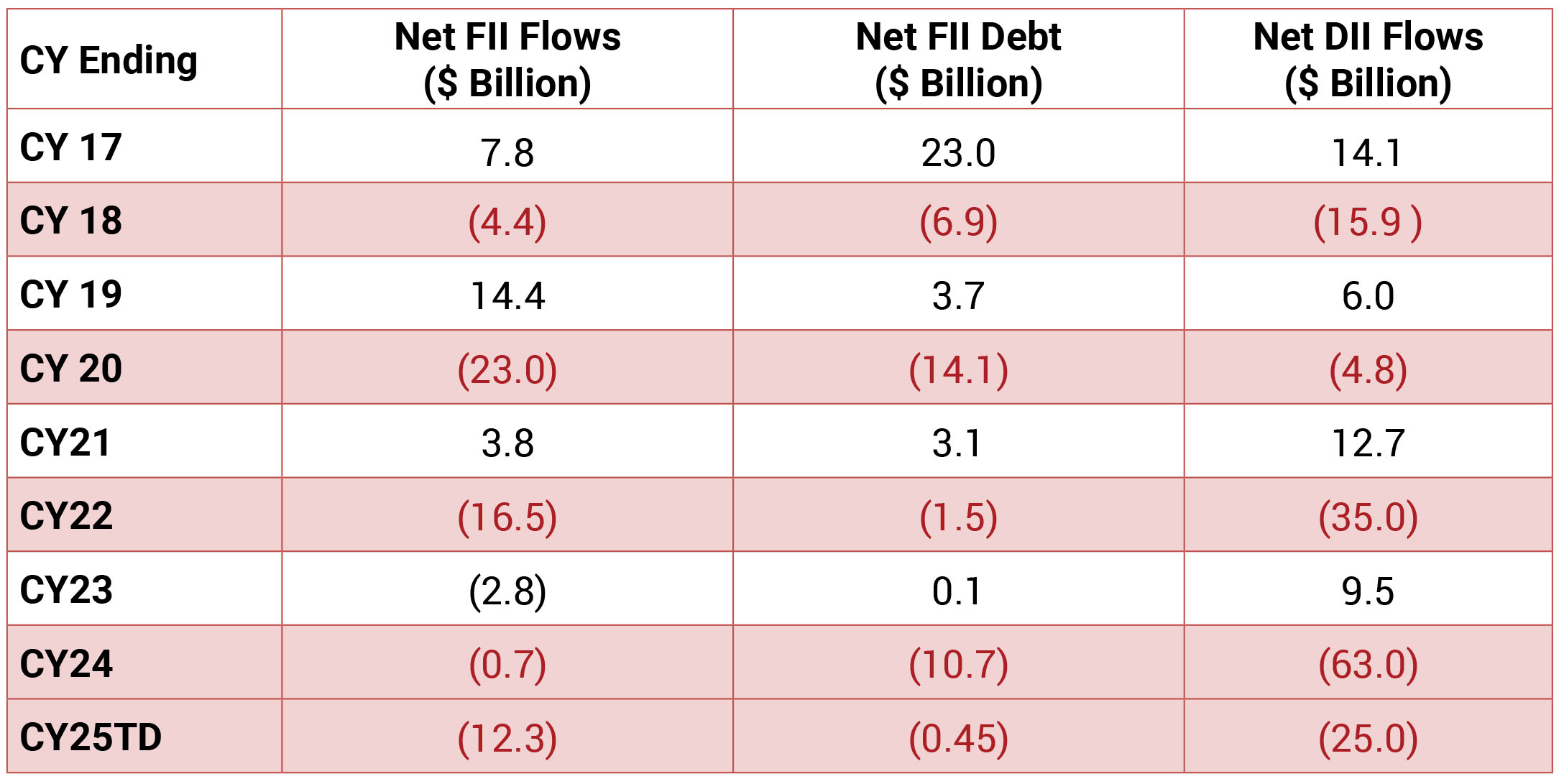

In the first half of the month, Foreign Institutional Investors (FIIs) sold $2.4 billion in Indian markets due to uncertainty

surrounding tariffs. However, after the tariff pause and given India’s relatively insulated market position, FIIs turned net buyers

in the second half, with strong inflows of $3.7 billion. This surge in FII buying even surpassed the Domestic Institutional

Investors (DII) buying during the same period. In contrast, FIIs turned net sellers in the debt market, with $2.8 billion sold,

reversing the $3.7 billion of net buying seen in March. DIIs remained net buyers for the 21st consecutive month, with moderate

inflows of $3.3bn in April (vs inflows of $4.3bn in Mar). Mutual funds were net buyers in Mar, with inflows of +$1.6bn (vs

+$1.6bn in Mar). Insurance funds were also net buyers in the month, with inflows of +$1.7bn (vs+$2.8bn in Mar).