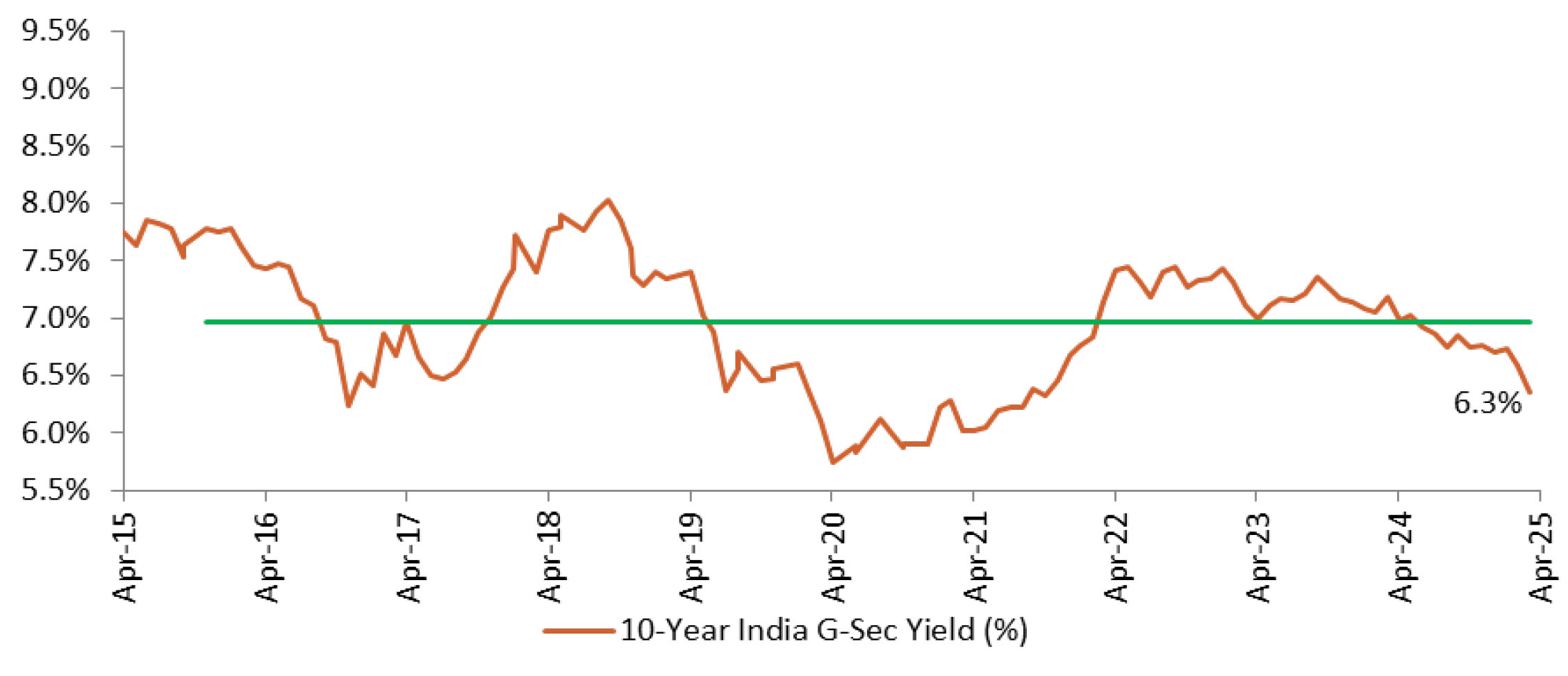

The RBI’s aggressive liquidity easing measures suggest a strong intent on ensuring smooth monetary transmission as it continues on its rate easing path. Based on our estimates of muted FY2026 growth and a comfortable inflation trajectory, we continue to expect 25-50 bps of rate cut in FY2026. However, uncertainties related to tariff measures announced by the Trump-led US administration (and consequently repricing of the Fed’s rate cut cycle) along with geopolitics-led supply-side disruptions pose headwinds to the outlook. We expect the yields to move lower supported by easing liquidity conditions and rate cut expectations amidst continued fiscal consolidation.