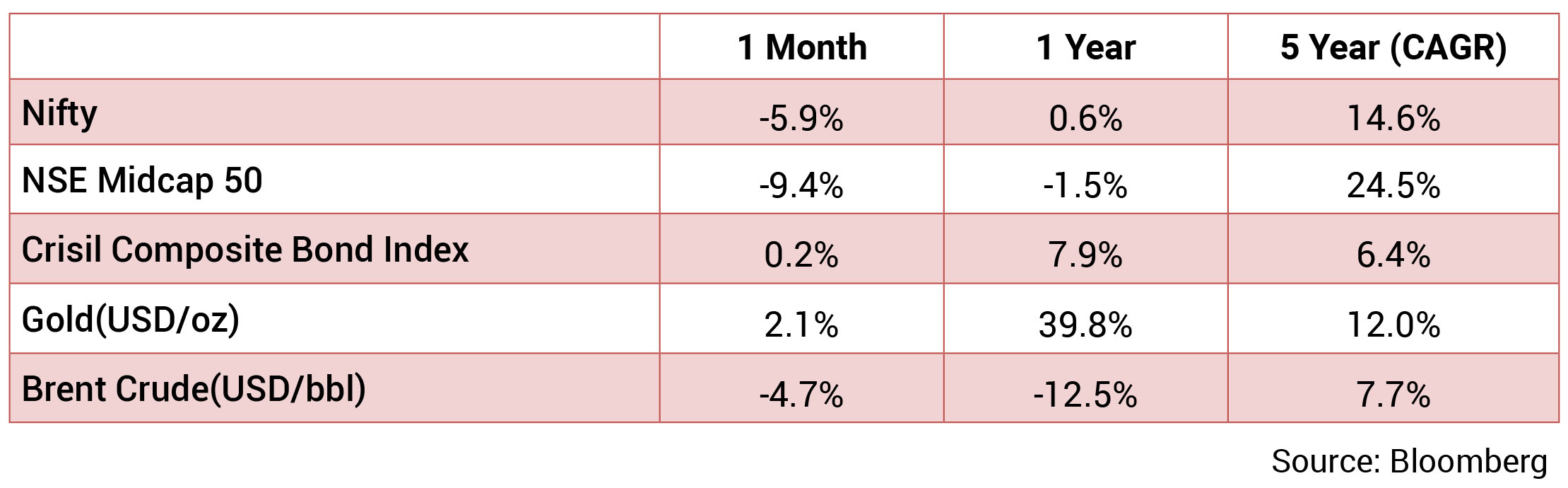

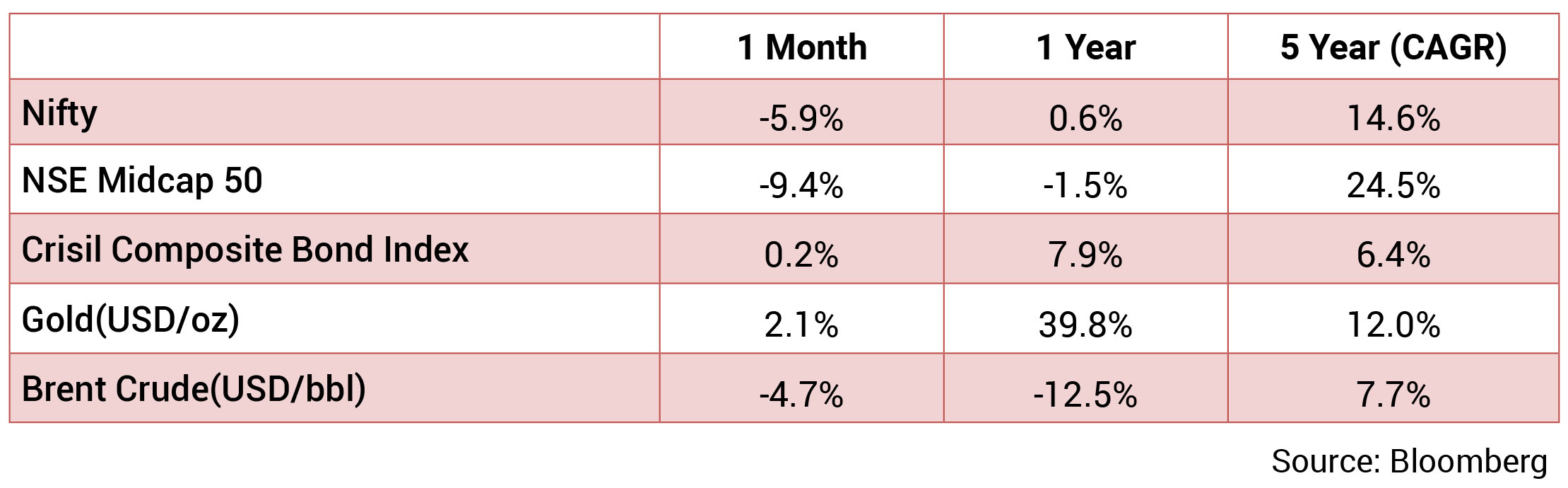

Global equities experienced a modest decline, with MSCI China and the Eurozone emerging as the leading

performers, registering gains of 11.8% and 3.5%, respectively. In contrast, India and Brazil lagged, with India’s Nifty

50 index recording its fifth consecutive monthly loss—the longest streak in nearly three decades. This downturn

was primarily driven by sustained FII selling, subdued corporate earnings, uncertainty around tariffs under Trump

2.0, and domestic growth concerns. Despite positive factors such as tax relief measures in the budget, a rate

cut by the Reserve Bank of India (RBI), and other liquidity support actions, the Nifty 50 ended the month down

5.9%, closing at 22,125. Large-cap stocks fell by 6.5%, while mid and small-cap indices dropped 10.8% and 13.1%,

respectively. All sectors ended the month in negative territory, with Financials showing relatively less losses at

-1.4%, while Real Estate (-12.8%), IT (-12.1%), and Industrials (-11.8%) experienced significant selloffs.

Benchmark 10-year government bond yields averaged 6.70% in Feb (a tad lower than the Jan average of 6.75%). On month-end values, the 10Y yield was a bit higher and ended the month at 6.73% (up 3 bps MoM). The US 10Y yield is at 4.21% (lower by 33 bps MoM). INR depreciated 1.0% over the month and ended the month at 87.51/USD, with one-year depreciation at 5.3%. Oil prices fell 4.6% in February and ended the month at 73.4 USD/barrel.

The global economic environment remains volatile amidst continued trade tensions. Global disinflation has recently stalled due to persistent services price inflation. But expectations of incremental easing in the US are starting to build again on the back of softening in growth-related parameters. This is evidenced in the recent fall in US Treasury yields and a slightly softer dollar. On the other hand, emerging markets like India continue to face capital outflows and the currency has remained under some pressure.

In India, the first advance estimates project real GDP growth for the current year at 6.4%, reflecting a softer expansion compared to last year’s robust 8.2% growth. Looking ahead, economic activity is expected to improve in the coming year. Agricultural performance remains strong, driven by healthy reservoir levels and positive rabi prospects. On the demand side, rural demand continues to rise, while urban consumption shows mixed signals, with high-frequency indicators offering varied readings. However, improving employment conditions, tax relief from the Union Budget, moderating inflation, and strong agricultural activity are expected to support household consumption going forward.

Benchmark 10-year government bond yields averaged 6.70% in Feb (a tad lower than the Jan average of 6.75%). On month-end values, the 10Y yield was a bit higher and ended the month at 6.73% (up 3 bps MoM). The US 10Y yield is at 4.21% (lower by 33 bps MoM). INR depreciated 1.0% over the month and ended the month at 87.51/USD, with one-year depreciation at 5.3%. Oil prices fell 4.6% in February and ended the month at 73.4 USD/barrel.

The global economic environment remains volatile amidst continued trade tensions. Global disinflation has recently stalled due to persistent services price inflation. But expectations of incremental easing in the US are starting to build again on the back of softening in growth-related parameters. This is evidenced in the recent fall in US Treasury yields and a slightly softer dollar. On the other hand, emerging markets like India continue to face capital outflows and the currency has remained under some pressure.

In India, the first advance estimates project real GDP growth for the current year at 6.4%, reflecting a softer expansion compared to last year’s robust 8.2% growth. Looking ahead, economic activity is expected to improve in the coming year. Agricultural performance remains strong, driven by healthy reservoir levels and positive rabi prospects. On the demand side, rural demand continues to rise, while urban consumption shows mixed signals, with high-frequency indicators offering varied readings. However, improving employment conditions, tax relief from the Union Budget, moderating inflation, and strong agricultural activity are expected to support household consumption going forward.

Union Budget: The budget has taken a cautious approach to the fiscal situation, with the fiscal deficit targeted at 4.4% of GDP for FY26,

a reduction from 4.8% in FY25. The fiscal deficit for the current FY25 has been revised down from 4.9% to 4.8%. Gross borrowing is set to

grow marginally to INR 14.8 trillion, up from INR 14 trillion in FY25. A major focus of the budget was the income tax relief, which is expected

to provide a significant boost of INR 1 trillion to middle-income households. This tax relief is likely to enhance consumption and, in turn,

increase GST collections, with indirect tax revenues projected to grow by 8.3% YoY in FY26, compared to 7.1% in FY25.

Additionally, the government expects substantial dividends from the Reserve Bank of India (RBI) and other public sector enterprises, which will help cushion the revenue shortfall. Capital expenditure growth has been revised down to 7.3% for FY25, significantly lower than the budgeted 17%, but it is expected to rise by 10.1% in FY26 over the revised estimates for FY25. The government has also shifted its fiscal focus from fiscal deficit to debt-to-GDP ratio, with a goal of reducing the debt-GDP ratio to 50% by March 2031, from the current level of 57.5%.

RBI MPC: The Monetary Policy Committee (MPC) reduced the policy repo rate by 25 basis points (bps) for the first time in five years during its February 2025 policy meeting. This decision comes as part of the RBI’s efforts to stimulate growth in the domestic economy, which has shown signs of a slowdown in the previous quarter. The MPC’s move aims to support economic activity amidst ongoing challenges, with the easing of inflationary pressures, particularly in food prices, providing the necessary policy space to implement growth-focused measure. The RBI projects FY26 growth at 6.7% YoY, while revising its Q1 and Q2 growth projections down by 20 and 30 basis points to 6.7% YoY and 7% YoY, respectively, compared to December 2024 forecasts. The RBI retained FY25 CPI at 4.8% YoY and expects FY26 CPI at 4.2% YoY. The RBI recognized the liquidity strain in the system on the back of advance tax payments, capital outflow, and forex operations and it acknowledged the need to be responsive to the needs of the banking system and indicated readiness to act when required.

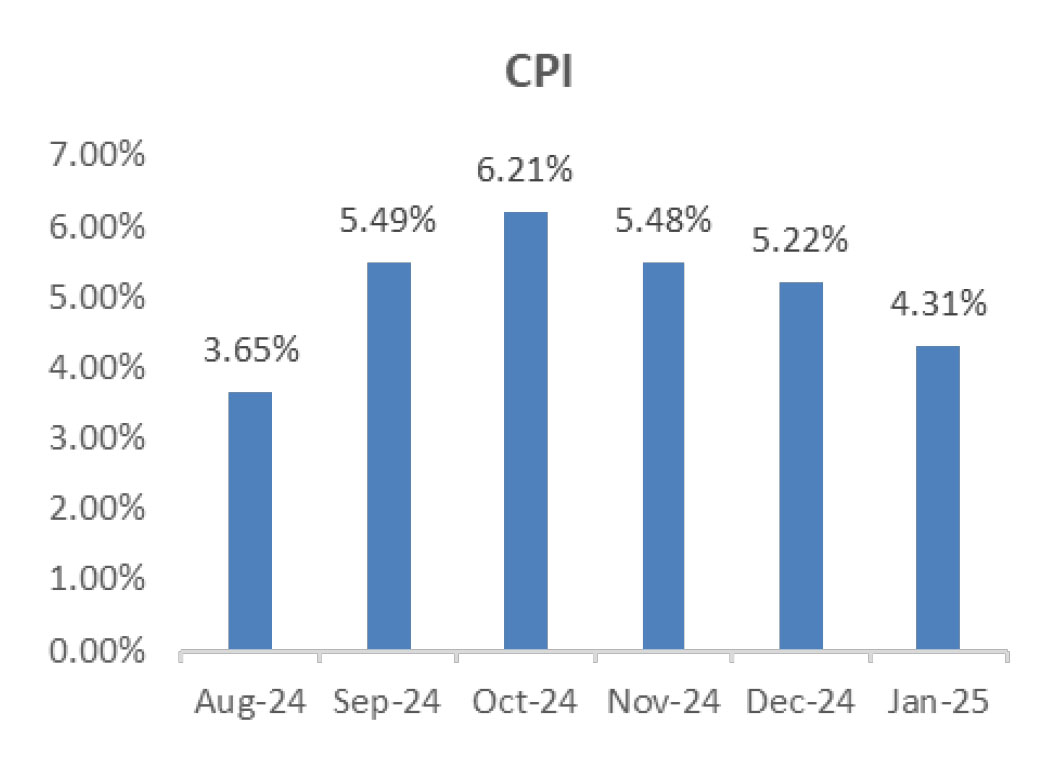

CPI: The January CPI decelerated to 4.3% from 5.2% in December. On a month-on-month basis, the headline CPI dropped by 0.3%, primarily driven by a slowdown in food price growth, which fell by 0.9%. Vegetable prices saw the largest decline, dropping 16%, and the overall slowdown in food prices was broad-based. Prices of pulses continued to decrease, while the rate of increase in oilseed prices also moderated. Core-core prices edged up by 0.4% month-on-month, primarily due to higher gold prices. On a YoY basis, core-core inflation slightly increased to 4.0% in January from 3.9% in December.

Trade: The merchandise trade deficit widened in January to US$23 billion, up from US$21.9 billion in December, primarily driven by a US$1.6 billion decline in exports, mainly due to lower oil exports. Gold imports moderated to US$2.7 billion in January from US$4.7 billion in December. On a FYTD basis, the trade deficit in FY25 has increased to US$243 billion (April-January) compared to US$206 billion in the same period of FY24, driven by higher crude oil and gold imports. Net crude oil imports rose to US$100.4 billion, reflecting higher volumes and lower discounts on Russian imports. The services surplus remained robust at US$20.3 billion in January, up from US$19.1 billion in December.

GDP: Q3FY25 GDP growth stood at 6.2% YoY, compared to 5.6% YoY in Q2FY25 (revised from 5.4%). The manufacturing sector saw a rebound with GVA growth rising to 3.5% in Q3FY25, up from 2.1% in Q2, reflecting improved profit growth in non-financial listed companies due to lower input costs. The services sector also maintained its momentum, supported by trade, hotels, and transportation. Agriculture growth reached a six-quarter high, driven by a strong kharif crop. Core GDP, excluding agriculture and public services, showed a more moderate improvement at 5.9% in Q3FY25, up from 5.6% in Q2, highlighting the ongoing need for policy support.

On the expenditure front, private consumption growth accelerated to 6.9% YoY in Q3FY25, up from 5.9% in Q2, likely driven by a recovery in rural demand, supported by strong crop output and higher rural wage growth. Urban demand also picked up in Q3, although the growth was more moderate. The investment-to-GDP ratio fell to a three-year low of 31.9% in Q3FY25, despite a 47.7% increase in nominal capital expenditure by the Centre, reflecting ongoing weakness in private corporate investment and potential moderation in household investment in real estate

Additionally, the government expects substantial dividends from the Reserve Bank of India (RBI) and other public sector enterprises, which will help cushion the revenue shortfall. Capital expenditure growth has been revised down to 7.3% for FY25, significantly lower than the budgeted 17%, but it is expected to rise by 10.1% in FY26 over the revised estimates for FY25. The government has also shifted its fiscal focus from fiscal deficit to debt-to-GDP ratio, with a goal of reducing the debt-GDP ratio to 50% by March 2031, from the current level of 57.5%.

RBI MPC: The Monetary Policy Committee (MPC) reduced the policy repo rate by 25 basis points (bps) for the first time in five years during its February 2025 policy meeting. This decision comes as part of the RBI’s efforts to stimulate growth in the domestic economy, which has shown signs of a slowdown in the previous quarter. The MPC’s move aims to support economic activity amidst ongoing challenges, with the easing of inflationary pressures, particularly in food prices, providing the necessary policy space to implement growth-focused measure. The RBI projects FY26 growth at 6.7% YoY, while revising its Q1 and Q2 growth projections down by 20 and 30 basis points to 6.7% YoY and 7% YoY, respectively, compared to December 2024 forecasts. The RBI retained FY25 CPI at 4.8% YoY and expects FY26 CPI at 4.2% YoY. The RBI recognized the liquidity strain in the system on the back of advance tax payments, capital outflow, and forex operations and it acknowledged the need to be responsive to the needs of the banking system and indicated readiness to act when required.

CPI: The January CPI decelerated to 4.3% from 5.2% in December. On a month-on-month basis, the headline CPI dropped by 0.3%, primarily driven by a slowdown in food price growth, which fell by 0.9%. Vegetable prices saw the largest decline, dropping 16%, and the overall slowdown in food prices was broad-based. Prices of pulses continued to decrease, while the rate of increase in oilseed prices also moderated. Core-core prices edged up by 0.4% month-on-month, primarily due to higher gold prices. On a YoY basis, core-core inflation slightly increased to 4.0% in January from 3.9% in December.

Trade: The merchandise trade deficit widened in January to US$23 billion, up from US$21.9 billion in December, primarily driven by a US$1.6 billion decline in exports, mainly due to lower oil exports. Gold imports moderated to US$2.7 billion in January from US$4.7 billion in December. On a FYTD basis, the trade deficit in FY25 has increased to US$243 billion (April-January) compared to US$206 billion in the same period of FY24, driven by higher crude oil and gold imports. Net crude oil imports rose to US$100.4 billion, reflecting higher volumes and lower discounts on Russian imports. The services surplus remained robust at US$20.3 billion in January, up from US$19.1 billion in December.

GDP: Q3FY25 GDP growth stood at 6.2% YoY, compared to 5.6% YoY in Q2FY25 (revised from 5.4%). The manufacturing sector saw a rebound with GVA growth rising to 3.5% in Q3FY25, up from 2.1% in Q2, reflecting improved profit growth in non-financial listed companies due to lower input costs. The services sector also maintained its momentum, supported by trade, hotels, and transportation. Agriculture growth reached a six-quarter high, driven by a strong kharif crop. Core GDP, excluding agriculture and public services, showed a more moderate improvement at 5.9% in Q3FY25, up from 5.6% in Q2, highlighting the ongoing need for policy support.

On the expenditure front, private consumption growth accelerated to 6.9% YoY in Q3FY25, up from 5.9% in Q2, likely driven by a recovery in rural demand, supported by strong crop output and higher rural wage growth. Urban demand also picked up in Q3, although the growth was more moderate. The investment-to-GDP ratio fell to a three-year low of 31.9% in Q3FY25, despite a 47.7% increase in nominal capital expenditure by the Centre, reflecting ongoing weakness in private corporate investment and potential moderation in household investment in real estate

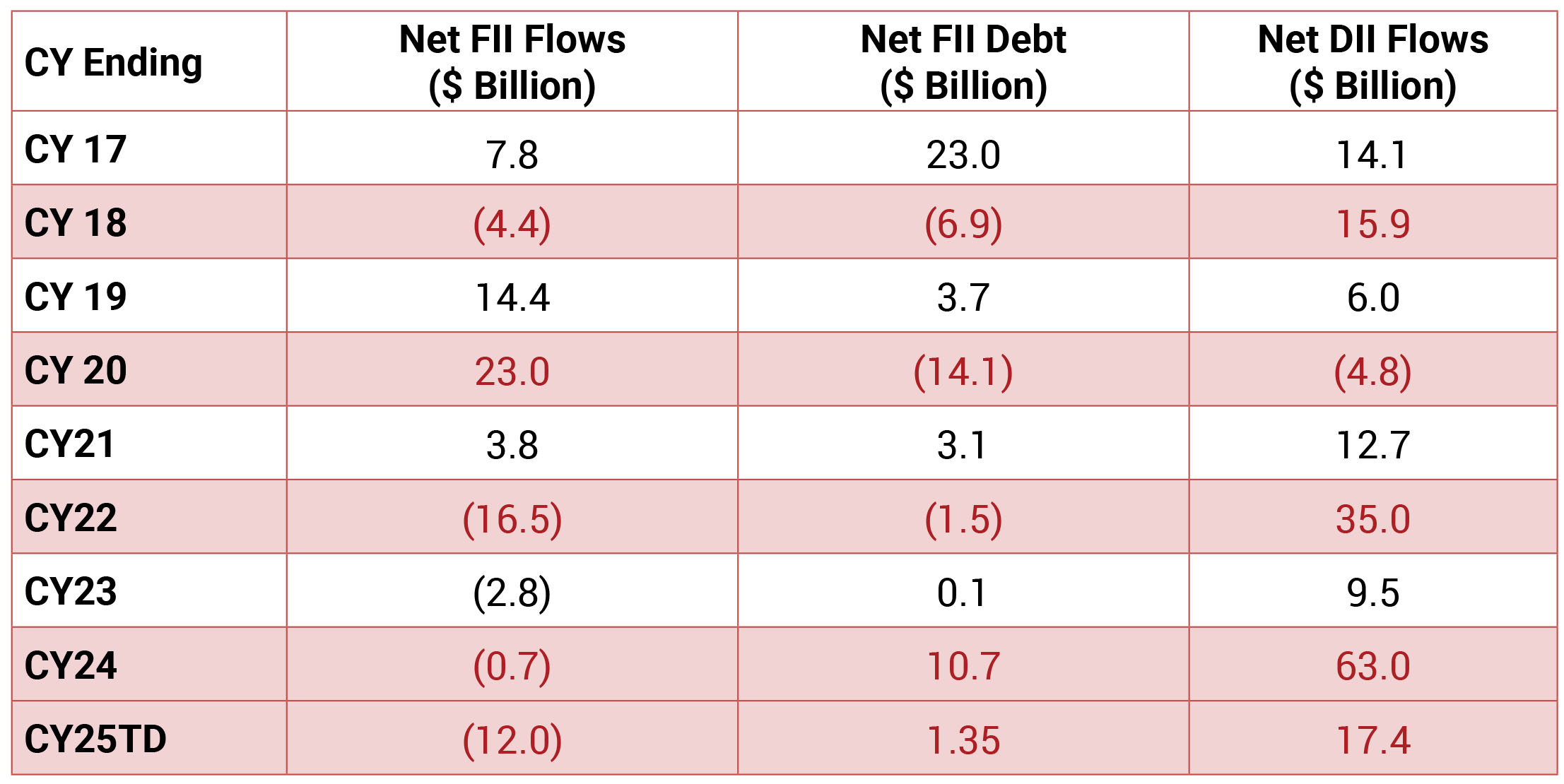

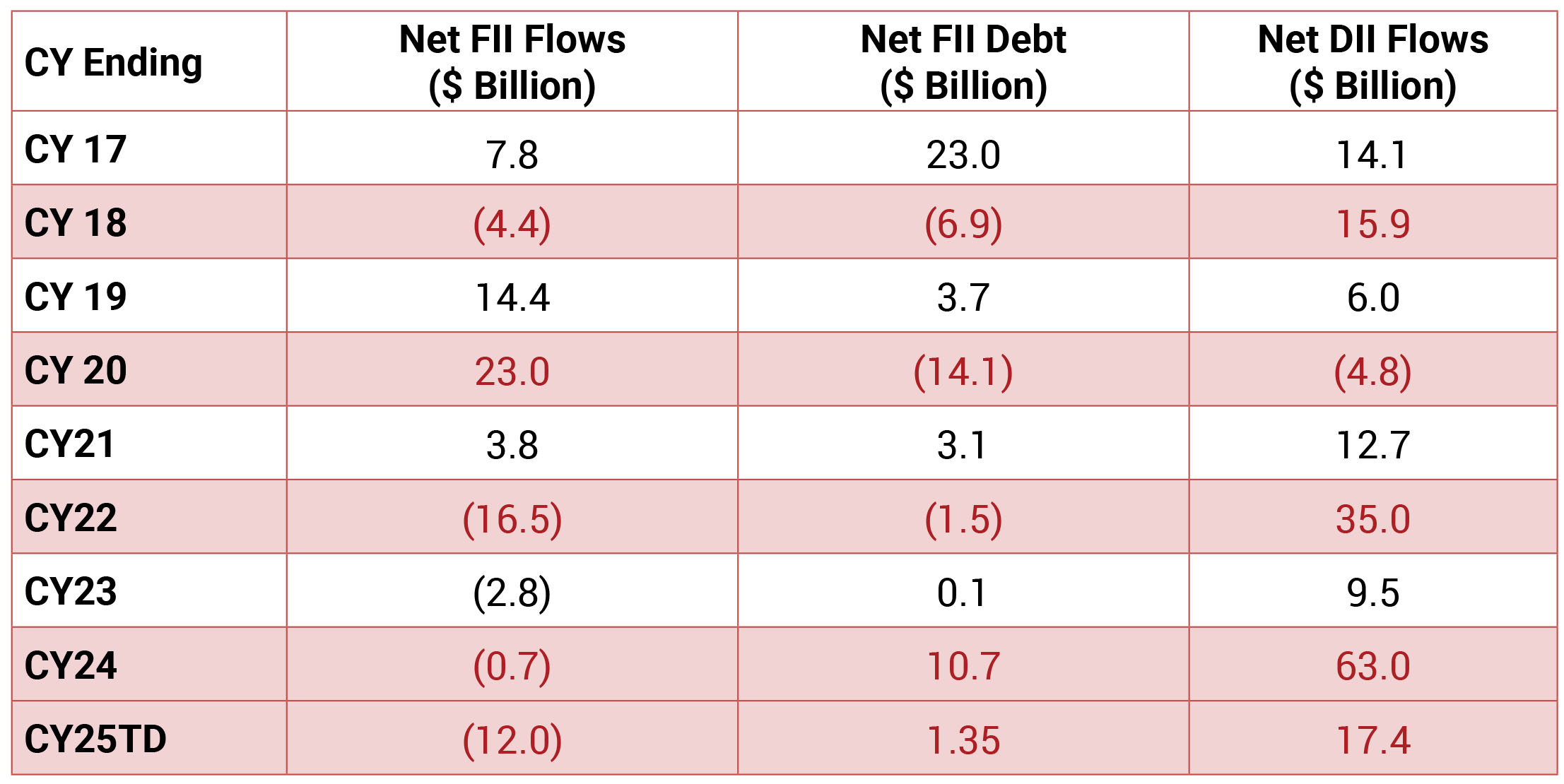

FIIs sold $4.0bn of equities in Feb (after selling $8.0bn in Jan) – with intense selling of $3.0bn in the first half of

the month and $1.0bn selling in the second half. DIIs remained net buyers for the 19th consecutive month, with

strong inflows of $7.4bn in Feb (vs. inflows of $10.0bn in Jan).