The uncertainty emanating from dimming US economic outlook, trade/tariffs policies and geopolitics is weighing on risk sentiments as reflected in the US equity markets giving up on the speculative euphoria and the UST yields dropping to levels last seen in mid-December.

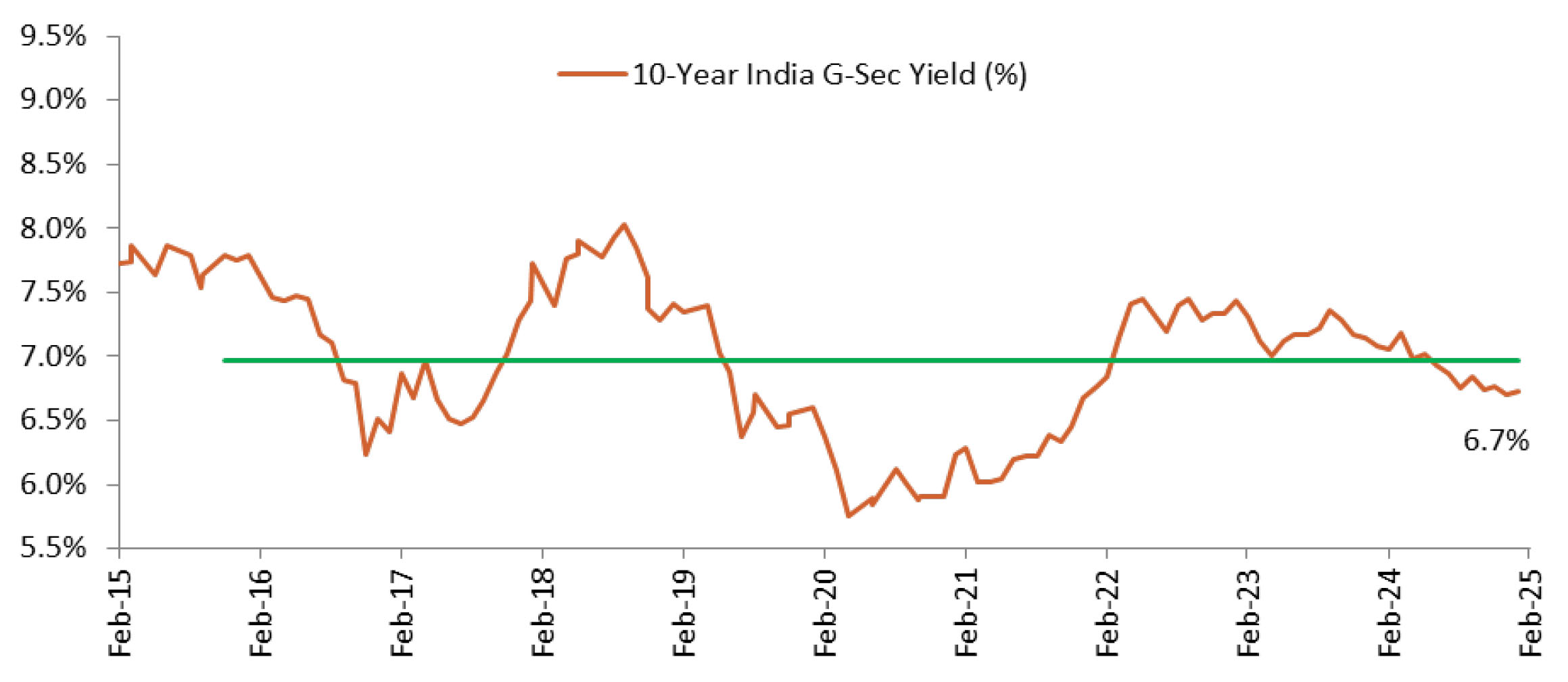

In India, the rate cut cycle has begun with RBI easing the policy rate by 25 bps in February. In addition, given the drain in liquidity from FX operations and CIC leakage, RBI has infused durable liquidity amounting to Rs1.35 lakh crore through OMO purchases and US$15 bn through FX buy/sell swaps. While growth data has seen some improvement, the moderation in inflation provides RBI comfort to cut by another 25 bps in the upcoming policy meeting in April.