● Budget: The FY26 budget pivoted to consumption from capex to provide a fillip to faltering domestic demand and boost economic growth without compromising on fiscal consolidation commitment. It put more money in the hands of people by realigning tax slabs (Rs. 1tn higher disposable income), increasing allocation for rural schemes and enhancing credit limit for KCC farmers from Rs. 300K to Rs. 500K (providing access to Rs. 3.3tn credit at 4% interest rate). This is expected to drive discretionary consumption in FY26.

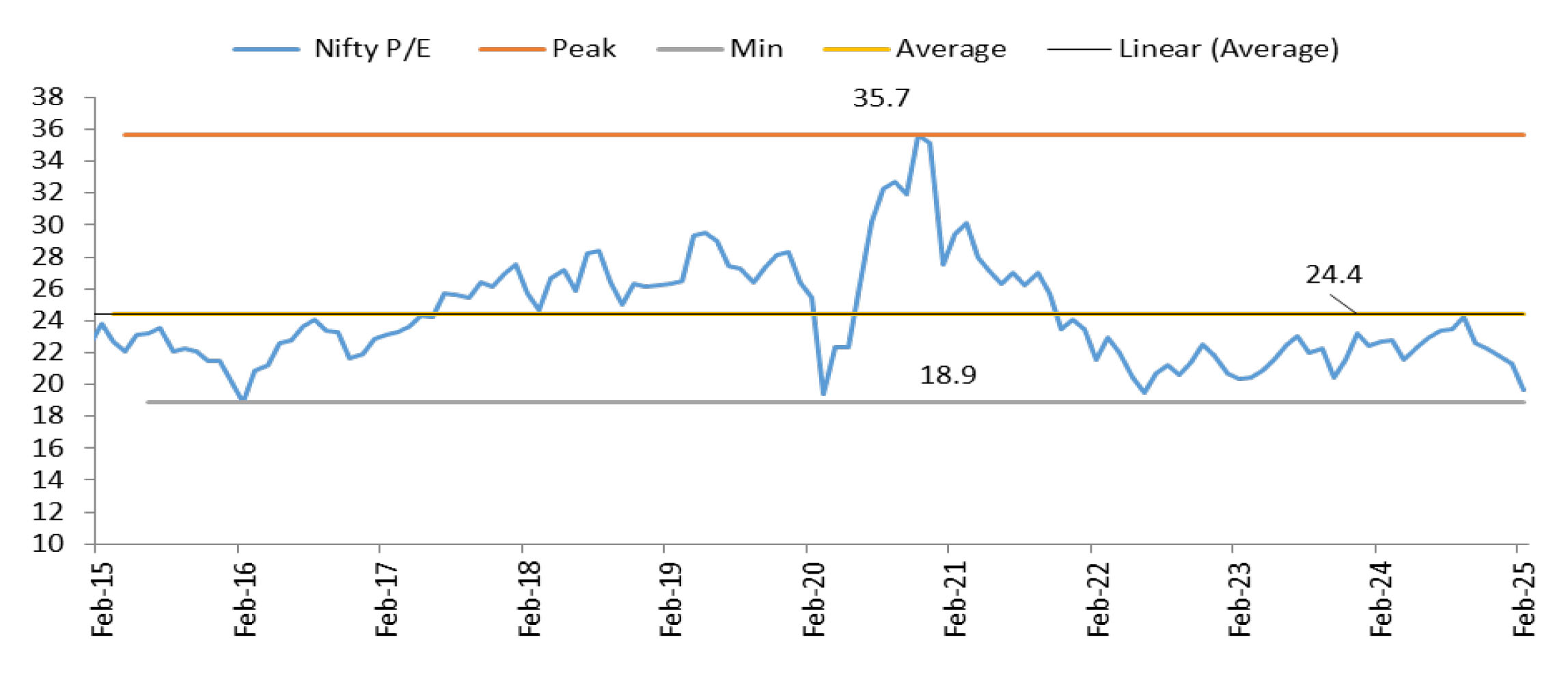

● Correction in mid-smallcap space: After a strong outperformance in CY24, mid and small caps have started underperforming large caps since the start of CY25. In Feb’25, the Nifty Midcap100 and Nifty Smallcap100 indices declined in double digits vs single digit decline in Nifty50 index. The decline in stock prices is broad based with around 65% of NSE-500 companies have declined more than 20% since the Sep’24 peak. While valuations have cooled off significantly from their highs, mid and small caps still trade about 25% above their long-period average, whereas large caps trade at a discount.

● Outlook: Weak demand environement continues to impact the earnings, further central government capex slowdown, extended monsoon has impact the growth of India Inc. However we believe the low/middle class dispoal income should increase led by DBT schemes and personal income tax cut. This should revive consumption. We believe state capex should also need to increase along with central capex to boost the economy. We remain positive on Indian equities from long term prespective.