Individual Fund

Guarantee Fund

(ULIF-048-05/02/10-GRTFND-107)

MONTHLY UPDATE SEPTEMBER 2025

|

AS ON 29TH AUGUST 2025 |

The portfolio will consist of equity, debt and money

market instruments. Asset allocation decisions will be

taken to protect investors.

Date of Inception

05th February 2010

AUM (in Lakhs)

365.92

NAV

32.6512

Fund Manager

Equity : Hemant Kanawala

Debt : Manoj Bharadwaj

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 37.5% (Nifty);

Debt - 62.5% (Crisil Composite Bond)

Modified Duration

Debt & Money

Market Instruments : 0.72

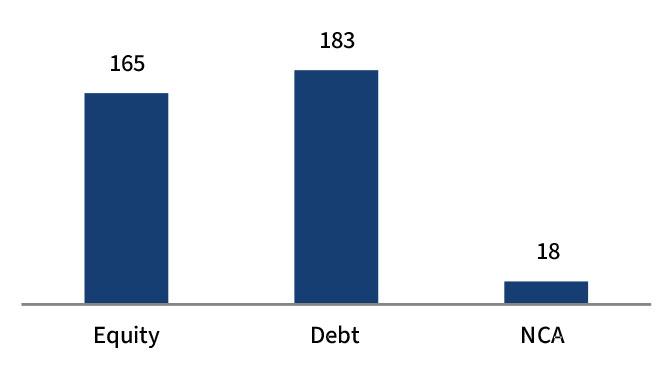

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 00 - 75 | 45 |

| Gsec / Debt | 00 - 100 | 15 |

| MMI / Others | 00 - 100 | 40 |

Performance Meter

| Guarantee Fund (%) | Benchmark (%) | |

| 1 month | -0.4 | -1.0 |

| 3 months | -0.1 | -0.9 |

| 6 months | 4.0 | 6.2 |

| 1 year | -0.4 | 3.3 |

| 2 years | 9.0 | 9.8 |

| 3 years | 8.2 | 9.1 |

| 4 years | 6.8 | 7.5 |

| 5 years | 10.2 | 10.1 |

| 6 years | 8.6 | 9.9 |

| 7 years | 7.6 | 9.4 |

| 10 years | 8.1 | 9.5 |

| Inception | 7.9 | 9.3 |

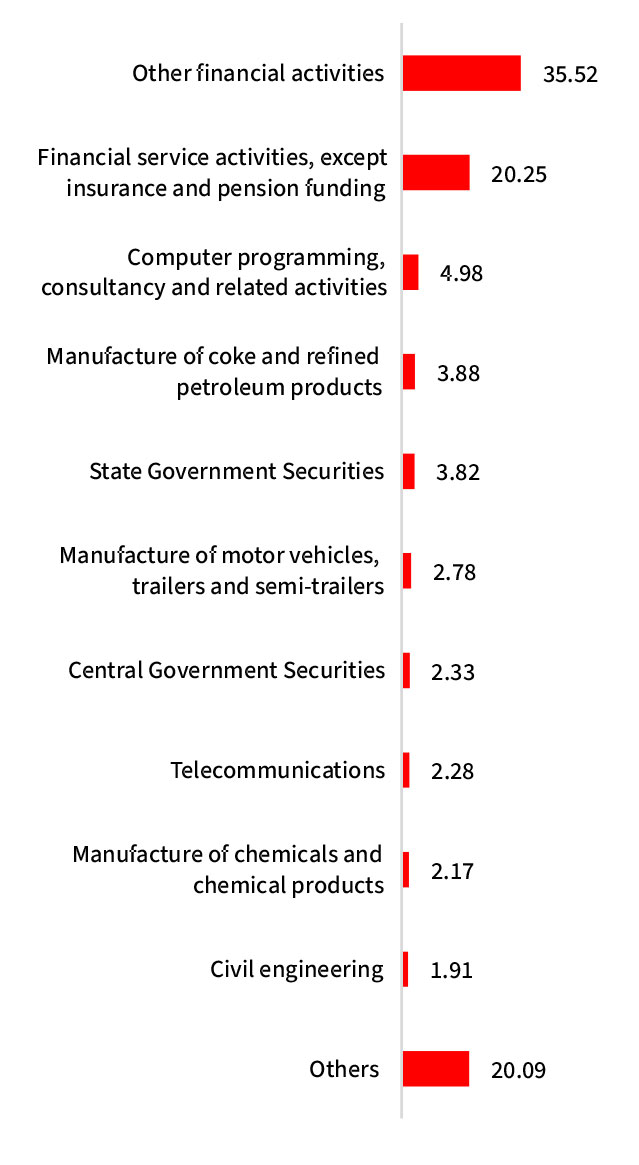

| Holdings | % to Fund |

| Equity | 45.11 |

| HDFC Bank Ltd. | 4.26 |

| Reliance Industries Ltd | 3.88 |

| ICICI Bank Ltd. | 3.50 |

| Bharti Airtel Ltd. | 2.28 |

| Infosys Ltd. | 2.27 |

| Larsen And Toubro Ltd. | 1.91 |

| I T C Ltd. | 1.74 |

| Tata Consultancy Services Ltd. | 1.35 |

| Mahindra & Mahindra Ltd | 1.29 |

| Hindustan Unilever Ltd | 1.12 |

| Others | 21.53 |

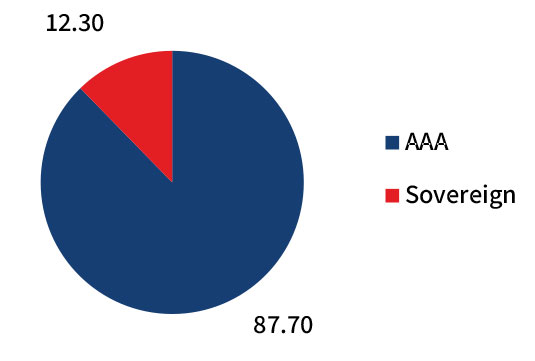

| G-Sec | 6.15 |

| 7.40% GOI 2035 - 09.09.35 | 0.36 |

| 8.44% RJ SDL - 27.06.2028 | 0.35 |

| 8.32% KA SDL - 06.02.2029 | 0.32 |

| 8.52% KA SDL - 28.11.2028 | 0.30 |

| 8.26% MH SDL -02.01.2029 | 0.28 |

| 6.83% GOI - 19.01.39 | 0.26 |

| 7.20% GJ SDL - 14.06.2027 | 0.24 |

| 8.27% TN SDL - 13.01.2026 | 0.24 |

| 7.18% GOI - 24.07.2037 | 0.19 |

| 8.83% GOI - 12.12.2041 | 0.19 |

| Others | 3.41 |

| Corporate Debt | 8.37 |

| 7.85% PFC - 03.04.2028 | 8.37 |

| MMI | 35.52 |

| NCA | 4.85 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.