Month Gone By – Markets (period ended July 31, 2020)

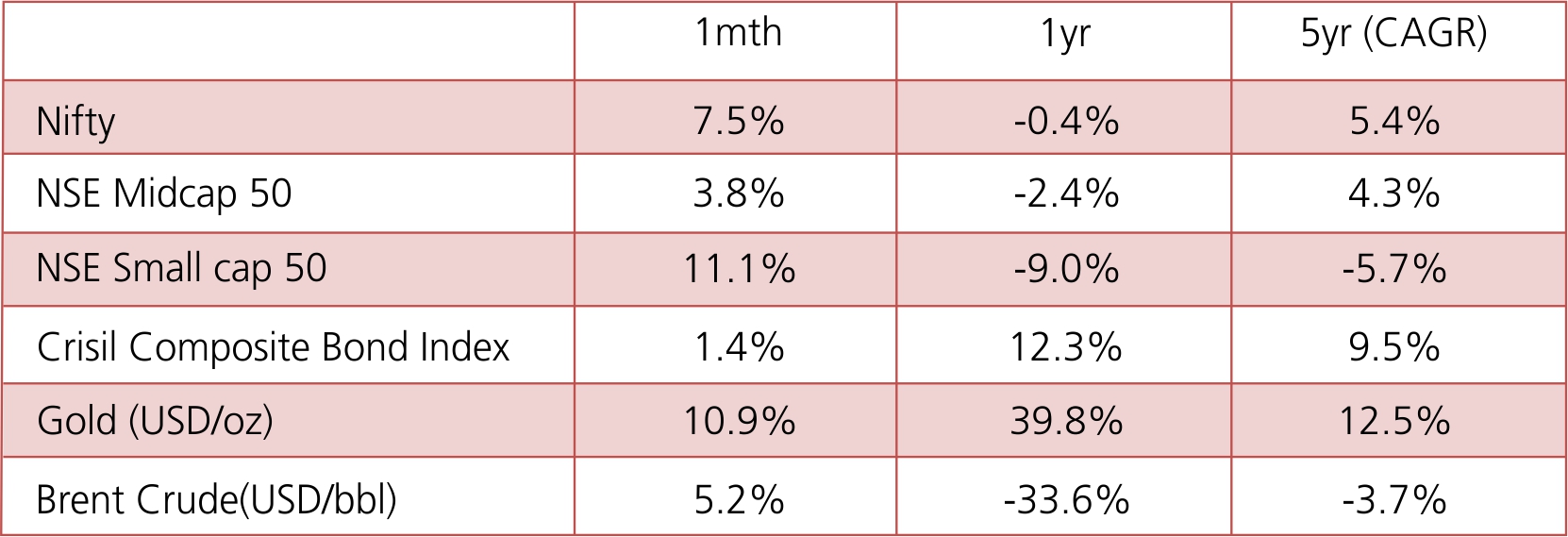

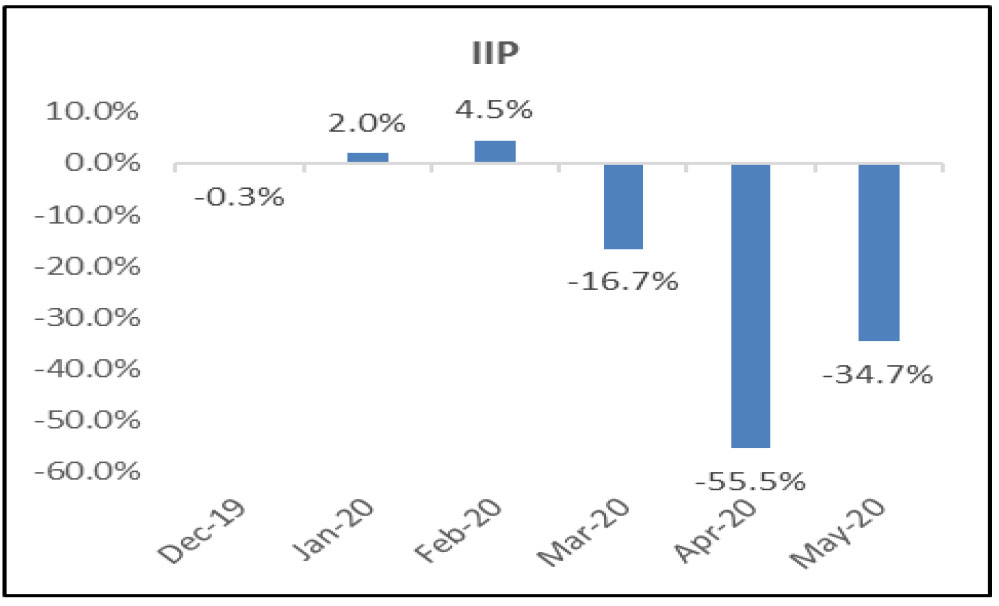

Indian equities continued its upward momentum in July with Nifty up 7.5%, markets have rebounded by 46% from March lows and now are only 10% below all-time peak in mid January. However, the rally in July lacks breadth, given 2/3rd of the market uptick was contributed by Infosys and RIL. Successful progress of Covid-19 vaccine trials and earlier-than-expected normalization in economic activity impacted the markets positively , however rising number of daily new COVID cases, escalating US-China tension, a sharp drop in US GDP data and RBI’s forecast on surge in bad loans kept the gains in check. India recorded its highest single day increase in new COVID-19 cases at >57,000 in end July. On the global front, the US Federal Reserve left key interest rate unchanged in its July meeting.

Brent oil price gained 5.2% in July to end the month at USD43.3/bbl following a 16.5% gain in June. YTD, oil prices are still 34.3% down. INR appreciated by 0.9% against USD and ended the month at 74.8/$ in June. YTD, INR has depreciated 4.8% against USD.

Brent oil price gained 5.2% in July to end the month at USD43.3/bbl following a 16.5% gain in June. YTD, oil prices are still 34.3% down. INR appreciated by 0.9% against USD and ended the month at 74.8/$ in June. YTD, INR has depreciated 4.8% against USD.

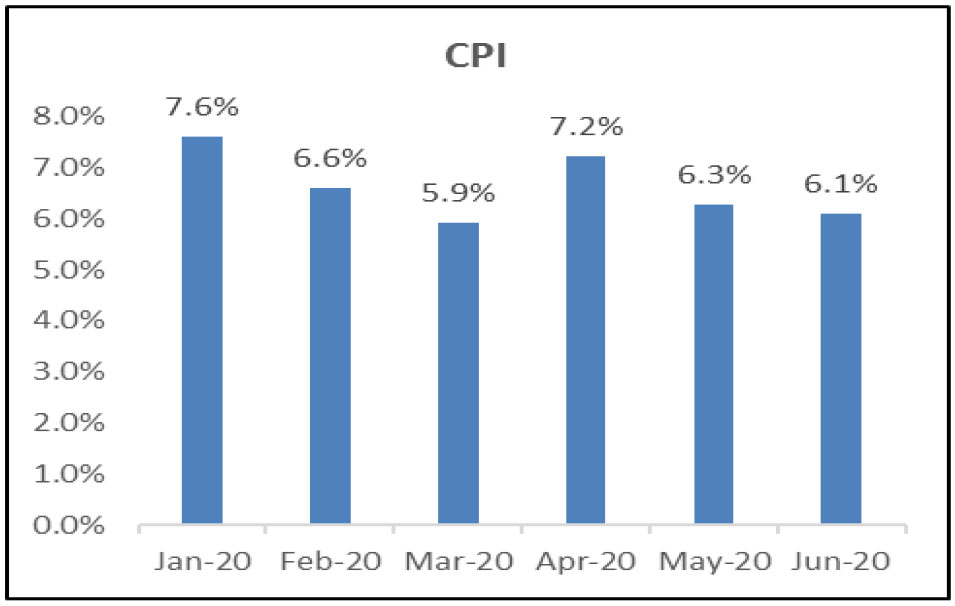

IIP: Index for Industrial Production for May contracted -34.7% (vs. -57.6% contraction in April). While the collapse was across the board, certain essential sectors like electricity (-15%) and consumer non-durables (-11%) were hit less as compared to sectors like consumer durables (-68%), infra goods (-42%) and capital goods (-64%) which recorded large declines.

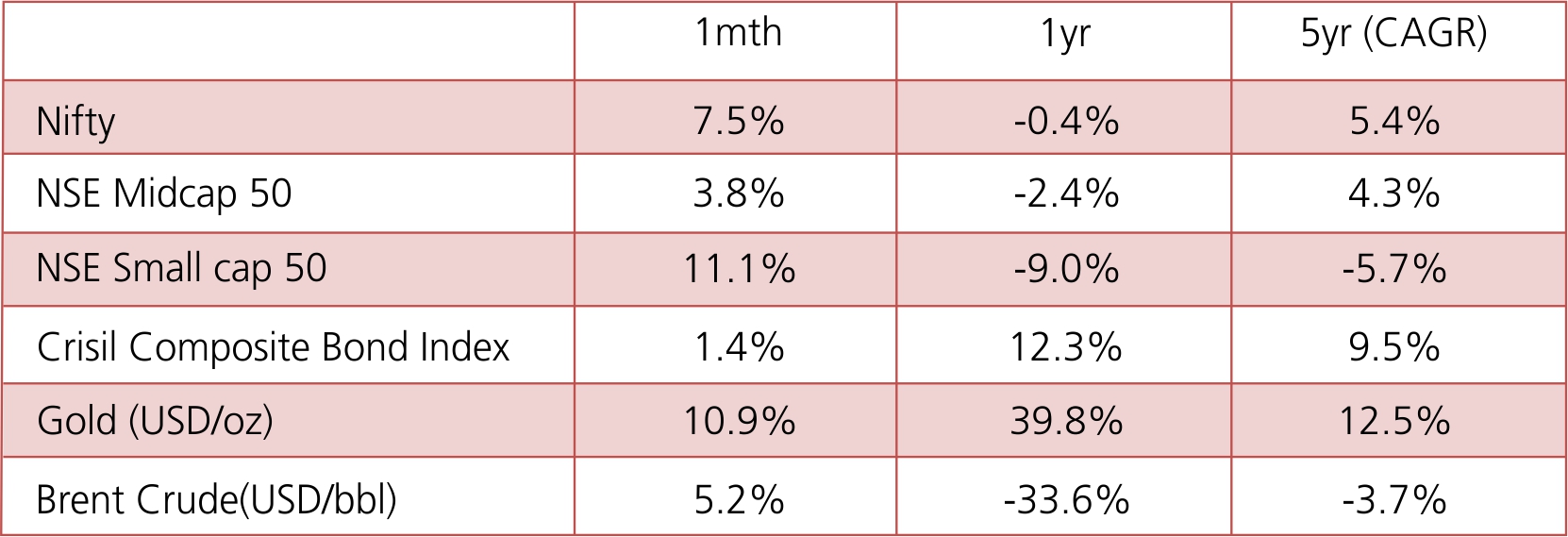

CPI: Headline CPI for June came in at 6.1% ahead of the consensus. CSO also released the CPI data for April at 7.22% and May at 6.27%. Food inflation at 7.4% in June has eased from 10.5% in April and 8.5% in May

Trade Deficit: India’s monthly merchandise trade balance printed a surplus of USD790mn in June, first surplus in 18-years. Merchandise exports were down -12% in June (vs. 36% decline in May and 60% decline in April) and imports were down 48% in June (vs 51% decline in May and 59% decline in April). Imports ex Oil and Gold declined 41% (vs. 34% decline in May), the 17th consecutive month of YoY declines.

Current Account Balance (CAB): India’s current account balance (CAB) turned into a surplus of USD0.6bn (0.1% of GDP) in 4QFY20 for the first time in 13 years. For the full year, CAB improved from a USD57bn (2.1% of GDP) deficit in FY19 to a USD25bn (0.9% of GDP) deficit in FY20. The decline in CAD was led by import compression as the non-oil trade deficit declined by USD16bn in FY20.

CPI: Headline CPI for June came in at 6.1% ahead of the consensus. CSO also released the CPI data for April at 7.22% and May at 6.27%. Food inflation at 7.4% in June has eased from 10.5% in April and 8.5% in May

Trade Deficit: India’s monthly merchandise trade balance printed a surplus of USD790mn in June, first surplus in 18-years. Merchandise exports were down -12% in June (vs. 36% decline in May and 60% decline in April) and imports were down 48% in June (vs 51% decline in May and 59% decline in April). Imports ex Oil and Gold declined 41% (vs. 34% decline in May), the 17th consecutive month of YoY declines.

Current Account Balance (CAB): India’s current account balance (CAB) turned into a surplus of USD0.6bn (0.1% of GDP) in 4QFY20 for the first time in 13 years. For the full year, CAB improved from a USD57bn (2.1% of GDP) deficit in FY19 to a USD25bn (0.9% of GDP) deficit in FY20. The decline in CAD was led by import compression as the non-oil trade deficit declined by USD16bn in FY20.

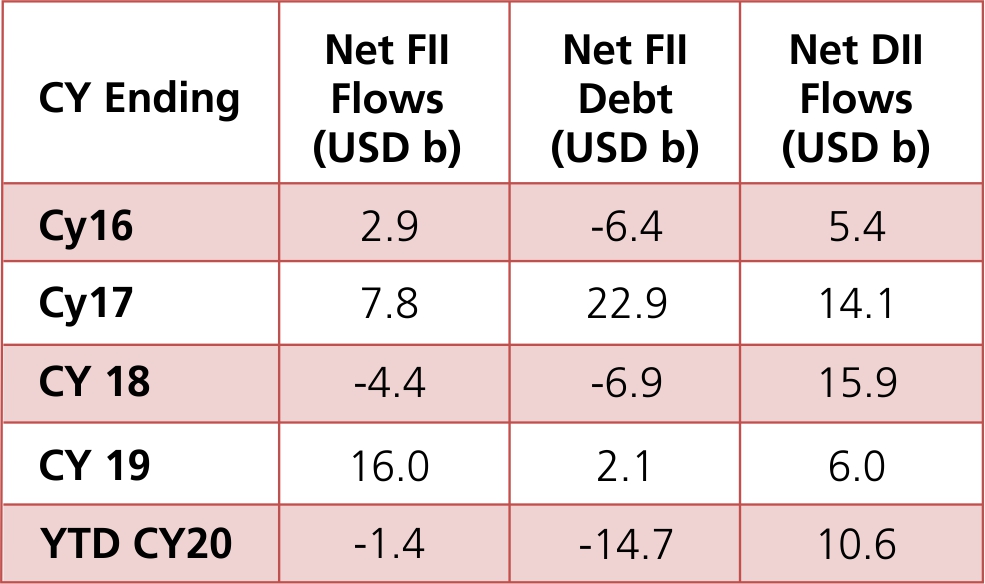

FIIs recorded net inflows of USD1.0bn into Indian equities in June. YTD, FIIs have sold USD 1.4bn. DIIs were net equity sellers of USD1.3bn in July. Both Mutual Funds and Other DIIs were net sellers to the tune of USD1.0bn and USD0.3bn respectively in July. YTD, DIIs have bought USD USD10.6bn. FIIs recorded net outflows from debt markets at USD 0.3bn in July. YTD, FIIs have sold USD 14.7bn in the debt markets.