Individual Fund

Kotak Pension Floating Rate Fund

(ULIF-022-07/12/04-PNFLTRFND-107)

Monthly Update August 2020

|

AS ON 31st July 2020 |

Aims to preserve capital and minimize downside risk, with investment in debt and government instruments.

Date of Inception

07th December 2004

AUM (in Lakhs)

79.82

NAV

30.6981

Fund Manager

Debt : Gajendra Manavalan

Benchmark Details

Equity - 0% (NA);

Debt - 100% (CRISIL Liquid)

Modified Duration

Debt & Money

Market Instruments : 1.59

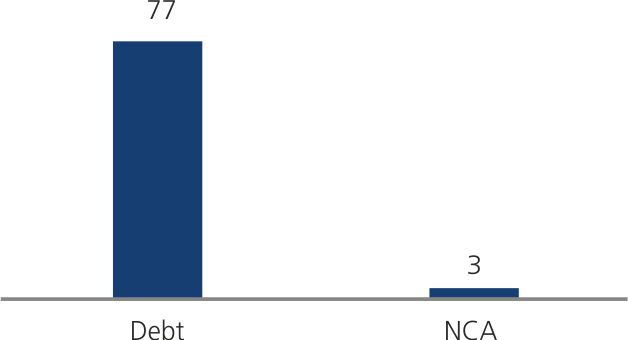

Asset Allocation

| Approved (%) | Actual (%) | |

| Gsec | 00 - 75 | 52 |

| Debt | 25 - 100 | 45 |

| MMI / Others | 00 - 40 | 4 |

Performance Meter

| Pension Floating Rate Fund (%) | Benchmark (%) | |

| 1 month | 0.4 | 0.3 |

| 3 months | 1.5 | 1.2 |

| 6 months | 4.2 | 2.5 |

| 1 year | 7.2 | 5.5 |

| 2 years | 8.0 | 6.6 |

| 3 years | 6.4 | 6.7 |

| 4 years | 6.6 | 6.8 |

| 5 years | 6.9 | 7.0 |

| 6 years | 7.2 | 7.3 |

| 7 years | 7.7 | 7.7 |

| 10 years | 7.9 | 7.7 |

| Inception | 7.4 | 7.1 |

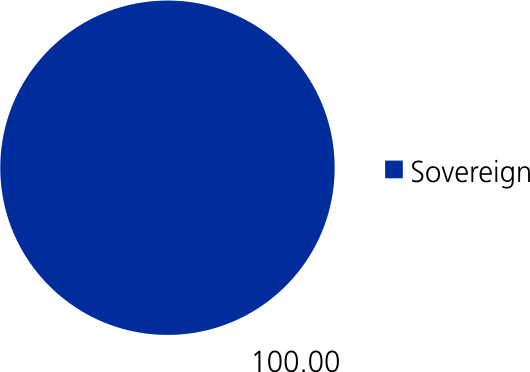

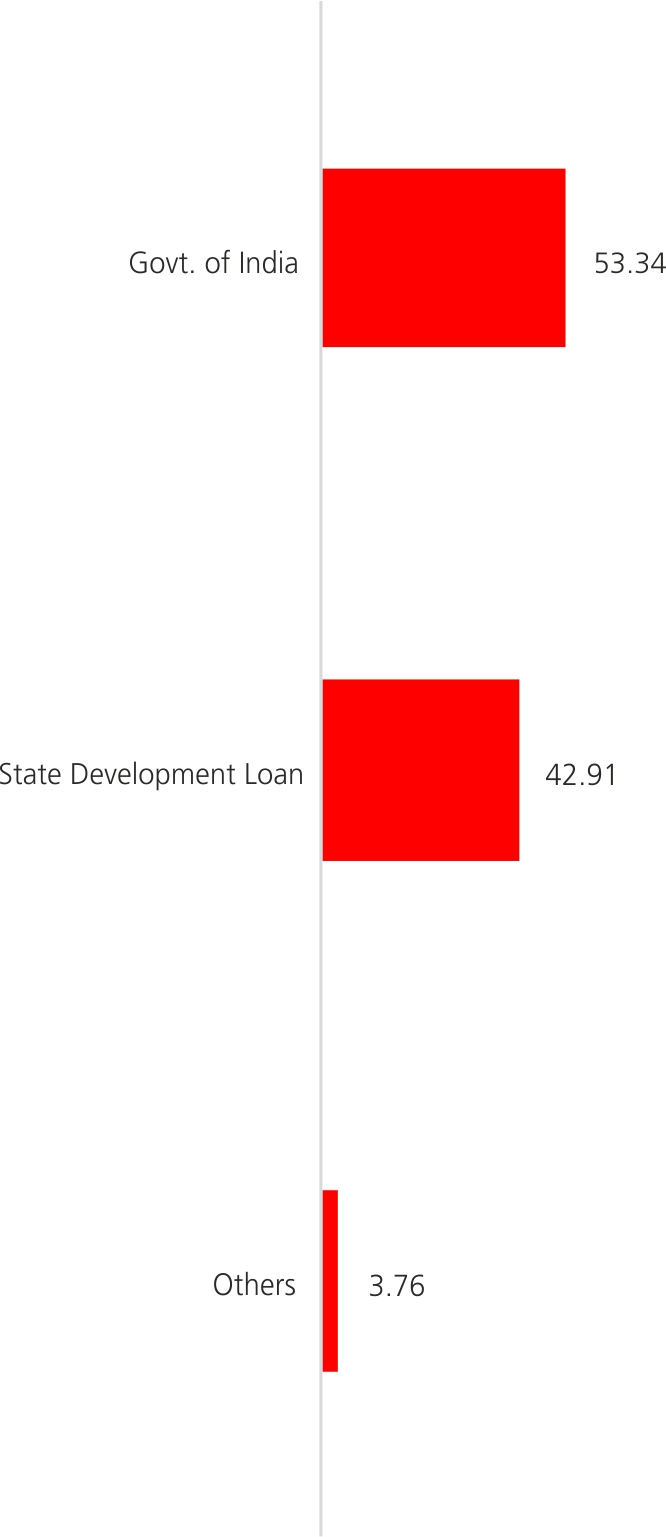

| Holdings | % to Fund |

| Equity | 00.0 |

| G-Sec | 51.61 |

| 9.37% MAH SDL - 04.12.2023 | 19.52 |

| 8.84% PN SDL - 11.06.2024 | 5.29 |

| 8.39% RJ SPL SDL - 15.03.2022 | 2.76 |

| 8.90% MH SDL -19.12.2022 | 2.75 |

| 8.92% RJ SDL - 21.11.2022 | 2.74 |

| 8.51% PN SDL - 10.04.2023 | 2.68 |

| 8.15% GOI FCI Bonds - 16.10.22 | 2.59 |

| 8.21% RJ SPL SDL - 31.03.2022 | 2.56 |

| 6.13% GOI - 04.06.2028 | 2.28 |

| 8.30% Fertilizer Co GOI - 07.12.23 | 2.05 |

| Others | 6.39 |

| Corporate Debt | 44.64 |

| FRB G - 21.12.20 | 44.64 |

| NCA | 3.76 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.