10 year benchmark yields were flat during the month due to huge supply in this paper. Unlike 10 year Gsec, 5 year, 14 year and 30 year gsec performed better. 5 year Gsec rallied by ~8 bps, 14 year by ~10 bps and 30 year Gsec by ~18 bps.

Corporate bonds continued to perform well. 5 year corporate bond rallied by 50-60 bps due to heavy demand and 10 year corporate bonds also rallied by 25-30 bps. The yield curve steepened as the shorter end yields fell more compared to longer end.

Considering the June CPI release, the average CPI inflation in Apr-Jun stands at 6.5%. Inflation averaged 6.7% in Jan-Mar and 5.8% in Oct-Dec. The average inflation for the last three quarters has been outside the MPC mandated 2-6% range .

Going forward, elevated CPI data could give rise to divergent views within the MPC and reduce the chances of rate cut in the upcoming policy. However, markets expect RBI to conduct more frequent OMO purchases and other liquidity measures to comfort the markets and keep a check on the bond yields. GDP projections by economists for FY21 has been in the range of -4.4%to -6.0%. Historically low growth data could pursuade RBI to continue its accomodative stance. It is expected that RBI may continue its accomodative stance but stay put in the August policy.

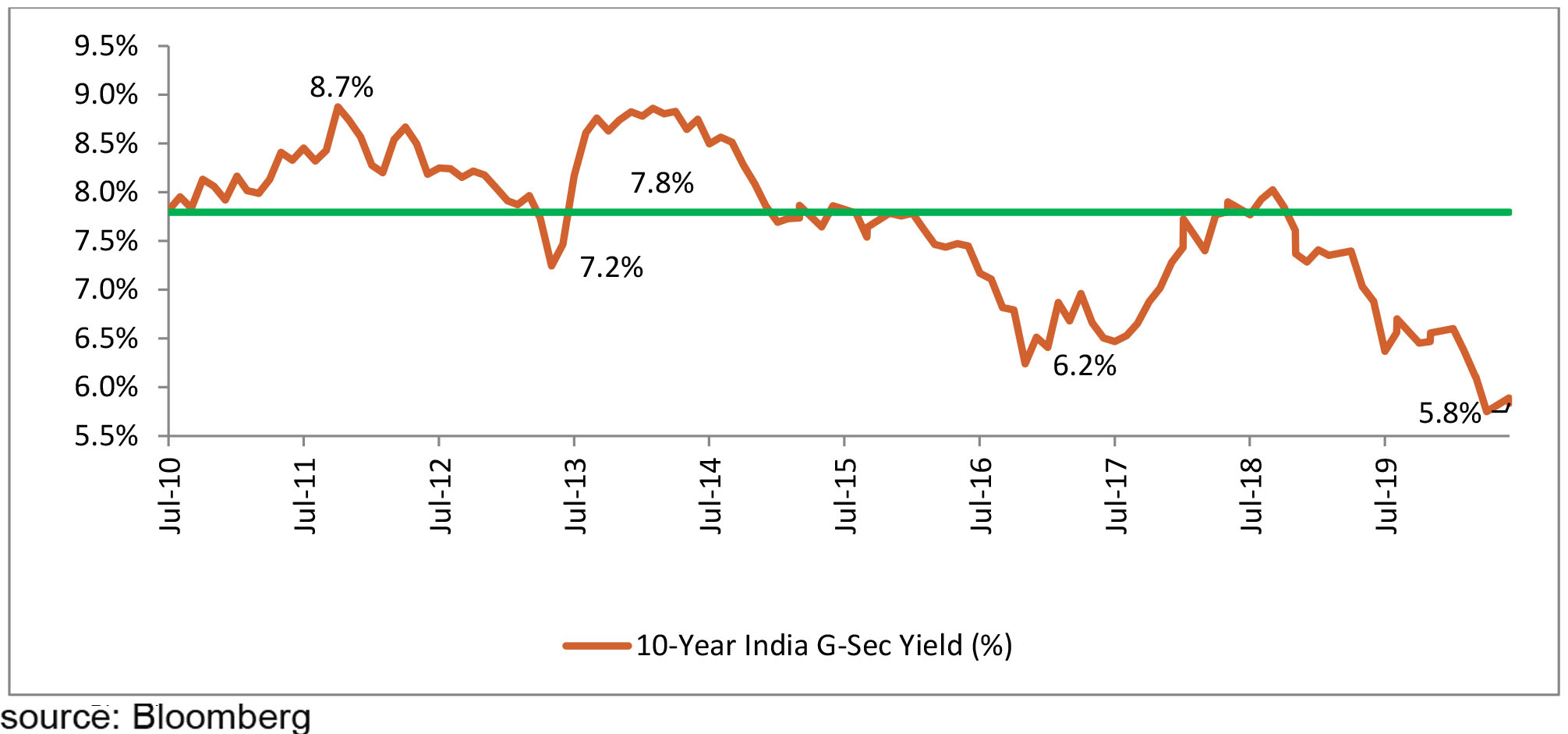

On this backdrop, the 10-year benchmark G-sec could trade in the range of 5.50%-5.90% during the month.