Group Fund

Kotak Group Balanced Fund

(ULGF-003-27/06/03-BALFND-107)

MONTHLY UPDATE AUGUST 2022

|

AS ON 29th July 2022 |

Aims for moderate growth by holding a diversified mix of equities and fixed interest instruments. May also be susceptible to moderate levels of

shorter-term volatility (downside risk).

Date of Inception

27th June 2003

AUM (in Lakhs)

1,42,923.62

NAV

101.3562

Fund Manager

Equity : Rohit Agarwal

Debt : Manoj Bharadwaj

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 60% (BSE 100)

Debt - 40% (Crisil Composite Bond)

Debt - 40% (Crisil Composite Bond)

Modified Duration

Debt & Money

Market Instruments : 3.59

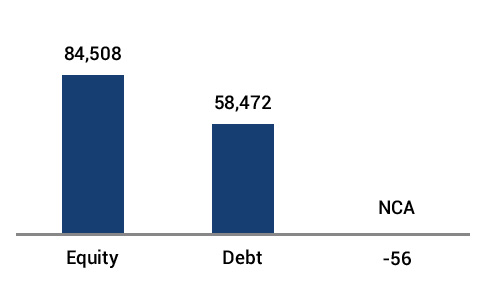

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 30 - 60 | 59 |

| Gsec / Debt | 20 - 70 | 32 |

| MMI / Others | 00 - 40 | 9 |

Performance Meter

| Kotak Group Balanced Fund (%) | Benchmark (%) | |

| 1 month | 6.2 | 6.0 |

| 3 months | 0.6 | -0.1 |

| 6 months | -1.3 | -0.1 |

| 1 year | 5.3 | 6.3 |

| 2 years | 15.8 | 16.2 |

| 3 years | 13.1 | 12.5 |

| 4 years | 10.7 | 10.0 |

| 5 years | 9.8 | 9.5 |

| 6 years | 10.4 | 10.4 |

| 7 years | 10.1 | 9.8 |

| 10 years | 12.2 | 11.2 |

| Inception | 12.9 | 11.6 |

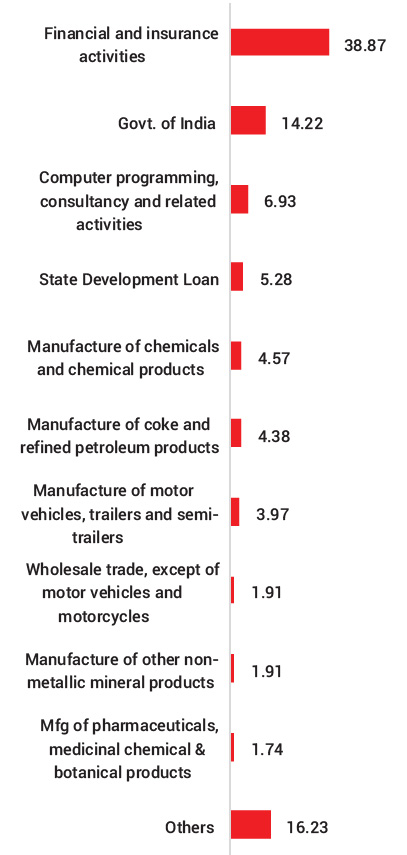

| Holdings | % to Fund |

| Equity | 59.13 |

| ICICI Bank Ltd | 4.65 |

| Reliance Industries Ltd | 4.38 |

| Infosys Ltd | 3.86 |

| Axis Bank Ltd | 2.31 |

| Maruti Suzuki India Ltd | 1.93 |

| State Bank of India | 1.85 |

| Hindustan Unilever Ltd | 1.77 |

| HDFC Bank Ltd | 1.74 |

| ICICI Prudential Bank ETF Nifty Bank Index | 1.59 |

| SBI ETF Nifty Bank | 1.59 |

| UltraTech Cement Ltd | 1.56 |

| I T C Ltd | 1.53 |

| Mahindra & Mahindra Ltd | 1.49 |

| Tata Consultancy Services Ltd | 1.49 |

| Larsen And Toubro Ltd | 1.43 |

| Bajaj Finance Ltd | 1.40 |

| Kotak Banking ETF - Dividend Payout Option | 1.39 |

| S R F Ltd | 1.13 |

| Bharti Airtel Ltd | 1.09 |

| SBI Life Insurance Company Ltd | 1.06 |

| Others | 19.87 |

| G-Sec | 22.19 |

| 7.38% GOI - 20.06.2027 | 2.76 |

| 6.54% GOI - 17.01.2032 | 2.52 |

| 7.54% GOI - 23.05.2036 | 2.21 |

| 6.24% MH SDL - 11.08.2026 | 1.80 |

| 7.10% GOI - 18.04.2029 | 1.07 |

| 7.61% GOI - 09.05.2030 | 1.07 |

| 5.74% GOI - 15.11.2026 | 0.86 |

| GOI FRB - 07.11.2024 | 0.77 |

| 8.54% REC - 15.11.2028 | 0.69 |

| 7.08% MP SDL - 09.03.2029 | 0.59 |

| Others | 7.85 |

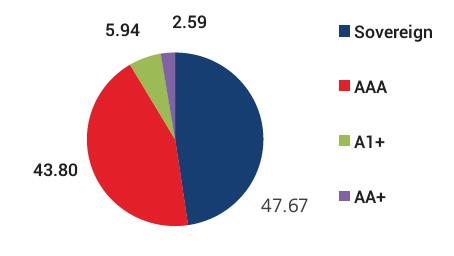

| Corporate Debt | 9.86 |

| 6.99% IRFC - 04.06.2041 | 0.99 |

| 5.65% Bajaj Finance Ltd - 10.05.2024 | 0.82 |

| 7.05% Embassy Office Parks REIT - 18.10.2026 | 0.71 |

| 8.56% REC - 29.11.2028 | 0.69 |

| 7.34% NHB - 07.08.2025 | 0.61 |

| 8.55% HDFC - 27.03.2029 | 0.61 |

| 7.28% HDFC - 01.03.2024 | 0.52 |

| 7.40% Muthoot Finance Ltd - 05.01.2024 | 0.47 |

| 6.25% Cholamandalam Invest and Fin co ltd - 21.02.2024 | 0.41 |

| 7.50% Sundaram Finance - 07.11.2022 | 0.26 |

| Others | 3.76 |

| MMI | 8.86 |

| NCA | -0.04 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.