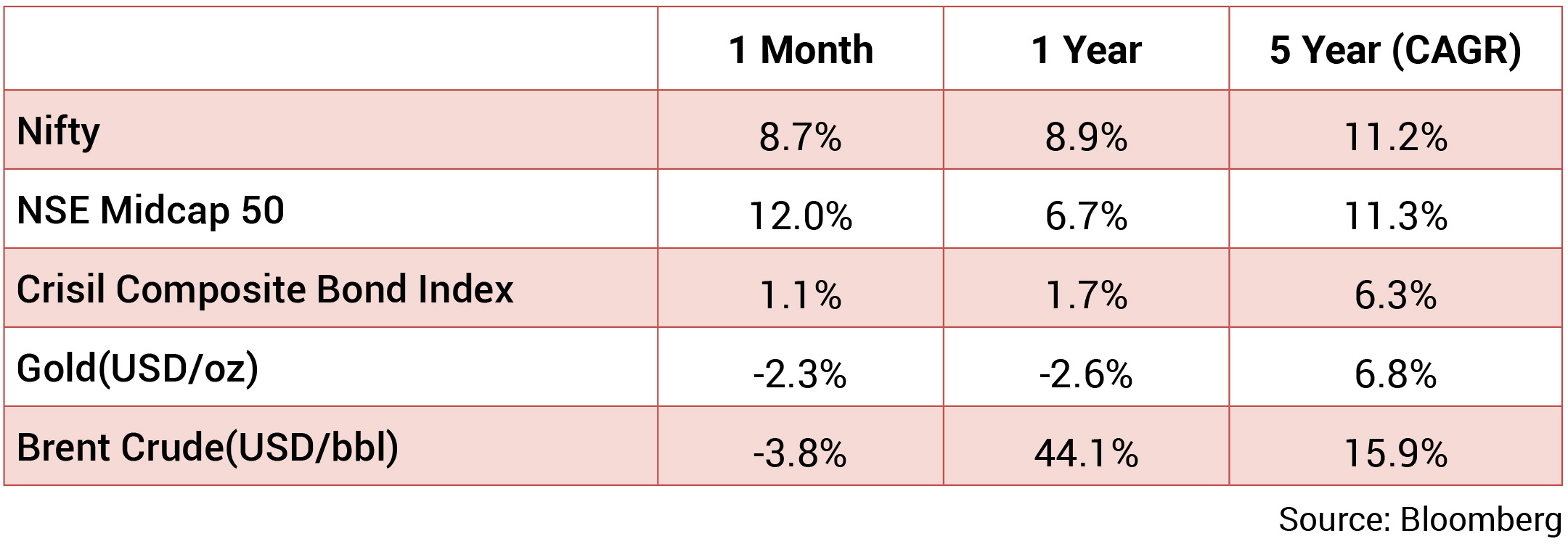

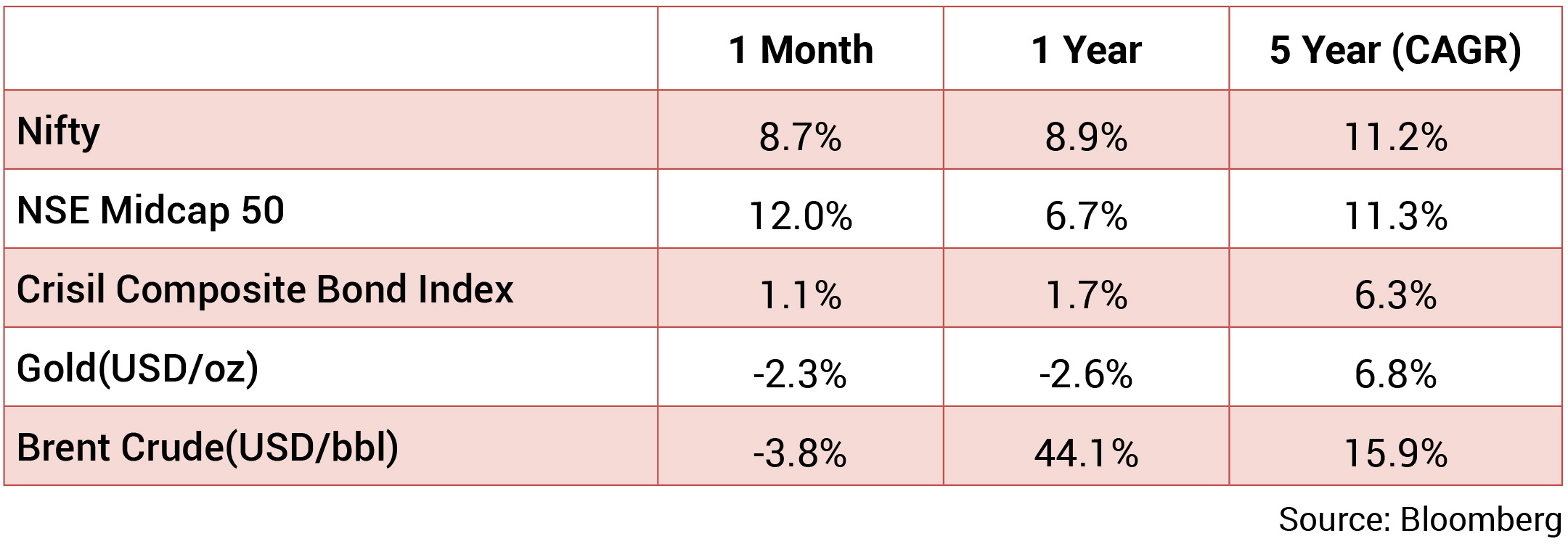

Month Gone By – Markets (period ended July 29, 2022)

Markets went up by 8.7% m-o-m primarily as concerns around continued aggressive central bank

tightening eased amidst recession-related fears. All sectors barring Energy ended the month

in the green as Nifty improved, currently above the 17k level. INR depreciated by 0.4% MoM,

reaching ~79.27/USD in July. DXY strengthened +1.2% over the month. Yields fell in July with the

10y benchmark trading in a range of 7.29%-7.47% and eventually ending the month 13 bps lower

m-o-m at 7.32%. The 10y benchmark averaged 7.39% in July.

Indicators of global economic activity weakened in July, with concerns of a synchronized downturn in US and Western Europe. US GDP fell 0.9% on an annualized basis in 2QCY22 following a contraction of 1.6% in 1QCY22. China’s GDP fell by 2.6% in 2QCY22, significantly weaker than had been expected and related largely to the strict regional lockdowns due to Covid and continued weakness in the property sector. Indicators of global supply constraints had remained elevated, although there are some signs that supply bottlenecks have started to ease. Some indicators of shipping costs had declined from their peaks, while PMI surveys indicated that manufacturing delivery times have fallen back across different regions.

Monetary tightening continued synchronously across the globe with many central banks increasing the pace of tightening to tackle historically high levels of inflation, despite growing fears of a recession. Rather than providing any future guidance, global central banks are turning data dependent before committing to any action. In its July meeting, the US Fed raised the target range of the Federal Funds rate by 75 bps to 2.25–2.50%, resulting in a cumulative hike of 225 bps since July 2022. The ECB and BoC also hiked their policy rate by 50 bps and 100 bps, respectively.

On the domestic front, several indicators suggest that the Indian economy is making resilient progress despite the drag from global spillovers, elevated inflation and some slackening of external demand as geopolitical developments take their toll on world trade. The PMI indicated sustained improvement in employment conditions in June 2022. Although manufacturing sector employment eased marginally on a sequential basis, it remained in expansionary mode. With the advancement of Southwest monsoon, the farm sector outlook remains positive. Meanwhile, the center’s fiscal deficit remains in check with the government remaining cautious on spending. The fortnightly revision of petroleum products duty/cess however induces an additional uncertainty. Oil prices declined sharply (-6.1%) over the month of July, following the decline of June amidst global growth concerns. Inability of OPEC to comply with announcements on increase in output and geo-political issues is likely to keep the pressure on crude prices. Additionally, inflationary pressures in Europe have intensified after the near doubling in wholesale gas prices since May, owing to Russia’s restriction of gas supplies to Europe and the risk of further curbs.

Indicators of global economic activity weakened in July, with concerns of a synchronized downturn in US and Western Europe. US GDP fell 0.9% on an annualized basis in 2QCY22 following a contraction of 1.6% in 1QCY22. China’s GDP fell by 2.6% in 2QCY22, significantly weaker than had been expected and related largely to the strict regional lockdowns due to Covid and continued weakness in the property sector. Indicators of global supply constraints had remained elevated, although there are some signs that supply bottlenecks have started to ease. Some indicators of shipping costs had declined from their peaks, while PMI surveys indicated that manufacturing delivery times have fallen back across different regions.

Monetary tightening continued synchronously across the globe with many central banks increasing the pace of tightening to tackle historically high levels of inflation, despite growing fears of a recession. Rather than providing any future guidance, global central banks are turning data dependent before committing to any action. In its July meeting, the US Fed raised the target range of the Federal Funds rate by 75 bps to 2.25–2.50%, resulting in a cumulative hike of 225 bps since July 2022. The ECB and BoC also hiked their policy rate by 50 bps and 100 bps, respectively.

On the domestic front, several indicators suggest that the Indian economy is making resilient progress despite the drag from global spillovers, elevated inflation and some slackening of external demand as geopolitical developments take their toll on world trade. The PMI indicated sustained improvement in employment conditions in June 2022. Although manufacturing sector employment eased marginally on a sequential basis, it remained in expansionary mode. With the advancement of Southwest monsoon, the farm sector outlook remains positive. Meanwhile, the center’s fiscal deficit remains in check with the government remaining cautious on spending. The fortnightly revision of petroleum products duty/cess however induces an additional uncertainty. Oil prices declined sharply (-6.1%) over the month of July, following the decline of June amidst global growth concerns. Inability of OPEC to comply with announcements on increase in output and geo-political issues is likely to keep the pressure on crude prices. Additionally, inflationary pressures in Europe have intensified after the near doubling in wholesale gas prices since May, owing to Russia’s restriction of gas supplies to Europe and the risk of further curbs.

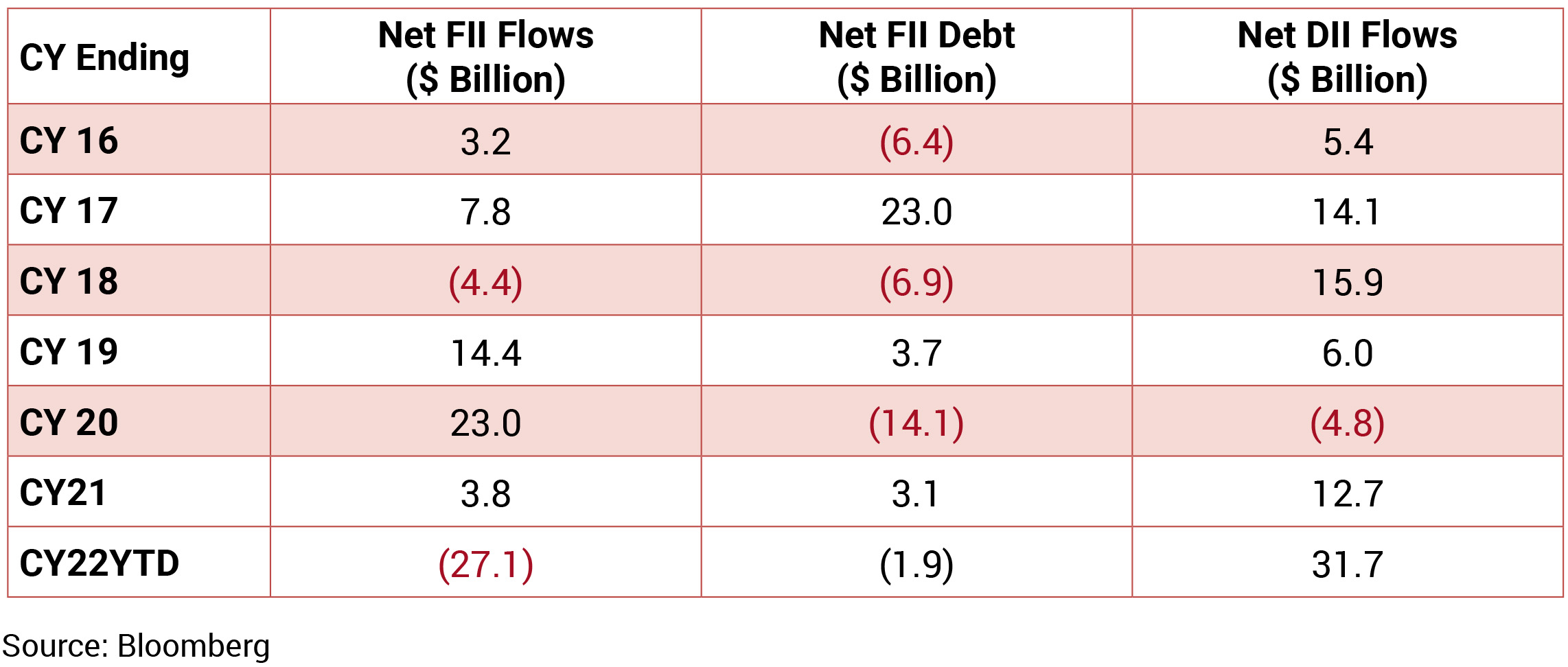

Source: Bloomberg

Source: Bloomberg

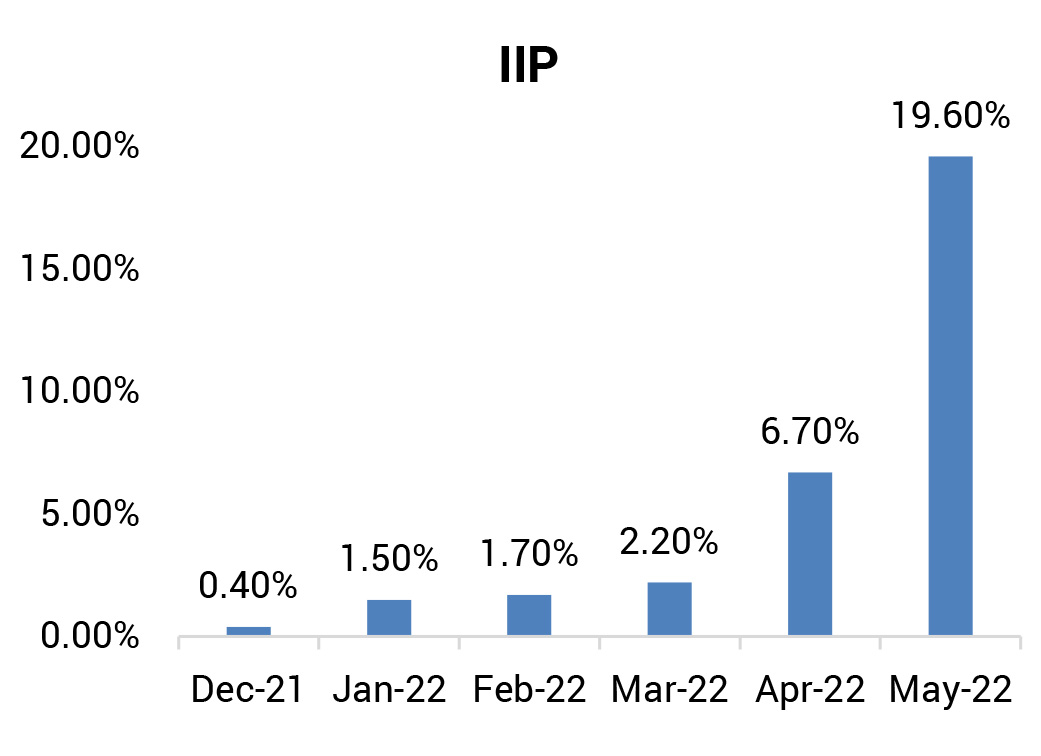

IIP: May IIP growth rose sharply to 19.6% (April: 6.7%) due to a low base (lockdown impact due

to the Covid second wave in May 2021), and increased sequentially by 2.3%. On a sectoral basis,

electricity production grew by 23.5% (April: 11.8%), manufacturing by 20.6% (5.8%), and mining

by 10.9% (8%). As per the use-based classification, all categories registered positive growths led

by consumer durable goods increasing by 58.5% (April: 7.4%), and capital goods by 54% (13.3%).

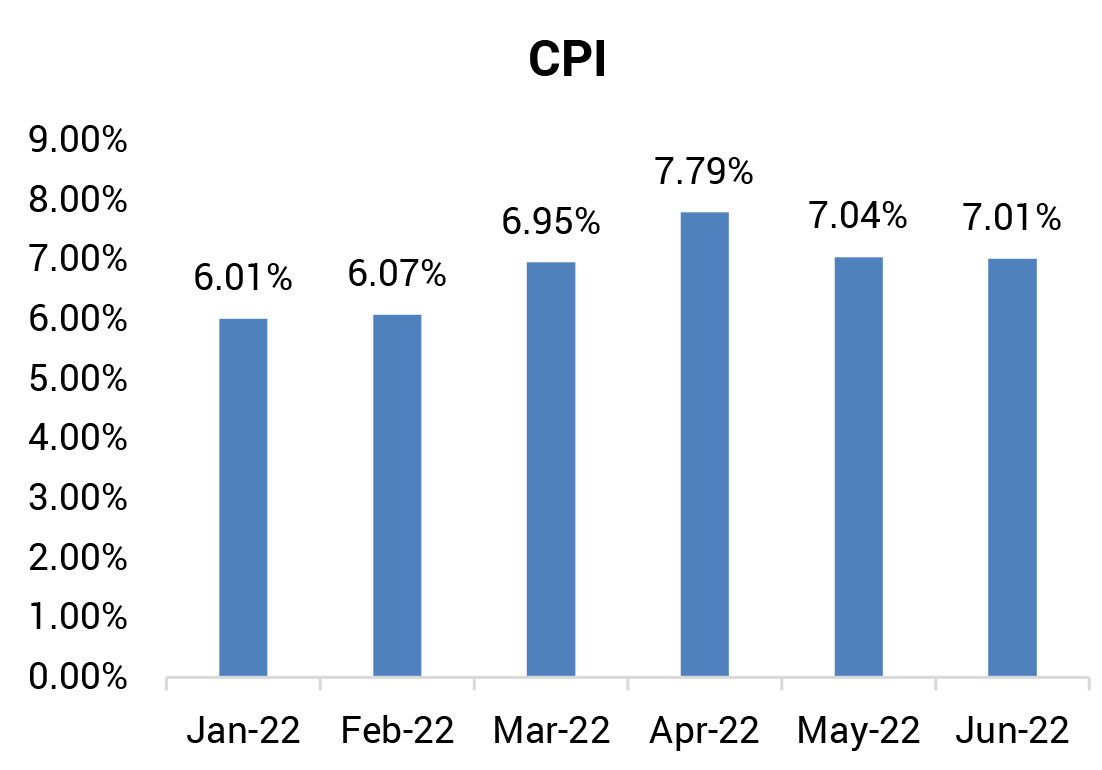

CPI: Headline CPI inflation in June eased marginally to 7.01% (May: 7.04%) led by a moderation in sequential momentum to 0.5% (0.9% mom in May). Food inflation moderated to 7.7% (May: 8%). On a sequential basis, the moderation in food prices was led by decline in prices of fruits, oils and fats, and pulses. The pace of increase in food prices moderated except for eggs. Meanwhile, core inflation increased marginally to 6% in June (5.9% in May), due to lower inflation in clothing and footwear, recreation, amusement, household goods and services, education, and personal care and effects. On the other hand, inflation under the transport and communication segment moderated due to fall in petrol and diesel prices after the excise duty cut in May.

Trade Deficit: India’s merchandise trade deficit widened to its highest monthly level of US$25.6 bn in June 2022 as against a deficit of US$9.6 bn a year ago and US$24.3 bn in May 2022. India’s merchandise exports at US$37.9 billion in June 2022 registered a robust growth of 16.8%. India’s merchandise imports at US$63.6 bn surged to their highest monthly level in June 2022, growing by 51%. Non-oil non-gold imports at US$40.2 bn registered robust growth in June 2022. Petroleum products and coal, coke and briquettes, accounting for 42.7% of total imports, contributed 68% of total import growth.

Fiscal deficit: The fiscal deficit stood at 21.2% of the Budgeted Estimates until 1QFY23, as compared to 18.2% in the same period last year. In absolute terms, the fiscal deficit was at Rs3,51,871 crore at the end of June 2022. The main contributors to the higher fiscal deficit were lower net tax revenues at 26.1% of FY2023BE and non-tax revenue at 23.1% of FY2023BE. Meanwhile, total expenditure was higher at 24% for the period vs 23.6% in the same period last year.

CPI: Headline CPI inflation in June eased marginally to 7.01% (May: 7.04%) led by a moderation in sequential momentum to 0.5% (0.9% mom in May). Food inflation moderated to 7.7% (May: 8%). On a sequential basis, the moderation in food prices was led by decline in prices of fruits, oils and fats, and pulses. The pace of increase in food prices moderated except for eggs. Meanwhile, core inflation increased marginally to 6% in June (5.9% in May), due to lower inflation in clothing and footwear, recreation, amusement, household goods and services, education, and personal care and effects. On the other hand, inflation under the transport and communication segment moderated due to fall in petrol and diesel prices after the excise duty cut in May.

Trade Deficit: India’s merchandise trade deficit widened to its highest monthly level of US$25.6 bn in June 2022 as against a deficit of US$9.6 bn a year ago and US$24.3 bn in May 2022. India’s merchandise exports at US$37.9 billion in June 2022 registered a robust growth of 16.8%. India’s merchandise imports at US$63.6 bn surged to their highest monthly level in June 2022, growing by 51%. Non-oil non-gold imports at US$40.2 bn registered robust growth in June 2022. Petroleum products and coal, coke and briquettes, accounting for 42.7% of total imports, contributed 68% of total import growth.

Fiscal deficit: The fiscal deficit stood at 21.2% of the Budgeted Estimates until 1QFY23, as compared to 18.2% in the same period last year. In absolute terms, the fiscal deficit was at Rs3,51,871 crore at the end of June 2022. The main contributors to the higher fiscal deficit were lower net tax revenues at 26.1% of FY2023BE and non-tax revenue at 23.1% of FY2023BE. Meanwhile, total expenditure was higher at 24% for the period vs 23.6% in the same period last year.

FIIs turned buyers of Indian equities in the month of July after 9 months of sustained outflows

(+$0.6bn, following -$6.4bn in June).

DIIs maintained their buying trend from the previous month, recording 17 consecutive months of positive flows (+$1.3bn).

DIIs maintained their buying trend from the previous month, recording 17 consecutive months of positive flows (+$1.3bn).