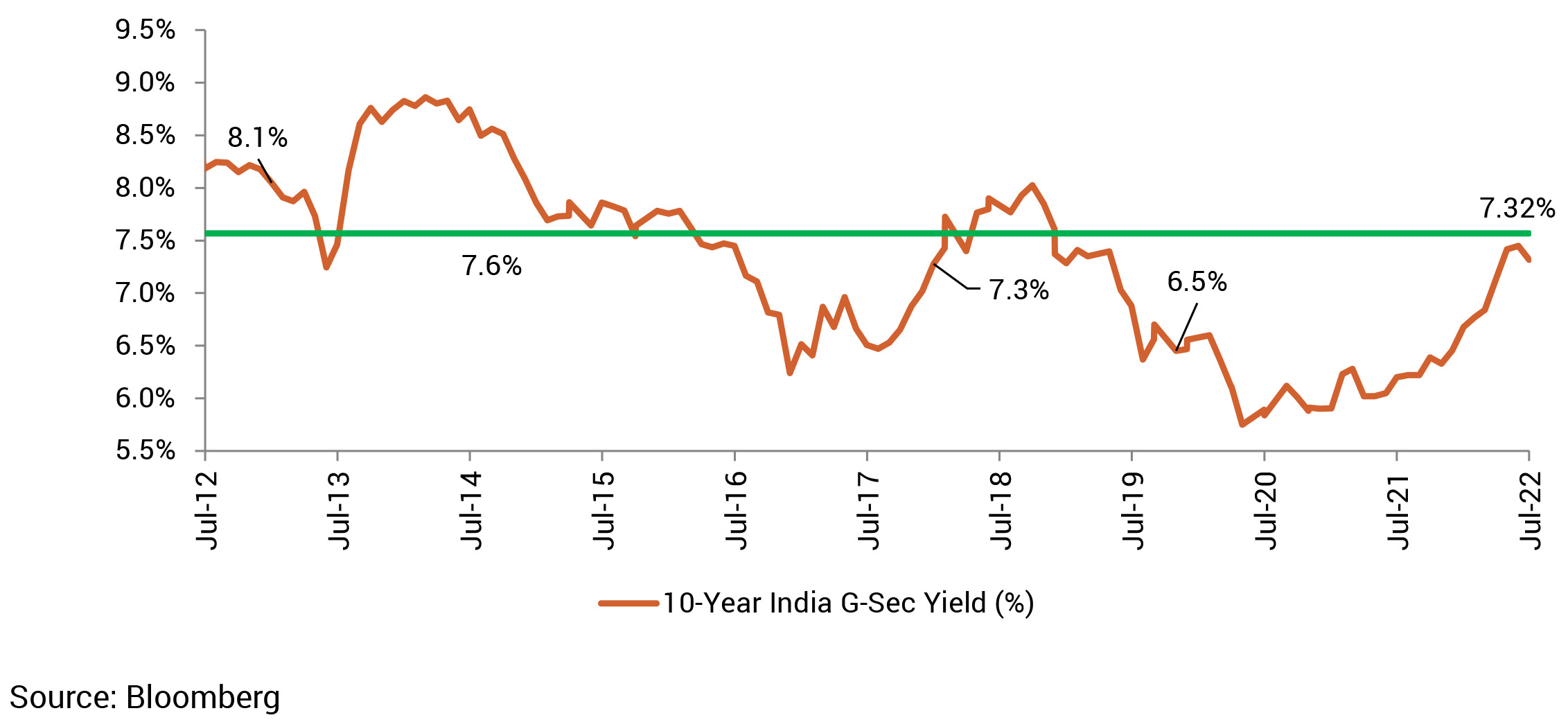

Domestic yields moderated during July as global growth concerns has eased concerns around continued aggressive central bank tightening. Inflation has also started to moderate with the current inflation trajectory undershooting the RBI’s projections for Q1 and Q2 of FY2023. In this backdrop, markets are anticipating that the RBI will take the policy rate to slightly above the prepandemic level of around 5.50% and turn data-dependent before deciding on the future course of action. Yields should therefore find support around the current levels until further cues and future trajectory would be shaped by the evolving demand-supply dynamics.