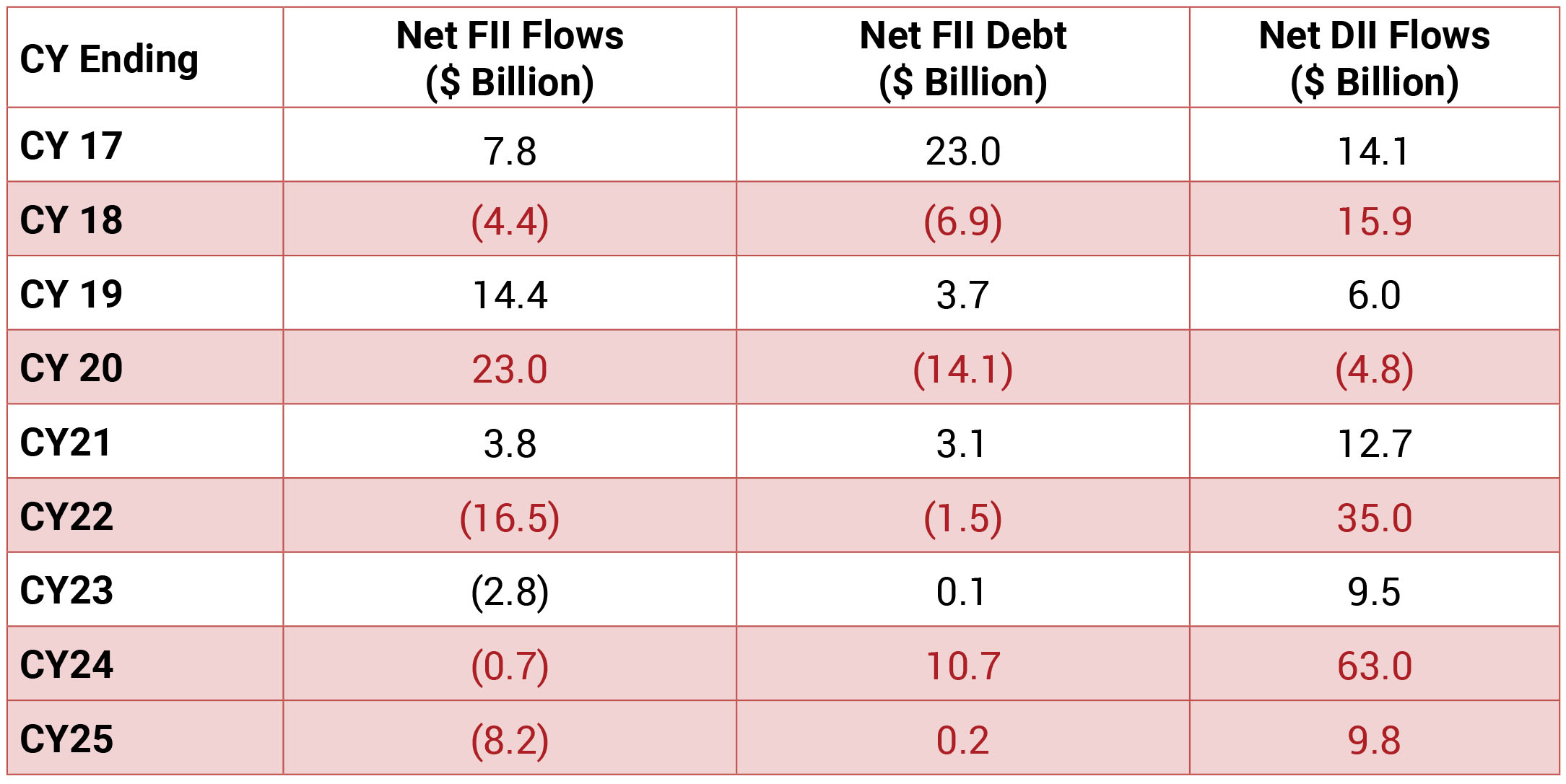

Global equities saw moderate gains, with MSCI Brazil and the Eurozone standing out as the top performers, up by

12.4% and 7.1%, respectively. In contrast, MSCI India and China were the underperformers. The Nifty 50 experienced

its fourth consecutive monthly loss, marking the longest such streak since September 2001. This decline was

driven by persistent FII selling, uncertainty over tariff policies under Trump 2.0, a weakening rupee, and concerns

about domestic growth. Large-cap stocks dropped by 2.7%, while small- and mid-caps were hit harder, falling 11.0%

and 8.3%, respectively. Most sectors ended the month in negative territory. Communication Services (+1.4%) and

Energy (+1.0%) fared relatively better, while Real Estate (-14.3%) and Industrials (-9.4%) experienced significant

sell-offs.

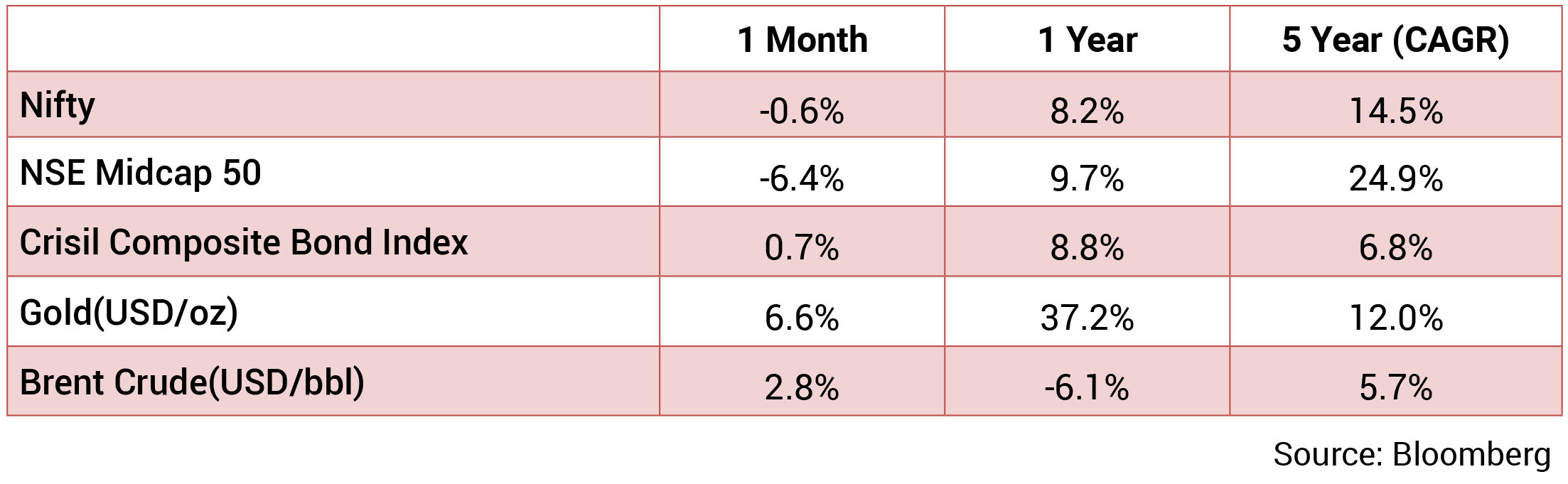

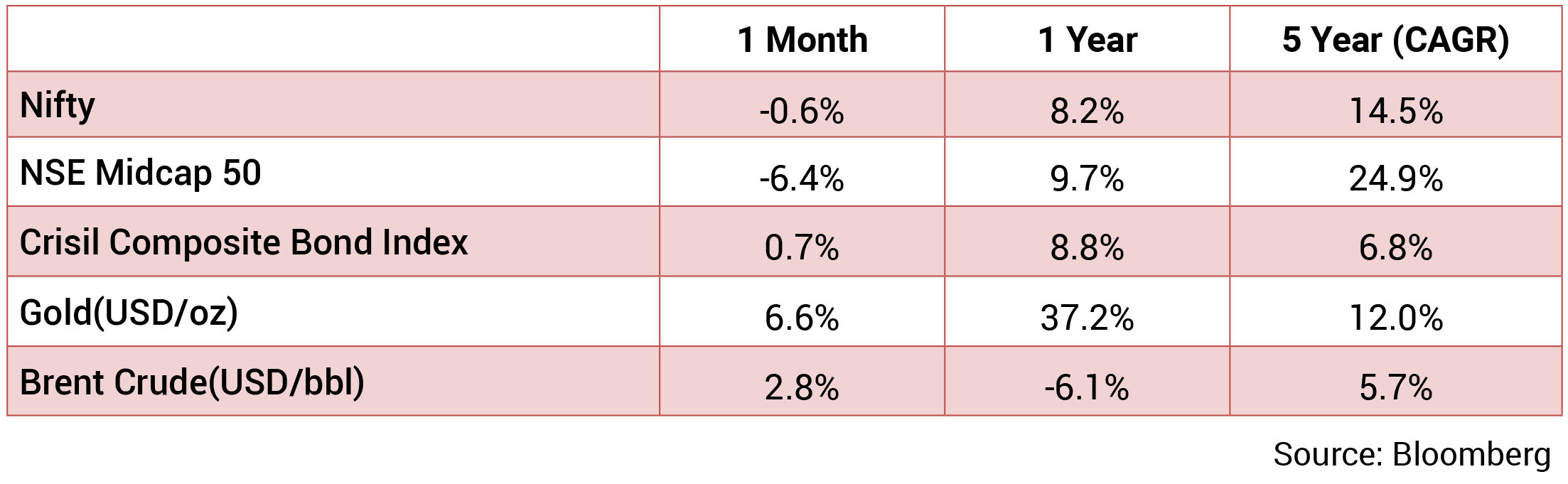

Benchmark 10-year government bond yield averaged 6.75% in January (a tad higher than the December average of 6.74%). On month-end values, the 10Y yield was lower and ended the month at 6.70% (down 6bps MoM). The U.S. 10Y yield is at 4.55% (-2bps MoM, +63bps YoY). INR depreciated 1.2% over the month and ended the month at 86.62/USD with one-year depreciation at 4.1%. Oil prices rose 4.8% in January following a fall of 0.2% in December and ended the month at 74.71 USD/barrel.

The economic outlook for 2025 is divergent across countries with some loss in momentum in the US and weak to modest recoveries in Europe and Japan. In the US, CPI inflation increased to 2.9% in December from 2.7% in November. Among AE central banks, the US Federal Reserve kept the federal funds rate unchanged to 4.25-4.50% and indicated that the extent and timing of further adjustments to the target range will depend on incoming data, the evolving outlook, and the balance of risks. ECB eased its policy rate in January by 25 bps while Japan has hiked by 25 bps.

The first advance estimates for 2024-25 released by the National Statistics Office (NSO) on January 7 confirmed that India continues to be the fastest growing major economy. After the Indian economy recorded a low GDP growth of 5.4% during Q2FY25, the recent high frequency indicators for the 3QFY25 indicate that the Indian economy is recovering from the moderation, driven by strong festival activity and a sustained upswing in rural demand. PMI readings remain strong and government spending has picked up. An above-normal monsoon and improvement in rural demand should also be supportive of growth.

Benchmark 10-year government bond yield averaged 6.75% in January (a tad higher than the December average of 6.74%). On month-end values, the 10Y yield was lower and ended the month at 6.70% (down 6bps MoM). The U.S. 10Y yield is at 4.55% (-2bps MoM, +63bps YoY). INR depreciated 1.2% over the month and ended the month at 86.62/USD with one-year depreciation at 4.1%. Oil prices rose 4.8% in January following a fall of 0.2% in December and ended the month at 74.71 USD/barrel.

The economic outlook for 2025 is divergent across countries with some loss in momentum in the US and weak to modest recoveries in Europe and Japan. In the US, CPI inflation increased to 2.9% in December from 2.7% in November. Among AE central banks, the US Federal Reserve kept the federal funds rate unchanged to 4.25-4.50% and indicated that the extent and timing of further adjustments to the target range will depend on incoming data, the evolving outlook, and the balance of risks. ECB eased its policy rate in January by 25 bps while Japan has hiked by 25 bps.

The first advance estimates for 2024-25 released by the National Statistics Office (NSO) on January 7 confirmed that India continues to be the fastest growing major economy. After the Indian economy recorded a low GDP growth of 5.4% during Q2FY25, the recent high frequency indicators for the 3QFY25 indicate that the Indian economy is recovering from the moderation, driven by strong festival activity and a sustained upswing in rural demand. PMI readings remain strong and government spending has picked up. An above-normal monsoon and improvement in rural demand should also be supportive of growth.

GDP: NSO estimated FY2025 real GDP growth at 6.4% against 8.2% in FY2024. With 1HFY25 GDP growth at 6.0%, the implied

2HFY25 GDP growth is at 6.7%. Growth is expected to be led by private consumption (estimated at 7.8% growth), while growth

in investments and government consumption is expected to be more moderate at 6.4% and 6.1%, respectively. NSO estimated

FY2025 real GVA growth at 6.4%, implying 2HFY25 growth at 6.6%. The pick-up in GVA growth in 2HFY25 is expected to be

led by agriculture (4.5% against 2.7% in 1HFY25), manufacturing (6.1% against 4.5% in 1HFY25), and financial and real estate

services (7.7% against 6.9% in 1HFY25). Some moderation is expected in construction (8.1% against 9.1% in 1HFY25) and

public administration, defense (8.9% against 9.3% in 1HFY25) and others.

RBI Liquidity Measures: The RBI decided to inject liquidity into the banking system through multiple channels, i.e., (1) OMO purchase auctions of Rs600 bn in three tranches of Rs200 bn to be held on January 30, February 13 and February 20, (2) a 56-day variable rate repo (VRR) auction of Rs500 bn on February 7 and (3) FX buy/sell swap auction of US$5 bn for a tenor of six months on January 31.

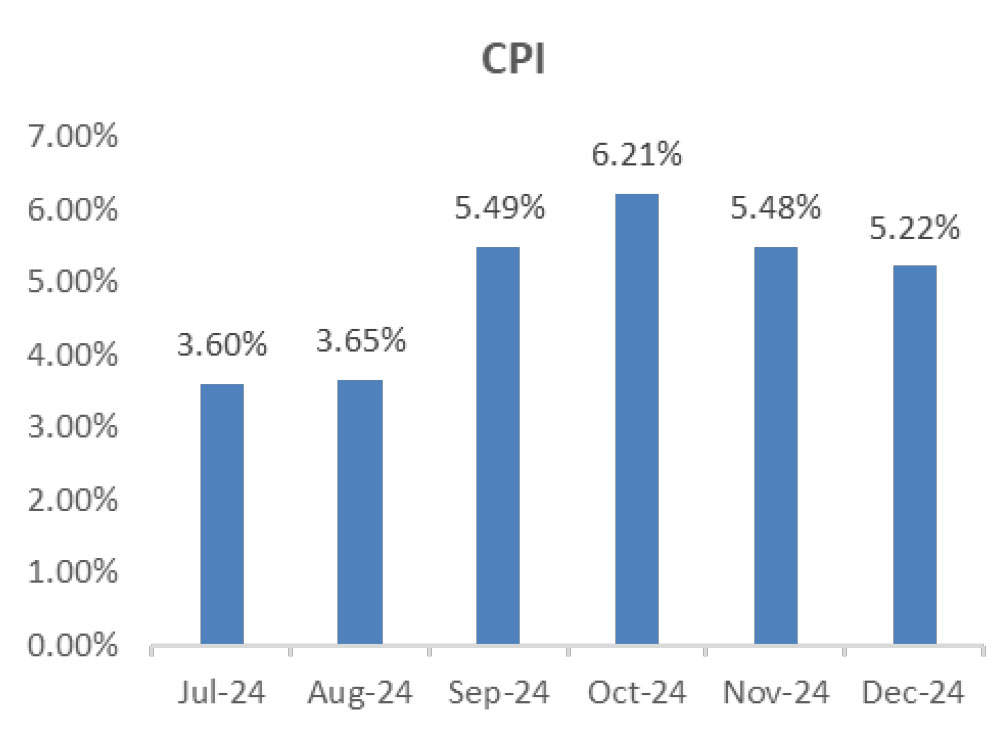

CPI: December CPI inflation decelerated to 5.2% (November: 5.5%). Headline CPI fell by 0.6% mom led by a sharp fall in food prices and moderate decline in core components’ prices. Food inflation (8.4% yoy) was led by sharp price increases in vegetables, oils and fats, fruits eggs and cereals. Core inflation (CPI excluding food, beverages and fuel) moderated marginally to 3.6% (November: 3.7%). Sequentially, core components’ prices remained broadly unchanged from the previous month (compared to a rise of 0.2% mom in November) led by a commensurate slowing in prices across all components. Gold, silver and ornaments all saw a sequential decline of (0.1%), (0.8%) and (1.0%), respectively, in December. Various core inflation metrics indicate similar softening, with super-core inflation (core inflation excluding petrol, diesel, gold and silver) continuing to decelerate at a sharper pace.

Trade: Goods trade deficit fell to US$21.9 bn in December as exports picked up and imports fell from the record high in November. Services trade surplus was stable at US$15.2 bn. Exports fell by 1% yoy in December to US$38.0 bn even as it picked up from US$32.1 bn in November. Oil exports increased to US$4.9 bn (November: US$3.7 bn) with 9MFY25 oil exports lower than 9MFY24. Non-oil exports were at US$33.1 bn, driven by engineering and electronic goods. Imports in December rose 4.9% yoy to US$60 bn (November revised to US$65bn from US$70 bn), driven by gold, machinery and electronic goods. Oil imports were at US$15.3 bn (November: US$16.1 bn), while non-oil imports were at US$44.7 bn (November: US$48.8 bn). Non-oil imports growth in 8MFY25 was led by electronic goods, gold and machinery.

Economic Survey: The Economic Survey called for pushing India to be a more competitive and innovative economy. This requires attracting and facilitating domestic and foreign investments, which is unlikely to be easy. Deregulation and reforms at the grassroots level would be required in the medium term to achieve a sustained high-growth economy. The survey pegs real GDP growth at 6.3-6.8% in FY2026. The survey identifies (1) the translation of order books of the private capital goods sector into sustained investment pick-up, (2) improvements in consumer confidence, and (3) corporate wage pick-up as key promoters of growth. A pick-up in rural demand supported by a rebound in agriculture, easing food inflation, and a stable macro environment are positives for the near-term growth outlook. However, risks remain on account of significant global political and economic uncertainties.

RBI Liquidity Measures: The RBI decided to inject liquidity into the banking system through multiple channels, i.e., (1) OMO purchase auctions of Rs600 bn in three tranches of Rs200 bn to be held on January 30, February 13 and February 20, (2) a 56-day variable rate repo (VRR) auction of Rs500 bn on February 7 and (3) FX buy/sell swap auction of US$5 bn for a tenor of six months on January 31.

CPI: December CPI inflation decelerated to 5.2% (November: 5.5%). Headline CPI fell by 0.6% mom led by a sharp fall in food prices and moderate decline in core components’ prices. Food inflation (8.4% yoy) was led by sharp price increases in vegetables, oils and fats, fruits eggs and cereals. Core inflation (CPI excluding food, beverages and fuel) moderated marginally to 3.6% (November: 3.7%). Sequentially, core components’ prices remained broadly unchanged from the previous month (compared to a rise of 0.2% mom in November) led by a commensurate slowing in prices across all components. Gold, silver and ornaments all saw a sequential decline of (0.1%), (0.8%) and (1.0%), respectively, in December. Various core inflation metrics indicate similar softening, with super-core inflation (core inflation excluding petrol, diesel, gold and silver) continuing to decelerate at a sharper pace.

Trade: Goods trade deficit fell to US$21.9 bn in December as exports picked up and imports fell from the record high in November. Services trade surplus was stable at US$15.2 bn. Exports fell by 1% yoy in December to US$38.0 bn even as it picked up from US$32.1 bn in November. Oil exports increased to US$4.9 bn (November: US$3.7 bn) with 9MFY25 oil exports lower than 9MFY24. Non-oil exports were at US$33.1 bn, driven by engineering and electronic goods. Imports in December rose 4.9% yoy to US$60 bn (November revised to US$65bn from US$70 bn), driven by gold, machinery and electronic goods. Oil imports were at US$15.3 bn (November: US$16.1 bn), while non-oil imports were at US$44.7 bn (November: US$48.8 bn). Non-oil imports growth in 8MFY25 was led by electronic goods, gold and machinery.

Economic Survey: The Economic Survey called for pushing India to be a more competitive and innovative economy. This requires attracting and facilitating domestic and foreign investments, which is unlikely to be easy. Deregulation and reforms at the grassroots level would be required in the medium term to achieve a sustained high-growth economy. The survey pegs real GDP growth at 6.3-6.8% in FY2026. The survey identifies (1) the translation of order books of the private capital goods sector into sustained investment pick-up, (2) improvements in consumer confidence, and (3) corporate wage pick-up as key promoters of growth. A pick-up in rural demand supported by a rebound in agriculture, easing food inflation, and a stable macro environment are positives for the near-term growth outlook. However, risks remain on account of significant global political and economic uncertainties.