Individual Fund

Kotak Pension Bond Fund

(ULIF-017-15/04/04-PNBNDFND-107)

MONTHLY UPDATE FEBRUARY 2025

|

AS ON 31ST JANUARY 2025 |

Aims to preserve capital and minimize downside risk, with investment in debt and government instruments.

Date of Inception

15th April 2004

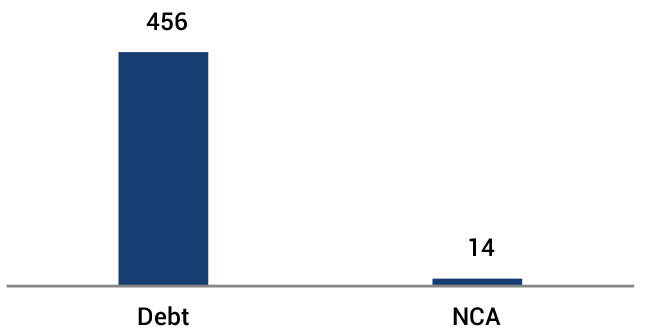

AUM (in Lakhs)

470.42

NAV

48.7300

Fund Manager

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 0% (NA);

Debt - 100% (Crisil Composite Bond)

Modified Duration

Debt & Money

Market Instruments : 2.21

Asset Allocation

| Approved (%) | Actual (%) | |

| Gsec | 00 - 75 | 35 |

| Debt | 25 - 100 | 39 |

| MMI / Others | 00 - 40 | 26 |

Performance Meter

| Pension Bond Fund (%) | Benchmark (%) | |

| 1 month | 0.6 | 0.7 |

| 3 months | 1.5 | 1.8 |

| 6 months | 3.1 | 4.0 |

| 1 year | 6.5 | 8.8 |

| 2 years | 6.2 | 8.3 |

| 3 years | 4.9 | 6.6 |

| 4 years | 4.5 | 5.7 |

| 5 years | 5.6 | 6.8 |

| 6 years | 6.7 | 7.6 |

| 7 years | 6.8 | 7.4 |

| 10 years | 6.9 | 7.6 |

| Inception | 7.9 | 6.8 |

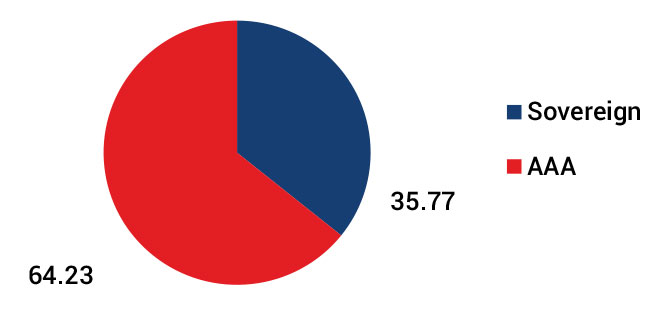

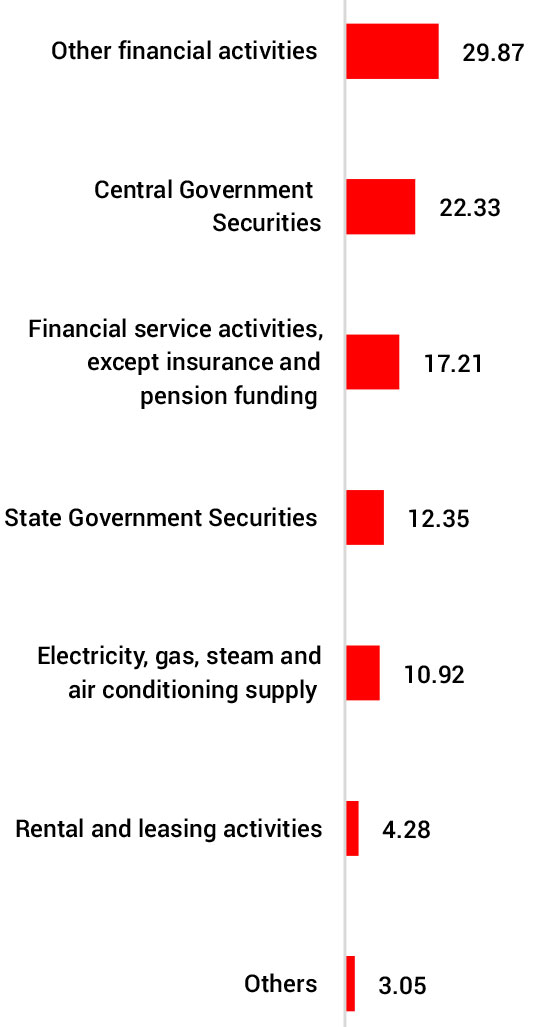

| Holdings | % to Fund |

| G-Sec | 34.68 |

| 7.10% GOI - 08.04.2034 | 6.45 |

| 7.38% GOI - 20.06.2027 | 5.78 |

| 7.54% GOI - 23.05.2036 | 2.24 |

| 7.17% GOI - 17.04.2030 | 1.23 |

| 8.44% RJ SDL - 27.06.2028 | 1.13 |

| 7.40% GOI 2035 - 09.09.35 | 0.94 |

| 8.32% KA SDL - 06.02.2029 | 0.92 |

| 8.27% TN SDL - 13.01.2026 | 0.86 |

| 8.38% TN SDL - 27.01.2026 | 0.84 |

| 7.20% GJ SDL - 14.06.2027 | 0.75 |

| Others | 13.54 |

| Corporate Debt | 38.90 |

| 10.08% IOT Utkal Energy Services Limited - 20.03.2027 | 3.96 |

| 8.13% PGC - 25.04.2031 | 2.21 |

| 8.54% NHPC - 26.11.2028 | 2.20 |

| 8.29% NABARD - 24.01.2029 | 2.20 |

| 8.90% PFC - 18.03.2028 | 2.20 |

| 8.63% REC - 25.08.2028 | 2.20 |

| 8.13% PGC - 25.04.2030 | 2.18 |

| 8.13% PGC - 25.04.2029 | 2.17 |

| 9.33% IRFC - 10.05.2026 | 2.17 |

| 8.09% REC - 21.03.2028 | 2.17 |

| Others | 15.24 |

| MMI | 23.37 |

| NCA | 3.05 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.