As mentioned earlier, geopolitics remains the key theme for CY2025 as Trump presidency begins. Besides the direct impact of trade related policies on economies, the indirect impact through higher inflation risks in the US and consequent higher neutral interest rate will create headwinds for most economies (more for EMs), given the inherent USD strengthening bias.

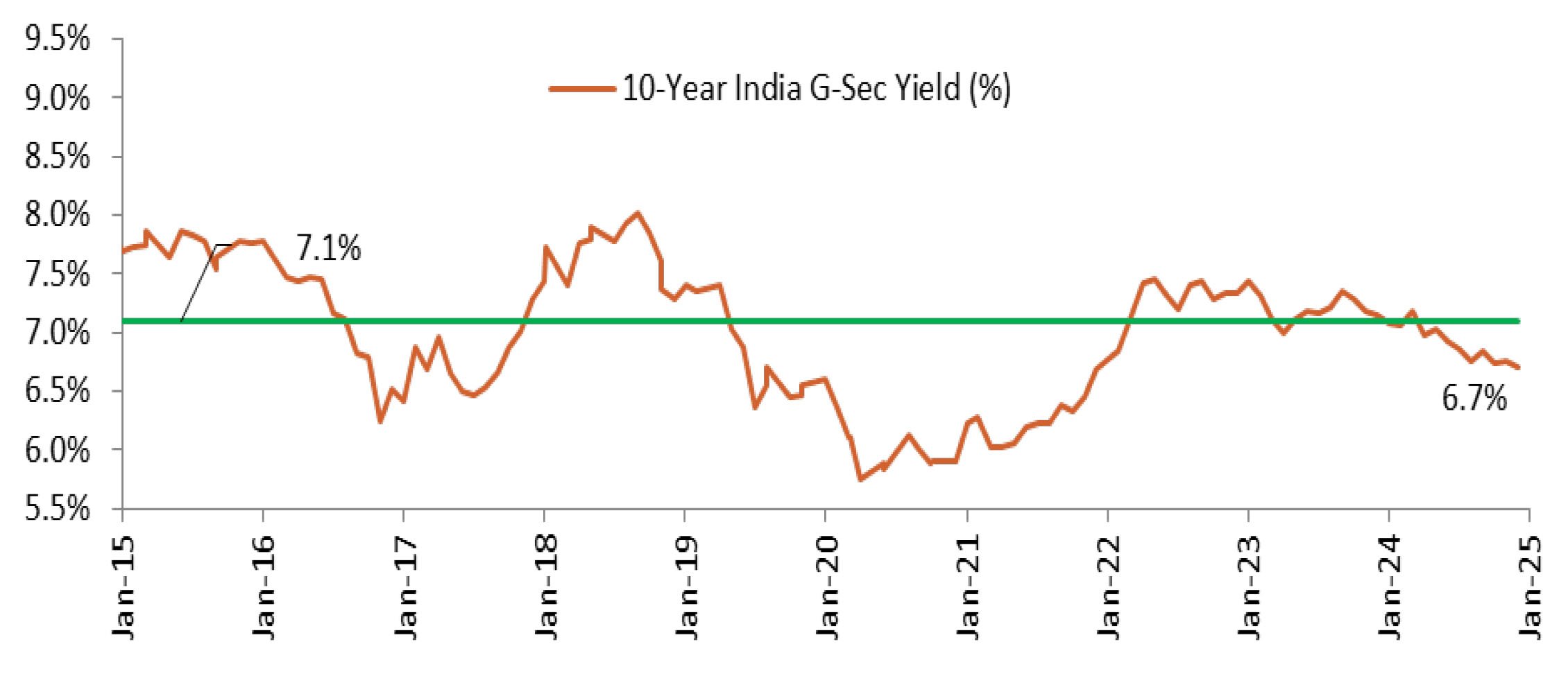

At the same time, the domestic growth slowdown in India and inflation slowly trending towards 4% will lead the MPC to embark on a rate cutting cycle in CY2025. We expect the RBI to view the Union budget as prudent, given the continued commitment to fiscal consolidation and its focus on growth enhancing reforms. The budget will ensure that India’s fiscal risk premium and inflation remain low, thereby providing room for monetary policy to support growth. The RBI’s recent liquidity easing measures have also set the stage for the better transmission of monetary policy. The growth-inflation dynamics also support the prospect for a rate cut in February 2025.