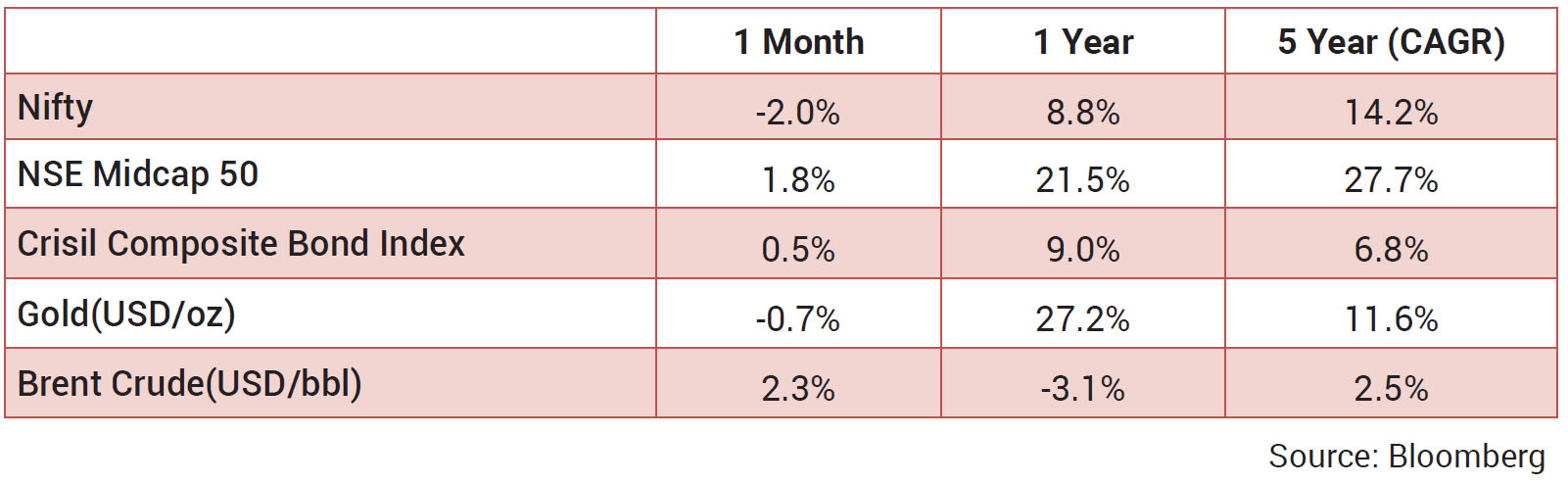

Global markets ended on a mixed note. Japan (+4.4%), Taiwan (+3.5%) and Hong Kong (+3.3%) were the major

gainers, whereas the US Dow Jones, Brazil and US SPX declined 5.2%, 4.3% and 2.4%, respectively. The Nifty

declined 2% in December but gained 8.8% in CY2024. Mid-cap and small-cap indices outperformed the large-cap

index and were up 1.4% and 0.6% in December and 23.9% each in CY2024. Sector-wise, healthcare and realty

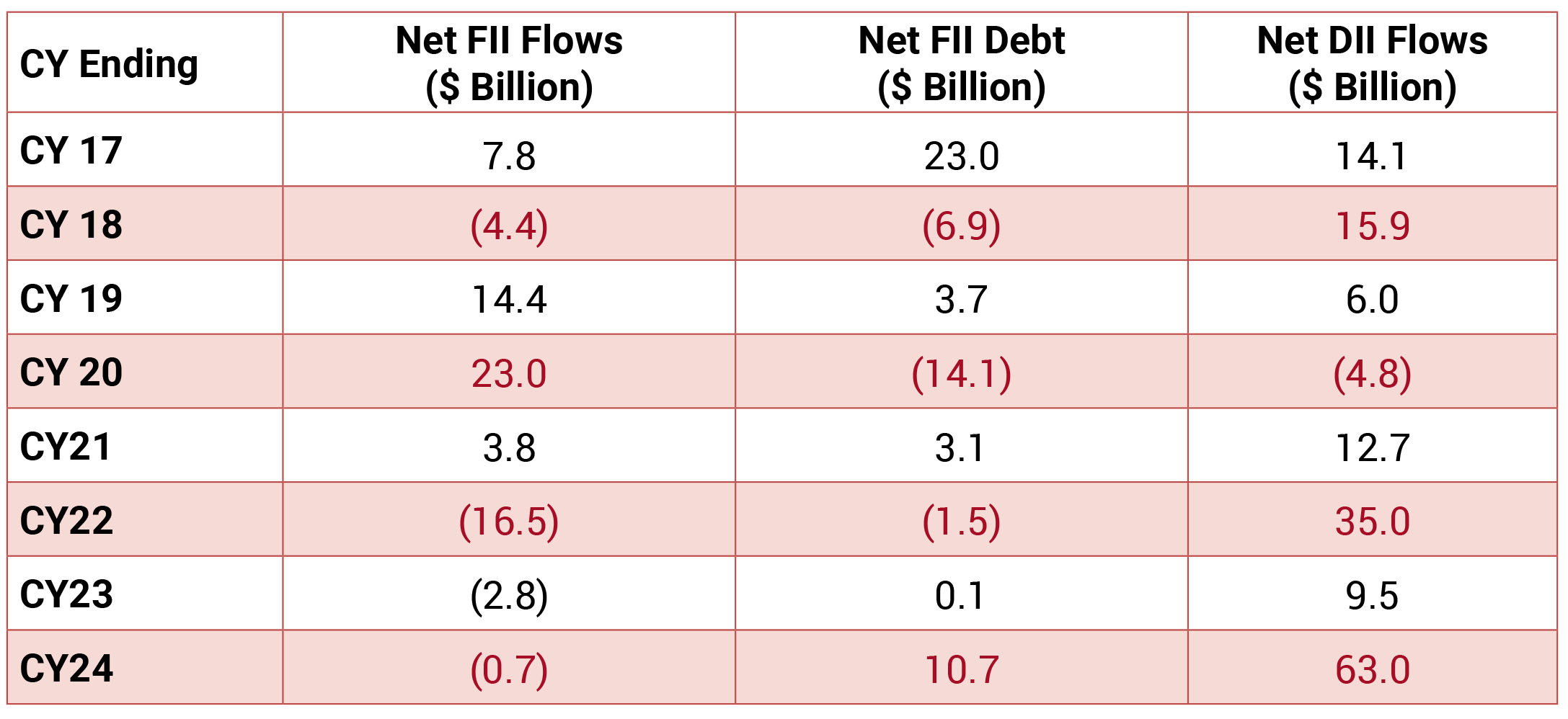

were the best-performing sectors in the month of December and in 2024. Equity inflows by institutions stood

at US$5.7bn. DMF’s and Foreign Portfolios Investors’ bid on equities at US$1.7bn and US$2.5bn, respectively.

Benchmark 10-year government bond yield averaged at 6.74% in Dec (Lower than the Nov average of 6.80%). On

month-end values, the 10Y yield was lower and ended the month at 6.76% (down 2bps MoM). The US 10Y yield is at

4.17% (12 bps lower than last month). INR depreciated by 1.34% over the month and ended the month at 85.6150/

USD. Oil prices moved up by 3.82% over the month and ended the month at 74.78 USD/barrel.

Global economic growth remains resilient despite ongoing geopolitical uncertainty, albeit with a diverging growth outlook across geographies. Headline inflation continues to hover close to targets but remains above target for major economies, amidst persistent services sector inflation. In the US, CPI inflation increased to 2.7% in November from 2.6% in October. Among AE central banks, the US Federal Reserve decided to lower the target range for the federal funds rate by 25 bps to 4.25-4.50% and indicated that the extent and timing of further adjustments to the target range will depend on incoming data, the evolving outlook, and the balance of risks. ECB cut their policy rate in December by 25 bps and Canada and Switzerland reduced their benchmark rates by 50 bps each whereas the UK, Japan and Australia kept their policy rates unchanged. Global yields, however, hardened in December and the US 10-year treasury yield reached the highest level since May 2024, along with a steepening of the yield curve, as summary of economic projections of the FOMC indicated a slower than anticipated pace of interest rate reductions in 2025.

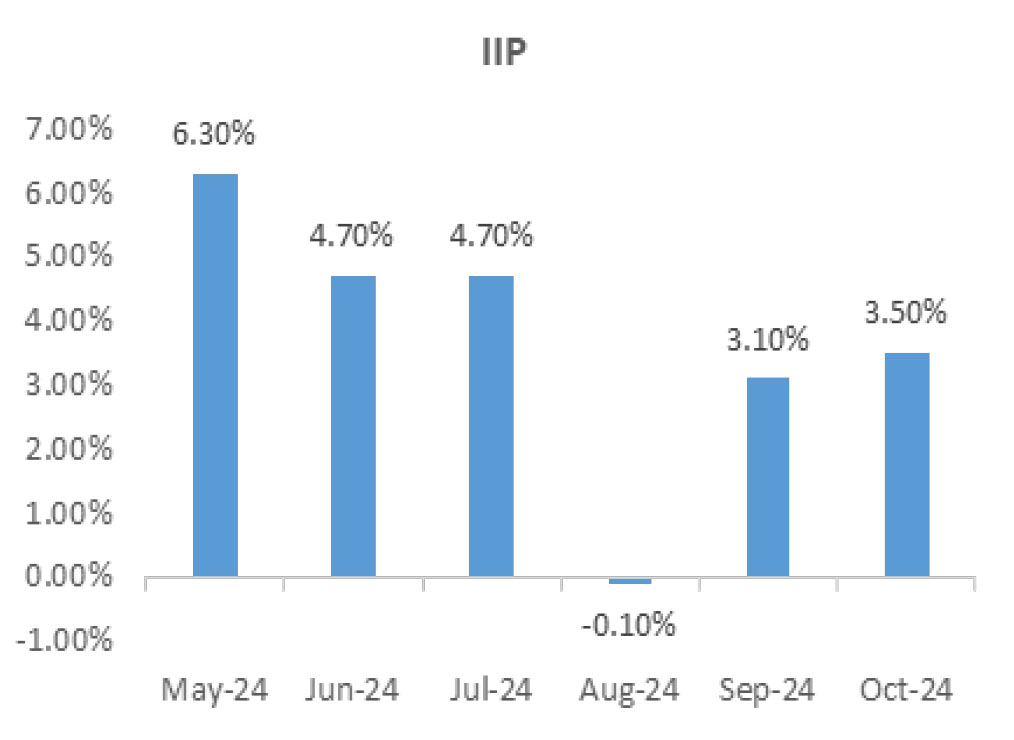

After the Indian economy recorded a low GDP growth of 5.4% during Q2FY25, the recent high frequency indicators for the 3QFY25 indicate that the Indian economy is recovering from the moderation, driven by strong festival activity and a sustained upswing in rural demand. PMI readings remain strong and government spending has picked up. An above-normal monsoon and improvement in rural demand should also be supportive of growth.

Global economic growth remains resilient despite ongoing geopolitical uncertainty, albeit with a diverging growth outlook across geographies. Headline inflation continues to hover close to targets but remains above target for major economies, amidst persistent services sector inflation. In the US, CPI inflation increased to 2.7% in November from 2.6% in October. Among AE central banks, the US Federal Reserve decided to lower the target range for the federal funds rate by 25 bps to 4.25-4.50% and indicated that the extent and timing of further adjustments to the target range will depend on incoming data, the evolving outlook, and the balance of risks. ECB cut their policy rate in December by 25 bps and Canada and Switzerland reduced their benchmark rates by 50 bps each whereas the UK, Japan and Australia kept their policy rates unchanged. Global yields, however, hardened in December and the US 10-year treasury yield reached the highest level since May 2024, along with a steepening of the yield curve, as summary of economic projections of the FOMC indicated a slower than anticipated pace of interest rate reductions in 2025.

After the Indian economy recorded a low GDP growth of 5.4% during Q2FY25, the recent high frequency indicators for the 3QFY25 indicate that the Indian economy is recovering from the moderation, driven by strong festival activity and a sustained upswing in rural demand. PMI readings remain strong and government spending has picked up. An above-normal monsoon and improvement in rural demand should also be supportive of growth.

RBI MPC: The repo rate was held at 6.5% with a 4-2 majority (Dr Nagesh Kumar and Prof Ram Singh voted for a 25-bps cut).

The neutral stance was voted unanimously to be kept unchanged. In anticipation of tight liquidity conditions in 4QFY25, the

RBI announced a 50 bps CRR cut to 4% in two tranches of 25 bps each on December 14 and December 28, releasing primary

liquidity of Rs1.2 tn for the banking system. The MPC revised its FY2025 real GDP growth estimate lower to 6.6% (earlier: 7.2%),

implying 2HFY25 growth at 7.0%. 1HFY26 GDP growth was pegged at 7.1%. The MPC revised up its FY2025 headline inflation

estimate to 4.8% (earlier: 4.5%), while penciling in 4.3% for 1HFY26. Food inflation is expected to soften on the back of (1)

seasonal easing of vegetable prices and kharif harvest arrivals and (2) good soil moisture conditions, along with comfortable

reservoir levels auguring well for rabi production. The key risks to disinflation are from adverse weather events and a rise in

agricultural commodity prices.

BoP: The current account deficit in 2QFY25 was US$11.2 bn (1.2% of GDP) (1QFY25 CAD is US$10.2 bn). The goods trade deficit widened to US$75 bn (1QFY25: US$65 bn). Net invisibles surplus rose to US$64 bn (1QFY25: US$55 bn), with nonsoftware surplus at US$5 bn (US$2 bn). The capital account surplus in 2QFY25 increased to US$30.5 bn (1QFY25: US$14.7 bn). Most of the rise was on the back of FPI flows, which more than doubled to US$18 bn (1QFY25: US$8 bn), even as net FDI registered outflows of US$2 bn (1QFY25: US$7 bn net inflows). 2QFY25 BOP was US$18.6 bn (1QFY25: US$5.2 bn).

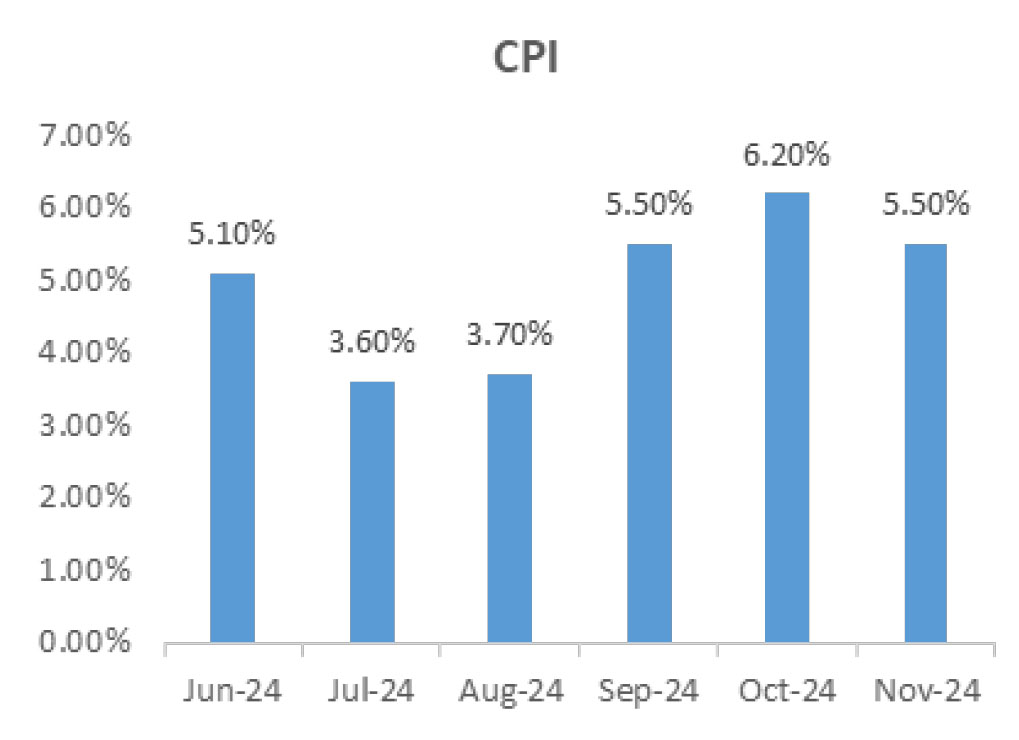

CPI: November CPI inflation decelerated to 5.5% (October: 6.2%). The headline CPI fell 0.2% mom, led by a sharp fall in food prices, even as core inflation remained steady. Food inflation (9.0% yoy) was led by sharp price increases in vegetables, oils and fats, fruits, and cereals. Core inflation (CPI excluding food, beverages and fuel) remained steady at 3.7% (October: 3.7%). Sequentially, core inflation increased 0.2% mom compared with 0.5% mom in October, led by a commensurate rise across components.

Trade: Goods trade deficit in November widened to US$37.8 bn from US$27.1 bn in October due to a spike in gold imports, while exports slumped to the lowest levels since November 2022. Services trade surplus rose to US$18 bn—a fresh record high. Exports fell 4.9% yoy in November to US$32.1 bn (October: US$39.2 bn). Oil exports continued to decline to US$3.7 bn (October: US$4.6 bn). Imports in November grew 27% yoy to US$70 bn (October: US$66.3 bn), driven primarily by gold imports. Oil imports were at US$16.1 bn (October: US$18.3 bn), while non-oil imports were at US$53.8 bn (October: US$48.0 bn). Gold imports spiked to a record high of US$14.8 bn (October: US$7 bn)

Fiscal Deficit: The FYTD fiscal deficit (until November 2024) is annualizing at around 4% of GDP, tracking approximately 52.5% of the F2025 budget target. Total expenditure moderated to 3.6% YoY in November, down from 31.7% in October, due to a slowdown in revenue spending (0.5% YoY), although capital expenditure rose to a four-month high of 21.3% YoY on a monthly basis. On a FYTD basis, expenditure growth held steady at 3.3% YoY. Total receipts saw a significant improvement, rising 10.6% YoY in November—the highest since July—after a sharp 50.1% drop in October, driven by a broad-based rise in revenues. Gross taxes grew by 10% YoY in November, compared to just 1.6% in October, with direct taxes showing acceleration both monthly and FYTD, bolstered by personal income tax.

BoP: The current account deficit in 2QFY25 was US$11.2 bn (1.2% of GDP) (1QFY25 CAD is US$10.2 bn). The goods trade deficit widened to US$75 bn (1QFY25: US$65 bn). Net invisibles surplus rose to US$64 bn (1QFY25: US$55 bn), with nonsoftware surplus at US$5 bn (US$2 bn). The capital account surplus in 2QFY25 increased to US$30.5 bn (1QFY25: US$14.7 bn). Most of the rise was on the back of FPI flows, which more than doubled to US$18 bn (1QFY25: US$8 bn), even as net FDI registered outflows of US$2 bn (1QFY25: US$7 bn net inflows). 2QFY25 BOP was US$18.6 bn (1QFY25: US$5.2 bn).

CPI: November CPI inflation decelerated to 5.5% (October: 6.2%). The headline CPI fell 0.2% mom, led by a sharp fall in food prices, even as core inflation remained steady. Food inflation (9.0% yoy) was led by sharp price increases in vegetables, oils and fats, fruits, and cereals. Core inflation (CPI excluding food, beverages and fuel) remained steady at 3.7% (October: 3.7%). Sequentially, core inflation increased 0.2% mom compared with 0.5% mom in October, led by a commensurate rise across components.

Trade: Goods trade deficit in November widened to US$37.8 bn from US$27.1 bn in October due to a spike in gold imports, while exports slumped to the lowest levels since November 2022. Services trade surplus rose to US$18 bn—a fresh record high. Exports fell 4.9% yoy in November to US$32.1 bn (October: US$39.2 bn). Oil exports continued to decline to US$3.7 bn (October: US$4.6 bn). Imports in November grew 27% yoy to US$70 bn (October: US$66.3 bn), driven primarily by gold imports. Oil imports were at US$16.1 bn (October: US$18.3 bn), while non-oil imports were at US$53.8 bn (October: US$48.0 bn). Gold imports spiked to a record high of US$14.8 bn (October: US$7 bn)

Fiscal Deficit: The FYTD fiscal deficit (until November 2024) is annualizing at around 4% of GDP, tracking approximately 52.5% of the F2025 budget target. Total expenditure moderated to 3.6% YoY in November, down from 31.7% in October, due to a slowdown in revenue spending (0.5% YoY), although capital expenditure rose to a four-month high of 21.3% YoY on a monthly basis. On a FYTD basis, expenditure growth held steady at 3.3% YoY. Total receipts saw a significant improvement, rising 10.6% YoY in November—the highest since July—after a sharp 50.1% drop in October, driven by a broad-based rise in revenues. Gross taxes grew by 10% YoY in November, compared to just 1.6% in October, with direct taxes showing acceleration both monthly and FYTD, bolstered by personal income tax.