● Policy continuity expected: We believe the government focus on capex, manufacturing and infra push would continue. Healthy corporate balance sheet and decent domestic demand is expected to be the driver for capex cycle in India

● GST collections: Goods and Services Tax (GST) collections in Dec’24 went up by 6.7% from the same period last year to INR1.77t. The YTD collection stands at 9.1% growth reflects the strong economic activity.

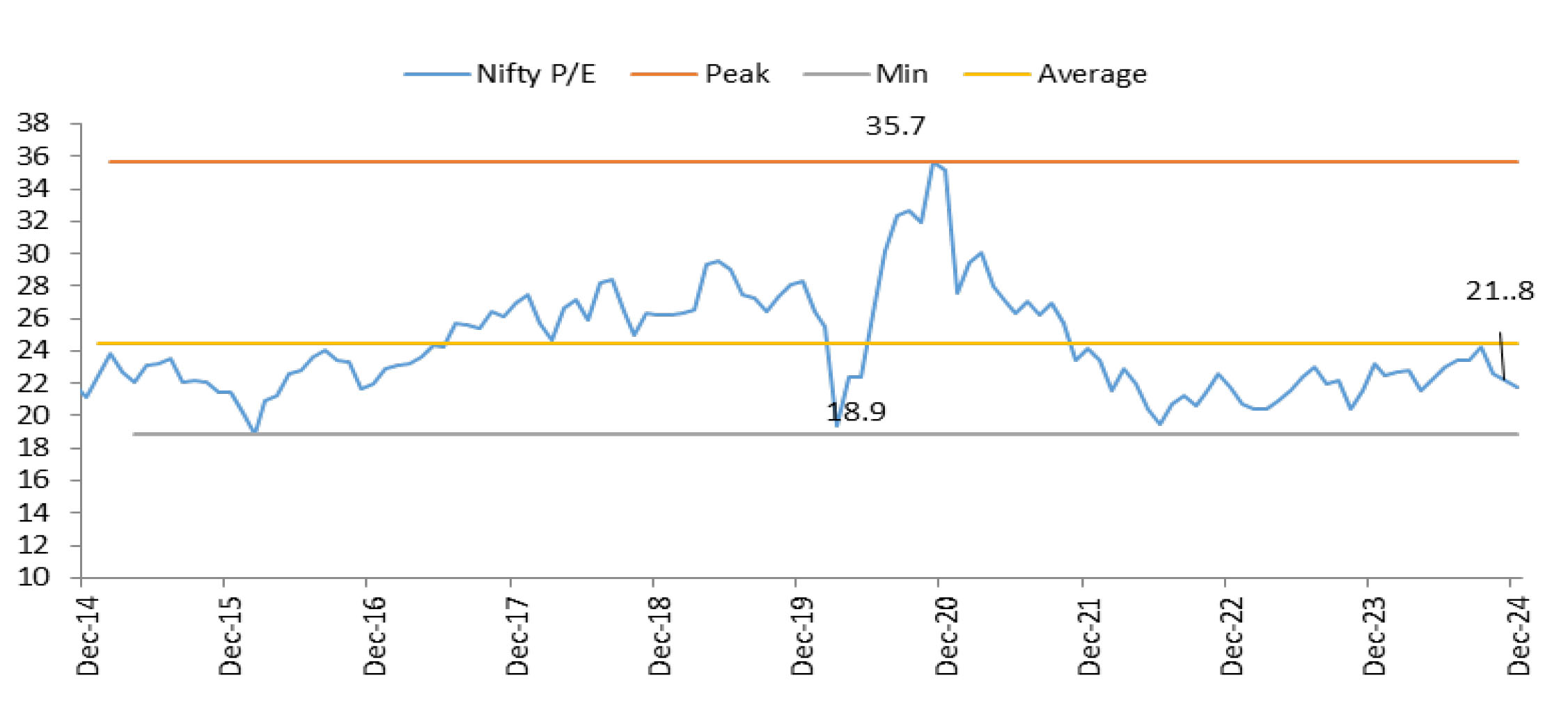

●Outlook: India is currently enjoying the best macro and micro tailwinds with above ~6.5% GDP growth, moderating inflation prints, range-bound crude prices, easing 10-year G-sec yield, stable currency, and resilient corporate earnings. A healthy domestic macro and micro environment, strong retail participation and global interest rates at its peak would continue to keep market sentiments positive.