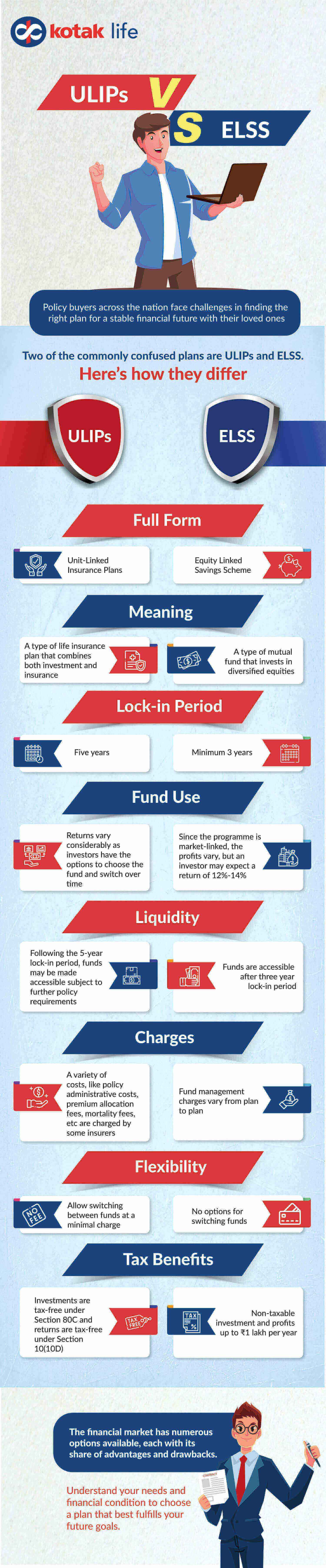

When it comes to long-term saving and investing options, consumers are sometimes confused while deciding whether to invest their hard-earned money in ULIP or ELSS. While both of these investment options have made their mark amongst other choices, we will go over them in-depth today to help you decide where to place your money.

ULIP vs ELSS The Basics

United Linked Investment Plan (ULIP)

A unit-linked insurance plan is a product sold by insurance firms that apart from a traditional insurance policy, combines insurance and investment into a single package.

Equity Linked Saving Scheme (ELSS)

The equity-linked savings plan, or ELSS, is the only mutual fund that qualifies for Section 80C benefits. ELSS is a diversified equity mutual fund that provides yearly tax benefits of up to ₹1.5 lakh.

Features of ULIPs

Lock-In Period

ULIP plans have a five-year lock-in period and they are a good option for developing a steady investment habit. Although ULIPs are a long-term investment, buying only one is generally enough. The lock-in period is usually specified by the policy’s grant date, and the premium must be paid monthly or yearly in one lump sum. In addition, following the 5-year lock-in term, the policyholder has the option of cancelling the insurance and withdrawing assets as needed.

ULIP Returns

Since an investor can contribute in any combination of equity, debt, or hybrid funds, ULIP returns can differ.

Liquidity

Following the 5-year lock-in period, funds may be made accessible subject to further policy requirements.

ULIP Charges

ULIPs seem to be a variety of costs, such as policy administrative costs, premium allocation fees, mortality fees, and so on.

Switching & Flexibility

It is possible to choose between funds such as equity, debt, hybrid, balanced, or money market funds, amongst others. The number of switches and the switching fees differs from one provider to the next.

ULIP Tax Benefits

Investments are tax-free under Section 80C, and returns are tax-free under Section 10 (10D) under ULIP tax benefits as per the Income Tax Act if life insurance coverage is at least ten times the yearly premium.

Features of ELSS

Lock-In Period

In the tax-saving investment product category, ELSS has a minimum 3-year lock-in period.

ELSS Returns

Since the program is market-linked, the profits vary, but an investor may expect a return of 12 percent to 14 percent.

Liquidity

After the three-year lock-in period, funds will be accessible to the investor.

ELSS Charges

Fund management fees vary based on the investment, but are approximately 2 percent, and are reflected in the program’s NAV. In the event of direct plans, there are lower costs.

Switching & Flexibility

As the whole sum is invested in equities and equity-related funds, there is no room for switching or flexibility. After the lock-in period has expired, a systematic transfer plan can be implemented.

ELSS Tax Benefits

Non-taxable investment and profits up to ₹1 lakh per year are tax-free.

To summarise, after examining the fundamental characteristics and tax benefits of both ULIP and ELSS, one may choose which is the best option for them on a need basis. However, if you’re still undecided about which option to choose, you may seek advice from a financial advisor for better clarity and guidance.