Unit Linked Insurance Plans are a type of insurance plan that helps you reach your financial objectives by generating wealth through market-linked investments. Depending on your risk tolerance, you can distribute your money among debt, equities, or balanced funds using these instruments. This allows you to earn market returns that outperform inflation.

ULIP is like a mutual fund with insurance cover added to it. However, there are some charges involved in ULIPs, unlike mutual funds, which have a single consolidated Total Expense Ratio (TER).

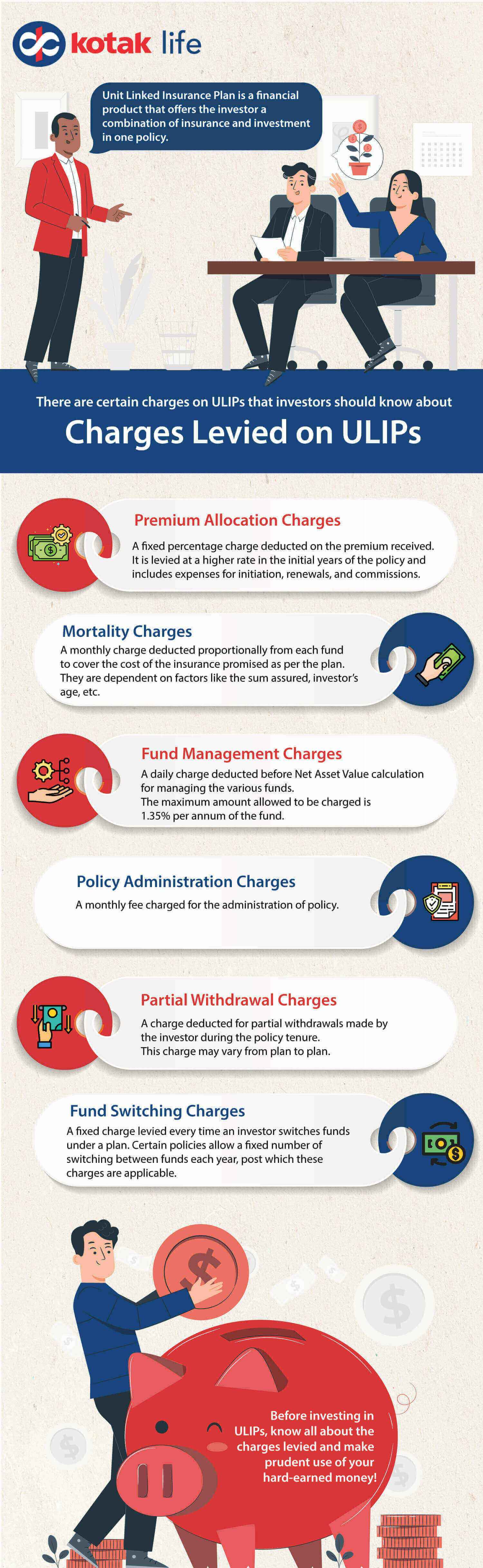

Types of Charges in ULIP

One of the key features of ULIPs is the presence of charges that are deducted from the premiums paid by the policyholder. These charges are levied to cover the various expenses incurred by the insurance company in managing the policy,

Such expenses include administration costs, mortality charges, fund management fees, and other expenses. Understanding the different types of charges that apply to ULIPs is crucial for investors looking to make an informed decision about investing in them.

1. Premium Allocation Charges

The Premium Allocation Charges (PAC) is a predetermined charge in ULIP policy. The percentage of the premium collected is normally imposed at a greater rate in the first few years of a policy. The original and renewal charges and the intermediary’s compensation expenses are usually included in this. It is a percentage of the premium deducted, and the remaining funds are utilized to obtain units at the current Net Asset Value (NAV).

2. Fund Management Charges

The price levied by the insurance provider for managing multiple funds in ULIP is known as the Fund Management Charge (FMC). It is a fee for fund management and is subtracted before reaching the NAV. Therefore, on a routine basis, the FMC is modified from NAV. Though it varies from investment to investment, life insurance firms aren’t allowed to impose fund administration fees greater than 1.35 percent annually under the IRDAI cap. The fund management charge for debt-oriented ULIPs is typically substantially cheaper than that of their equity equivalents.

3. Discontinuance Charges in ULIP

For the full or partial early encashment of units, a surrendering fee may be imposed. Typically, a proportion of the corpus or the yearly premiums is used to compute this fee. The maximum surrender fees that life insurance firms may impose are governed by Insurance Regulatory and Development Authority (IRDAI) regulations.

There shall be no further fees assessed by the insurer upon surrender of the policy beyond the discontinuation charge, which shall not exceed 50 basis points per year on the unit sum insured. After understanding these fees, it’s important to know that the IRDAI has set restrictions to minimise their impact on the overall yield from the investible component of your premium.

ULIP discontinued charges are imposed when an investor prematurely surrenders ULIPs. The minimum lock-in term for these investment programs is five years. ULIPs, on the other hand, can be surrendered before the lock-in term expires in the event of unforeseen circumstances that prevent regular premium payments. The surrender charge, which is computed as a percentage of the yearly premium amount, will be imposed in this situation.

4. Fund Switching ULIP Charges

Switching is the process of moving money or investments from one option to another. A limited amount of fund switches may be permitted without charge each year, with other switches incurring a fee of ₹100 or ₹250 for each switch.

5. Partial Withdrawal Charges

ULIPs allow for partial withdrawals of money. Some plans allow unlimited partial withdrawals, while others limit them to only 2-4 each year. These withdrawals might be free up to a specific point before costing ₹100 apiece as part of the ULIP policy charges, or maybe they’re free for an infinite series of withdrawals.

6. Partial Administration Charges

The reimbursement of the charges incurred by the insurer is known as administration costs in ULIP. These are monthly fees that may or may not be related to the insurer’s standard paperwork or activities. Administration costs are imposed by cancelling a proportionate number of the investor’s units from each fund.

7. Premium Discontinuance Costs

You can discontinue paying your premiums before the five-year lock-in term expires. When you stop paying your premiums, your money will be put into a Discontinuance Fund. As stated in the policy terms, a Premium Discontinuance fee may be charged as part of ULIP plan charges. This is calculated as a percentage of the fund’s worth or the premiums.

8. Mortality Charges

When a person invests in ULIP, the insurer charges mortality charges in ULIP to pay insurance protection and other expenditures in the event of the insured’s death.

What are Mortality Charges?

When a person invests in ULIP, the insurer charges mortality charges in ULIP to pay insurance protection and other expenditures in the event of the insured’s death. It is generally taken, along with other fees, before the policyholder’s money is invested.

The mortality fee is calculated using the amount at risk, which is equal to the sum assured minus the fund value. The sum at risk is the amount that the insurer must pay out of pocket if the insured dies. Further, the fee should ideally reduce as the fund value increases throughout the policy period.

Factors Affecting Mortality Charges

Mortality charges, also known as mortality risk charges, are an essential component of life insurance policies. These charges are designed to cover the insurer’s risk of paying out a death benefit to the policyholder’s beneficiaries. The amount of the mortality charge is influenced by several factors that affect the likelihood of the policyholder’s death.

Age

One of the most significant factors that impact mortality charges is age. As people age, their risk of mortality increases, and as a result, the mortality charge increases too. This is because older individuals are more likely to pass away than younger individuals, and therefore, the insurance company needs to charge higher premiums to compensate for the increased risk.

Health Status

Another important factor that affects mortality charges is the policyholder’s health status. Individuals with pre-existing medical conditions or who engage in high-risk activities such as smoking or extreme sports are more likely to pass away prematurely, and therefore, they will be charged a higher mortality risk charge.

Gender

Gender is also a factor that impacts mortality charges. Women typically have a longer life expectancy than men, and as a result, they are generally charged lower mortality risk charges than men of the same age and health status.

Occupation

Certain occupations can also impact mortality charges. For example, individuals who work in hazardous or high-risk jobs, such as construction or mining, are more likely to suffer fatal accidents. As a result, they may be charged a higher mortality risk charge to compensate for the increased risk.

Lifestyle Habits

Lifestyle habits such as diet, exercise, and alcohol consumption can also impact mortality charges. Individuals who maintain a healthy lifestyle and have a lower risk of developing chronic diseases are generally charged lower mortality risk charges than those who have unhealthy habits.

Family Medical History

Family medical history is another factor that can impact mortality charges. If the policyholder has a family history of certain medical conditions, such as heart disease or cancer, they may be charged a higher mortality risk charge to compensate for the increased risk of developing these conditions.

How can I Lower the Mortality Charges?

Mortality charges are an important consideration for anyone who invests in Unit Linked Insurance Plans (ULIPs). These charges are designed to cover the cost of life insurance, which is an integral component of ULIPs. While mortality charges are a necessary expense, they can also be a significant drain on investment returns. However, there are several strategies that can be used to lower mortality charges and increase the overall return on investment for ULIPs.

Here are several steps individuals can take to lower mortality charges:

Opt for a Lower Sum Assured

The sum assured is the amount of insurance coverage that is provided by the ULIP. The higher the sum assured, the higher the mortality charges. Therefore, one way to lower the mortality charges is to opt for a lower sum assured. However, it is important to note that the sum assured should be sufficient to cover the policyholder’s needs.

Choose a Longer Policy Term

The policy term is the duration of the ULIP. The longer the policy term, the lower the mortality charges. This is because the probability of the policyholder passing away during the policy term decreases as the policy term increases. Therefore, choosing a longer policy term can help lower the mortality charges.

Compare Policies from Different Insurers

Mortality charges can vary between insurers. Therefore, it is important to compare policies from different insurers to find the one that offers the lowest mortality charges. This can be done by researching online, consulting with a financial advisor, or using a comparison website.

Handpick the Ideal Term Insurance Policy

Term insurance policies offer pure insurance coverage without any investment component. As a result, the mortality charges associated with term insurance policies are generally lower than those of ULIPs. Therefore, if the primary objective is insurance coverage, opting for a term insurance policy may be a better choice.

Calculating Mortality Charges in ULIP

In ULIP, the mortality charge is calculated as a percentage of the cover or the annual total at risk. As a result, the total risk is the most important metric to consider when calculating the mortality charge in ULIP. The amount at risk varies depending on whether you have a Type I or Type II ULIP

ULIP Type – I

As a death benefit, the nominee receives the greater of the guaranteed sum and the fund value. In this case, when the fund’s value grows, the amount at risk decreases.

When an insured die, the insurance company under Type I ULIP policies generally pays the nominee the sum insured amount or the cash value of the ULIP plan (s). The nominee will receive the highest value of the two options (s). Therefore, if your amount guaranteed is ₹40 lakh and the fund value is ₹50 lakh, the beneficiary will get the fund value of ₹50 lakh.

ULIP Type – II

The nominee receives the whole amount pledged as well as the fund value as a death benefit. As a result, the total risk is equal to the guaranteed amount. The sum of the insured and the fund amount is what is paid in this situation. Due to the substantial significant benefit of the life coverage amount upon the death of the policyholder, the premium is greater for these types of ULIPs. The beneficiary would acquire ₹90 lakh (₹40 lakh amount guaranteed + ₹50 lakh funds value) - with reference to the same example as used above.

The mortality charges in ULIP are determined by parameters such as the country’s life expectancy ratio, the policyholder’s age, gender, financial condition, living area, and employment, in addition to the sum at risk. The formula for calculating the monthly mortality fee in ULIP is as follows:

Mortality charge = [Mortality rate (for attained age) * Sum at Risk/1000] * 1/12

Bottom Line

After learning everything, there is to know about mortality charges in ULIP and knowing how to calculate mortality charges in ULIP, it appears to be a great investment choice that provides you with two-in-one benefits. Besides, the eight most essential types of charges in ULIP are apparently what to look out for when purchasing ULIP insurance. However, it is important to remember that these ULIP charges differ from one insurance company to the next.

Alongside this, it is essential to know the tax benefits of investing in ULIP under Section 80C of the Income Tax Act.

Key takeaways

- The Premium Allocation Charges (PAC) is a predetermined charge in ULIP policy.

- The price levied by the insurance provider for managing multiple funds in ULIP is Age as the Fund Management Charge (FMC).

- ULIP discontinued charges are imposed when an investor prematurely surrenders ULIPs.

- The reimbursement of the charges incurred by the insurer is known as administration costs in ULIP.

FAQs

1

What are the charges associated with ULIPs?

There are several charges associated with ULIPs, including premium allocation charges, fund management charges, policy administration charges, mortality charges, and surrender charges. These charges are deducted from your premium and investment amount.

2

What is a premium allocation charge in ULIPs?

The premium allocation charge is a one-time fee that is deducted from your premium when you invest in a ULIP. This charge is usually a percentage of your premium amount and covers expenses such as agent commission, underwriting costs, and marketing expenses.

3

What is a fund management charge in ULIPs?

A fund management charge is a fee that is charged by the insurance company for managing the funds invested in your ULIP. This charge is usually a percentage of the total assets under management and is deducted on a daily basis.

4

What is a surrender charge in ULIPs?

A surrender charge is a fee that is charged by the insurance company if you surrender your ULIP before the completion of the lock-in period. This charge is usually a percentage of the fund value and is designed to discourage premature withdrawals.

5

How do I minimize the charges in my ULIP?

To minimize the charges in your ULIP, you should choose a plan with lower charges, invest for a longer period of time, and avoid premature withdrawals. Additionally, you should compare the charges and features of different ULIPs before investing to ensure that you are getting the best value for your money.