BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS /FRAUDULENT OFFERS

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

Kotak Guaranteed Fortune Builder UIN: 107N128V05 Form No: N128.

Kotak Term Benefit Rider, UIN: 107B003V03, Form No: B003; Kotak Accidental Death Benefit Rider, UIN: 107B001V03, Form No: B001; Kotak Permanent Disability Benefit Rider, UIN: 107B002V03, Form No: B002; Kotak Life Guardian Benefit, UIN: 107B012V02, Form No: B012; Kotak Accidental Disability Guardian Benefit, UIN: 107B011V02, Form No: B011, Kotak Critical Illness Plus Benefit Rider - 107B020V01, Form No.: B020.

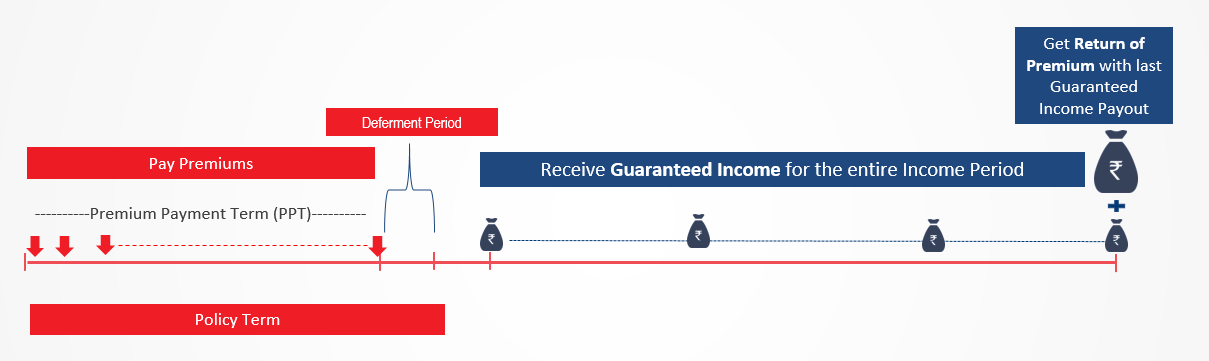

An Individual, Non-Linked, Non-Participating, Savings, Life Insurance Plan. This is a saving and protection oriented plan. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale. For more details on riders please read the Rider Brochure. @Guaranteed benefits due under this plan are available provided premiums are paid regularly for the entire premium payment term and the policy is in force. Ref. No.:KLI/23-24/E-WEB/1536

Kotak Mahindra Life Insurance Company Ltd. Regn. No.:107, CIN: U66030MH2000PLC128503, Regd. Office: 8th Floor, Plot # C- 12, G- Block, BKC, Bandra (E), Mumbai - 400 051. Website: www.kotaklife.com | WhatsApp: 9321003007 | Toll Free No:1800 209 8800.

Trade Logo displayed above belongs to Kotak Mahindra Bank Limited and is used by Kotak Mahindra Life Insurance Company Ltd. under license.