What are Savings Plan?

A savings plan is an instrument thatoffersan opportunity togrowyour hard-earned money by combining a great savings plan with insurance and guaranteed benefits.

Understanding savings plans can help yougrowone of the pillars of financial security. The best savings scheme is also a systematic approach to regularly setting aside a portion of your income to collect funds over time.

It provides a disciplined framework that helps you allot resourcesaccordingly,wisely, manage expenses, and prioritize your financial plans. By using an ideal savings plan, you canalso adopthealthy financial habits and overcome unexpected challenges and expenses.

Invest in a Savings PlanTypes of Savings Plan

Saving money is ideal for financial planning, ensuring a user has a safety net for emergencies, future expenses, andlong-term plans. Savings plans are tailored to meet different needs and preferences. From traditional options like fixed deposits tomoderninvestment avenues like mutual funds, understand the diverse savings plans available in India.

Fixed Deposits

Fixed deposits are India's most popular andcommonsavings instruments. Banks and financial institutions offer them as a way to allow individuals to deposit an amount for a fixed period at a predecided interest rate. Fixed deposits also provide capital protection and a guaranteed return, making them a secure option for conservative investors.

Recurring Deposits

Recurring Deposits (RDs)are one of the commonfamiliar savings option for people who wish to deposit a fixed amount regularly, often monthly, for a pre-decided period. RDs offer flexibility regarding investment amount and duration, and they are agood optionfor individuals who build savings through disciplined and regularintervals..

Public Provident Fund (PPF)

Public Provident Fund is astableand long-term plan the Government of India offers. PPF accounts have a lock-in period of 15 years, offergoodinterest rates, and offer tax benefits under Section 80C of the Income Tax Act. They also suit people looking for tax-efficient long-term savings with guaranteed returns.

National Savings Certificate

National Savings Certificate is an instrument with a fixed maturity period and interest rates offered by the Government of India. NSC offers tax benefits under Section 80C and can be bought from post offices across India. It also provides a safe and reliable avenue for people looking to accumulate savings over a fixed period.

Sukanya Samriddhi Yojana

SSY (Sukanya Samriddhi Yojana) is a savings plan for girls to promote their education and contribute towards their marriage expenses. It offers impressive interest rates, tax benefits under Section 80C, and partial withdrawal options after the girl child is of a certain age. SSY is a great savings option for parents looking to secure their daughter's tomorrow.

Employee Provident Fund

Employee Provident Fund is an unavoidable savings scheme after retirement for employees in India. Both the employer and the employee contribute towards the fund, and the amount collated can be withdrawn at retirement or in case of emergency. It also offers tax benefits and is an essential retirement savings tool.

Mutual Funds

MFs are schemes that collect funds from multiple investors to put money into a wide-ranging portfolio. They also offer a range of options catering todifferentrisk management profiles and investment plans. Italso offersprofessional management, liquidity, and a great chance for higher returns over the long-term goals.

Unit-Linked Insurance Plans

ULIPs combine insurance coverage and investment options, allowing policyholders to invest in various fund options basis on the risk appetite and financialgoals. Unit-linked Insurance Plans also offer flexibility, and potential for wealth creation, making it agreatchoice for long-term financial planning.

Key Features of Kotak Life Savings Plan

Kotak Life savings plans stand out as a formidable solution to create a robust financial portfolio while enjoying the benefits of life insurance coverage. These plans combine the advantages of disciplined savings with long-term investment opportunities, ensuring a reliableway toachieving financial goals. With a focus on customer-centricity and a deep understanding of evolving market dynamics, Kotak Life has engineered a suite of features that set their savings plans apart from the rest.

Guaranteed Benefit

Savings plan offers a guaranteed sum, which is pre-established at thestartof the policy on the basis of premiums. It also provides maturity benefits if the client survives the policy duration, and a death benefit isalsooffered to the nominee if the policyholder dies during the policy tenure.

Term Period

You canchoosea policy term period that best fits your requirements. You can also choose the short-term saving plans if you anticipate you will need your money soon. Also, you can extend your insurance formorenumber of years if you want to save for the long term.

Loyalty Additions

Savings plans offer financial rewards as loyalty additions on long-term investments, increasing the plan benefits.

Increase in income

Some income plans offer income boosts and enhance the yearly proceeds during the payout phase.

Bonuses

Participating plans offer bonuses along with the plan benefits at maturity.

One-time Investment Options

Some savings plans offer the benefit of one-time payment through a single premium facility.

Enhanced Sum Assured

Investors who opt for higher premium amounts can enjoy enhanced sum assured.

Free-look Period

Insurance policiesoftencome with a small time frame called a free-look period. Savings plans also come with this disclaimer. If a policyholder has doubts about the policy or is unhappy with the clauses put together, they can return the policy. The policyholder can return the policy in 30 days if the policy is bought online. In the case of all other channels, the free look period is 15 days.

Grace time

For annual, half-yearly, and quarterly plans, the grace period indicates that the premium can be paid within 30 days after the premium due date. Kotak Life does not impose any fines or deductions during this time. This privilege is given to thepolicy ownersso the policy does not lapse and they get enough time to arrange the premium amount.

Premiums

You have the option of paying your premiums over a particular time period or all at once. These options are available to make the policyholder's life easy and more accessible. The chosen payment method in no way impacts the assured benefits.

Savings Plans from Kotak Life in 2024

Kotak Life offers some of the savings plans that give guaranteed returns. Check out Kotak Life savings plans:

- Guaranteed@Benefits with multiple plan options to suit your varied needs

- Life cover for financial security for your family

- Option to avail Guaranteed@income for your short-term and long-term goals

- Life cover for financial security for your family

- Guaranteed@lump sum benefit with a flexible liquidity option

- Enhanced Protection Through Riders

- Tax Savings

- Guaranteed@Loyalty Addition & Guaranteed@ Additions

- Maturity & Death Benefit

- Multiple Premium Payment Terms

- Guaranteed@Yearly Additions to increase life cover

- Guaranteed@Loyalty Addition at maturity

- Enhanced Protection Through Riders

- Tax Savings

- Multiple Premium Payment Terms

Kotak Get Assured Income Now

Kotak Fortune Maximiser

Kotak Sampoorn Bima Micro-Insurance Plan

Kotak Premier Life Plan

Kotak Assured Income Accelerator

Kotak Premier Endowment Plan

Kotak Premier Moneyback Plan

Kotak Classic Endowment Plan

Kotak SmartLife Plan

Kotak Premier Income Plan

POS Bachat Bima Plan

- Life Cover till 85 years of age

- 3 Plan Options - Early Income, Paid-Up Addition and Premium Saver.

- Early Income Payout from end of 1st policy month / year

- 6 Optional Riders

- Additional Benefit with the same premium for Female Life

- Additional benefit in case premium is paid through ECS/Auto Debit option

- Multiple plan options – Life Goal Maximiser, Bright Future Maximiser, Golden Years Maximiser

- Flexibility to choose bonus*payout options

- Life cover up to 85 years for you and your spouse

- Optional rider support

- Short-term, 5-year plan

- Fixed premium - ₹200 only

- Guaranteed@Payout – Both maturity benefit and death benefit

- No medicals

- Protection up to the age of 99 years

- Receive Bonus*payouts or accumulate under the policy

- Enhance protection through optional riders

- Tax benefits u/s 80C and 10(10D)

- A non-participating life insurance plan

- Guaranteed@income during the payout phase

- Income boosters to increase yearly returns

- Death benefits independent of the income paid

- Guaranteed@additions

- Earn bonus*from 6 policy year onwards

- Additional Protection through optional riders

- Payouts at regular intervals

- lump-sum amount at maturity

- Bonus*from the first year

- Accidental death benefit

- Yearly bonuses*from 1styear along with maturity benefits

- Discounts on premium with high sum assured

- Choice of policy term options

- A limited pay non- linked participating plan

- Offers protection up to the age of 75 years

- Choice of bonus*options

- Guaranteed@Annual / Monthly Income

- Enhanced life coverage on higher premiums and for females

- Bonuses*throughout the policy period

- Guaranteed@Yearly Additions & Guaranteed@Loyalty Addition

- Two plan options – Life and Life Plus

- Double life coverage on accidental death with Life Plus option

Enjoy the flexibility of Guaranteed Income Benefit withKotak Guaranteed Fortune Builder.

What are the Benefits of Saving Plans?

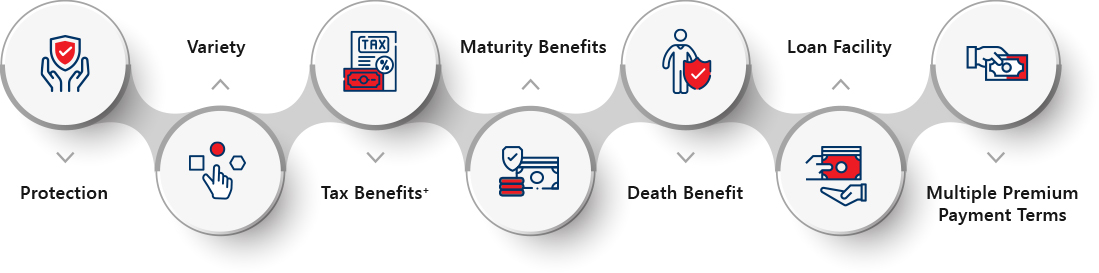

Saving plans serve as a foundation for building a strong financial portfolio. It allows people to achieve the short-term and long-term goals while also safeguarding against unexpected finances. Saving for down payment on a house, funding higher education, or ensuring a comfortableand secureretirement, these savings plans offer a structured approach to promote financial discipline and encourage a habit of regular savings. The infographic alongside displays the benefits of savings plans.

Regular savings plans have set benefits that can help most of us not only achieve our financial goals but also secure our family's future. Check out all the benefits below:

Protection

Security for your family against financial crisis is the primary objective of these policies. Some of these plans also guarantee returns on your investment, thereby protecting your capital.

Variety

Kotak Life offers a considerable assortment of savings and investment plans to cater to every financial need. You can select the one that best suits your age, budget, and financial horizon.

Multiple Premium Payment Terms

You can choose from monthly, half-yearly, quarterly, and annual modes as per your budget. Single premium and limited payment options are also available.

Ease of Paying Premiums

You can pay your insurance payment and renew your plan online without waiting in queues and wasting time.

Maturity Benefits

The maturity benefit is the lump sum you receive as a return after completing the policy term. You can build your own house, plan a vacation with your family, or maybe plan your retirement.

Payment Options

Premiums are supposed to help you insure your family and get guaranteed benefits, not to make you feel stressed. Therefore, you can choose between two premium payment modes: one lump sum payment or over a specified duration of time. For example, if you don't want to deal with the stress of long-term premium commitments, you can pay them in a single go.

Customization

- You can augment your coverage with multiple riders and personalize your policy as per your individual needs.

- Term rider provides additional sum assured over and above the death benefit on the base plan.

- Accidental death benefit rider offers extra benefits in case of accidents.

- Permanent disability benefit rider offers rider sum assured as per the defined rider benefit if permanent disability due to an accident occurs.

- Premium Waiver of future premiums under the base plan in case of death or total disability of the policyholder.

Convenience of Choosing Policy Term

You can choose from different policy durations available in the plan according to your financial needs.

Tax Benefits

You can avail of tax benefits on the paid premiums and death /maturity benefits under these policies.

Death Benefit

If anything unfortunate occurs to you, your family will face issues if you are emotionally and financially unprepared. This is where a death benefit steps in, a lump sum payout made to a life insurance policy beneficiary.

Loan Facility

A savings plan permits you to take a loan for your financial requirements, but only when the insurance reaches a surrender value. Once you have surpassed that period, you are eligible for a loan against the policy

Take advantage of Kotak Life Savings Plan for Regular Guaranteed Returns.

Who Should Buy a Savings Insurance Plan?

Savings plans offer a combination of savings and insurance benefits. You must check if the savings insurance plan you are planning to buy aligns with your requirements. Here is how a savings insurance plan can help you.

Read more-Who should invest in a savings plan?

Young Entrepreneurs

Beginning early give investors, a chance to take greater risks and increase their chances of earning better returns. They have more time to recover from poor choices without having an impact on their long-term financial objectives. Young entrepreneurs should buy saving plans in their early days so they can get a solid second income during their entrepreneurship stint.

Recently Married Couples

A greater potential for wealth building may arise from making the most of the two-fold increase in investment power. Young couples should invest in savings schemes to plan the next phases of their life better, be it kids’ education or buying a dream house or an international vacation.

People Nearing Retirement

Savings insurance plans can be a valuable addition to retirement planning strategies. As individuals approach their retirement years, buying guaranteed returns plans can provide the dual benefit of life insurance coverage and a means for long-term savings. These retirement savings insurance plans offer financial security for the family through the life cover component. The savings portion allows policyholder to fulfil life goals.

Parents

There are several tax benefits to take into account while saving money for your child.Child insurance plans, savings accounts at state-run financial institutions, and tuition costs are exempt from taxes as long as they adhere to certain guidelines stated in the tax legislation. Parents buying money savings plans at the right time can get lumpsum returns when their kids need it the most.

Individuals with Dependents

Individuals with dependents, should consider a savings insurance plan. The policy is a financial safety net, making sure the dependents are financially secure even if the policyholder can no longer help them. Also, the savings component allows the accumulation of funds that can be utilized to handle unforeseen expenses.

Why Do You Need a Savings Plan?

Whether it is planning for a comfortable retirement, handling unexpected expenses, or pursuing long-term goals, having a well-thought-out investment plan is crucial. By implementing a comprehensive savings strategy, you can gain financial freedom, peace of mind and pave the way for a secure future.

Aid in the Event of a Financial Crisis

Investing in a good savings policy can aid you in a variety of financial situations, the majority of which occur unexpectedly. The current recession is the best illustration of when savings have made it possible to keep the household running even in the event of a job loss and to pay for school expenses.

Wings to Pursue Your Dreams

Money is one of the key resources you need to realize your aspirations. The ability to use your savings to supplement your income in these areas of life will help you become financially stronger to pursue your goals in life. To learn something new, to start something new, for everything, you need money.

Long-Term Security

With the simple habit of saving money, you can cover all of your needs, including those for money, health, and life beyond retirement. All of your hard-earned money will serve as the foundation of your future and offer true long-term security. The ups and downs of the market will influence your compensation, which will impact any potential retirement plans or a steady income to save for the future.

Plan for a second income throughGuaranteed Monthly Income Planwith Kotak Life.

How to Choose the Right Investment Plan Options?

Saving money is important tofinancial planning,helping individuals achieve their short-term and long-term goals. The best savings and investment plan matches the requirements. However, choosing the best savings plan can be difficult since numerous options are available. To make an ideal decision, it is essential to consider various factors and align them with your financial plans.

Define Your Financial Goals

Before choosing the best savings plan, it is essential to figure out your financial goals. Whether you saving for a down payment on a house, education, emergencies, or anything else? Each goal requires a different time frame and approach. By identifying your goals, you can assess the savings plan options that suit them.

Consider Time Horizon

The time horizon for your savings goal is vital in choosing the right savings plan. Short-term goals like saving for a vacation or buying a car in a few years may benefit from more liquid and low-risk options like a regular savings account. Conversely, long-term goals like retirement planning may require investment-based saving plans to offer the potential for higher returns over an extended period.

Risk Tolerance

Understanding your risk tolerance is essential when choosing a savings plan. Some plans offer guaranteed assured returns with lower interest rates, like traditional savings accounts and government bonds. If you are ready to take on risk more than usual for possible higher returns, you can choose investment options from stocks or mutual funds. Analyze your comfort level with risk to choose a savings plan that aligns with your risk tolerance and goals.

Evaluate Liquidity

Liquidity refers to how easily you can access your savings when required. If you anticipate needing your savings soon for emergencies or other unexpected expenses, choose plans that provide high liquidity, like regular savings or money market accounts. On the other hand, if you have a longer time frame and can afford to lock your money away for a longer duration then choose from options like fixed deposits or retirement accounts may offer better returns.

Research and Compare Options

Take enough time to research and compare different savings plans financial institutions offer. Look for plans that offer competitive interest rates, favorable terms, or low fees. Consider consulting with a financial advisor who can provide guidance tailored to your needs and goals. You should also consider an insurance company with a high solvency ratio. Kotak Life Insurance has a solvency ratio of 2.83% for FY 22-23.

Tax Considerations

Tax implications can significantly impact your savings plan. Evaluate whether the savings plan you are considering offers tax advantages. Understanding the tax implications can help you maximize your savings and minimize your tax liability.

Regularly Review and Adjust

Once you have chosen a savings plan, it is essential to regularly review and adjust your strategy as your financial situation and goals evolve. Monitor the performance of your savings plan, reassess your risk tolerance, and make any necessary changes to stay on track.

Save for your business venture with theKotak Assured Savings Plan.

When Should You Buy a Savings Plan?

A savings plan is an investment scheme that provides long-term benefits. By consistently paying premiums over a period of 5 years to 10 years, you can reap the returns when the policy reaches maturity. So, when is the ideal age to buy a savings plan? The simple answer is the earlier, the better.

You can also get tax exemption undersection 80Cof the Income Tax Act, 1961.

Let us explore the advantages of purchasing a savings plan in your 20s, 30s, and 40s.

Buying a Savings Plan in Your 20s:

Savings plan is an investment scheme that allows you to get guaranteed returns and a small component of life cover. Investing in your 20s can help you get a maturity amount that will help you sort your household expenses, plan for an early retirement, or maybe an investment in an idea that can one day become your livelihood.

Buying a Savings Plan in Your 30s:

In your 30s, buying savings scheme can help you enjoy a smooth transition into early retirement, planning for a second home, maybe an international vacation with your spouse, and a corpus that helps you in building your financial strength. Beyond this, you can also get a life cover and additional protection with rider policy.

Buying a Savings Plan in Your 40s or Later

In your 40s, you might be free from your kid’s educational expenses, but your retirement will be close and inflation might take a toll on your savings. Starting now can help you build a retirement corpus, in some cases, an additional guaranteed income benefit that can allow you to enjoy your second innings. The life cover can help your spouse to stand stronger during the golden years of your life.

Save for a down payment on your dream home with theKotak life Savings Plan.

Why Choose Kotak Life for a Savings Plan in India?

When it comes to planning for the future, having a reliable and trustworthy savings plan is essential. In India, one of the leading names in the insurance industry is Kotak Life Insurance. With a wide range of savings plans tailored to meet different financial goals, Kotak Life has emerged as a preferred choice for individuals looking to secure their future and build a strong financial foundation. Here are some compelling reasons why you should choose Kotak Life for your savings plan in India.

Customized Saving Plans

Kotak Life offers a wide range of savings plans designed to meet various financial goals and risk preferences. Whether you are saving for your child's education, retirement, or building wealth for the long term, there is a savings plan that suits your needs. These plans come with flexible premium payment options, allowing you to choose the frequency and duration of payments according to your financial capabilities. With the option to customize your savings plan, you can align it with your specific financial goals.

Comprehensive Coverage

Apart from savings and investment benefits, Kotak Life savings plans also provide comprehensive life insurance coverage. In the unfortunate event of your demise during the policy term, your loved ones will receive a death benefit, which can provide financial security and stability to your family. This dual benefit of savings and life insurance makes Kotak Life savings plans a prudent choice for individuals looking to protect their loved ones while growing their wealth.

Superior Customer Service

Kotak Life Insurance is known for its customer-centric approach and superior customer service. The company has a strong network of branches and customer service centres across India, ensuring easy accessibility and prompt assistance to policyholders. Whether you have queries regarding your savings plan, need assistance with claim settlement, or require any other support, the dedicated customer service team at Kotak Life is always ready to help.

Which Savings Insurance Plan is Right for You?

Savings insurance plans offer you the flexibility to choose your premium payment term and policy term, and accordingly, your returns change. In most cases, you will pay a premium for up to 10 years, and accordingly, your returns will be decided.

If you have short-term goals, you can choose an investment tenure of up to 5 years and get the returns. However, it is recommended to have an endowment plan with an investment of at least 10-15 years since this will get you the highest returns.

Kotak Guaranteed Fortune Builder- investment for

guaranteed income.

Considerations to Make Before Investing in a Savings Plan

To prepare for unforeseen events and maintain a stress-free life, sound financial planning is crucial. The most reliable approach to ensuring a secure financial future is tobeginsaving regularly at a young age. However, there are a few things to consider while choosing a savings strategy for you and your family.

Risk Capacity and Profile

Determine your risk tolerance in order to locate and select the optimal savings strategy. The two most crucial factors that might affect how much risk a person can bear are personal preferences and age. Young adults in their 20s and 30s canusuallychoose investments that carry a high level of risk but also offer a higher rate of return. They canalso choosemore aggressive strategies, such as investing more capital in equities or the stock market than in the debt market. A wise decision is to invest money in aUnit Linked Insurance Plan (ULIP)if you are seeking plans with higher risk and higher rewards.

Ultimate Goals

You must be certain of your goals before selecting the most advantageous savings strategy. Knowing your end objective makes it simple to choose options for investments that save on taxes. These objectives can range from building a corpus for your retirement, having enough money set up for your child's higher education or wedding, or even possibly building a home.

Savings Plan Highlights

If you are investing in a savings plan, the chances are that you can use the policy to avail of a loan. You can avail up to 50% of your surrender value as a loan. Surrender value is the sum you get when you forfeit your life insurance policy before maturity. You can select the greatest savings plan that can offer you security and savings thanks to numerous options and wide coverage.

Start early with the Kotak Assured Savings Plan.

Buy NowImportance of Buying a Savings Plan

In an era characterized by constant economic fluctuations and unforeseen circumstances, it has become increasingly essential for individuals to plan and invest wisely for their financial future. One such avenue that offers stability and long-term growth potential is a savings plan.

Building a Safety Net

Life is unpredictable, and unexpectedthingssuch as medical emergencies, job loss, or natural disasters can throw your financial stability into disarray. By investing in a savings plan, you create a safety net that safeguards you and your loved ones during times of crisis. Thesepoliciesprovide a cushion of funds that can be accessed when needed, ensuring that you can overcome unforeseen challenges without jeopardizing your financial health.

Encouraging Disciplined Saving Habits

One of the biggest advantages of a savings plan is its ability to instill discipline and consistency in your saving habits. By committing to a regularand dedicatedcontribution towards your plan, you cultivate a mindset of financial responsibility. The habit of setting aside a predeterminedfundeach month not only helps you achieve your short-term goals andlong-term plans.

Capitalizing on Compound Interest

Compound interest refers to the process of earning interest on both the principal amount and the accumulated interest over time. By investing in a savings plan early, you give your money more time to grow, exponentially increasing your returns in the long run. This compounding effect can significantly augment your wealth and help you achieve your financial objectives faster.

Achieving Financial Goals

Whether it's purchasing a home, funding your child's education, or planning for retirement, everyone has specific financial goals they aspire to achieve. A savings plan acts as a structured approach to realizing these objectives. By setting aside funds regularly and leveraging the growth potential of your investment, you are better positioned to attain your goals within the desired timeframe.

Tax Benefits and Flexibility

Many savings plans offer attractive tax benefits that can help you optimize your tax liability. Contributions made towards certain types of savings plans are eligible for tax deductions, providing you withvaluable and greatsavings. Additionally, some plansalsooffer flexibility in terms of withdrawal options and the ability to customize your investment strategy, allowing you to align your financial planning with your unique needs and circumstances.

How Long Should You Invest in a Savings Plan

Saving money is animportantaspect of financial planning, and investing those savings can help accelerate wealth accumulation. However, determining the optimal duration for investing in a savings plan can be a challenging task. On the one hand, investing for too short a period might not yield significant returns, while on the other hand, investing for too long could limit your access to funds.

Let us now explore the factors to consider when deciding how long to invest in a savings plan, with the aim of finding the middle ground that aligns with your financial goals and circumstances.

Risk Tolerance and Asset Allocation

Assessing your risk tolerance and aligning it with your investment strategy can help determine how long you should investin a particular savings plan.A longer investment horizon allows for a more aggressive investment approach with a higher allocation to growth-oriented assets. Conversely, if you have a lower risk tolerance or for a shorter time period, a more conservative approach with a higher allocation to fixed-income investments might be appropriate.

Market Volatility and Investment Returns

Alwaysconsider historical market trends, consult with financial advisors, and evaluate the potential risks and rewards associated with different investment durations. While the short-term market volatility can lead to unpredictable returns, making it challenging to achieve your financial goals within a short duration. Longer investment periods allow for potential market recoveries and the benefit of compounding returns.

Liquidity and Access to Funds

Another factor to consider is your need for liquidity and access to funds. Investing for a longer duration mightrestrainyour ability to withdraw money when unforeseen expensesor situationsarise. Strike a balance betweeninvesting for the long termand maintaining a sufficient emergency fund or cashcollectionto cover unexpected financial needs. Assess your cash flow requirements, potential emergencies, and short-term financial obligations when determining the duration of your savings plan.

Flexibility and Adjustments

Life events such as career changes, marriage, children, orunforeseenexpenses can impact your investment horizon. Regularly review and reassess your financial situation to ensure that your investment duration remains aligned with yourever-changinggoals and circumstances. Flexibility and the ability to make adjustments to your savings plan can help you adapt to changing needs.

Build wealth and achieve financial independence with

Kotak Guaranteed Savings Plan.

How to Buy Savings Plan in India?

Manyinvestorsin India still prefer the traditional offline method of purchasing savings plans due to various reasons, such as limited access to the internet, preference for face-to-face interactions, or a lack of comfort with online transactions.

All you have to do is follow some steps like visit the nearest insurance company, fill in the necessary details, pay the premium, and keep an eye out for regular reviews and updates.

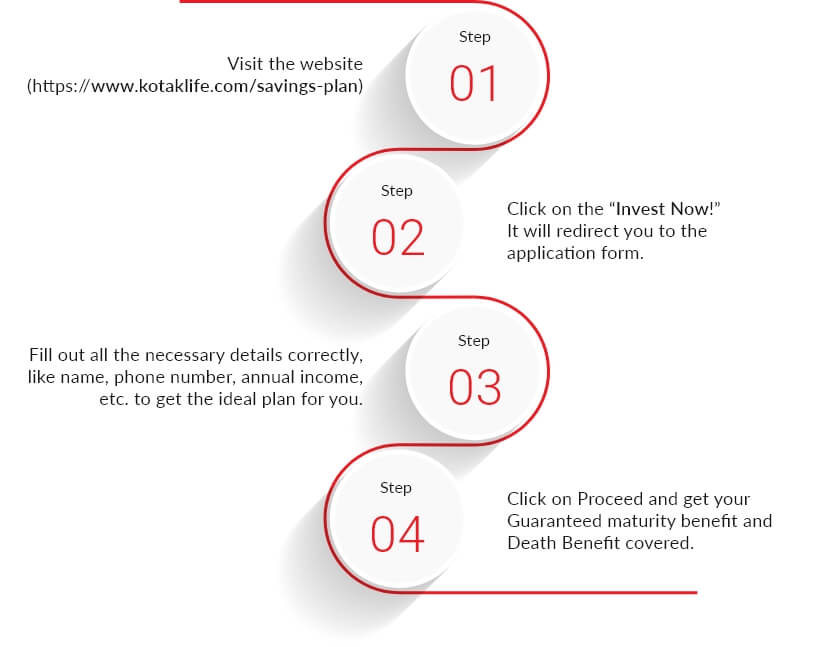

Steps to Buy Savings Plan Online

Savings plans are life insurance products made to assist you in making regular, disciplined savings and toofferfinancial security for your family in the event of your untimely death.

Nowadays, you canbuya savings plan online without having to go to an insurer's or agent's office. You can conduct online research to find the plans that best meet your needs, determine your eligibility for them, upload the required documentation, and make payments. Typically, policies are sent via email, but you can also receive notifications on your phone.

Here are some simple steps you need to buy savings plans online:

Step

01

Visit the websitehttps://www.kotaklife.com/savings-plan

Step

02

Click on the“Invest Now!”It will redirect you to the application form.

Step

03

Fill out all the necessary details correctly, like name, phone number, annual income, etc. to get the ideal plan for you.

Step

04

Click on Proceed and get your Guaranteed maturity benefit and Death Benefit covered.

Testimonials

I was looking for an investment product that would offer me guaranteed yet good returns. I spoke with many of my friends, and most of them offered me a solution I already knew. I decided to research a bit on the internet when I found Kotak Guaranteed Savings Plan. I decided to check out the plan and loved it. It would help me plan my future goals in a much-structured manner, and that clicked. I bought it. This is a great product, and the assistance is good too. Long-term investors can benefit a lot from this, especially those who are looking for stable returns.

-Mr Rajendra Verma

Kotak Guaranteed Savings Plan helped me not only save a chunk of money every money through premiums but also put me into the discipline of saving. In a span of 7-10 years, I would be able to plan a few things for my house and my kids and save more and invest in growing my wealth over time. If you are looking for something that will help you get Guaranteed returns, life cover, and tax benefits, Kotak Guaranteed Savings Plan is your plan.

- Mr Abhay Vaman Sarode

Plan your finances efficiently if you want to achieve your life goals at the right time. I did it by investing in a savings plan that helped me and my family lead a stress-free life and achieve life goals. Not only that, one good feature about the product is that you get a life cover bundled with maturity benefits. Meaning in case of an unfortunate event, your family can still have the financial support to live the rainy days.

- Mr Moreshwar Daulattrao Patil

I came across Kotak Guaranteed Savings Plan when one of my friends was speaking to an insurance advisor. When asked, she said that she was planning to start investing her savings in a savings plan by Kotak Life. It offers both life cover and guaranteed returns to help you grow your wealth without any risk. All you need to do is pay a monthly premium, and you will get a pre-defined return that will be guaranteed.

- Mr Atul Mishra

Life insurance policies can help you grow your wealth at a stable rate if you choose the right product. In my case, I chose Kotak Guaranteed Savings Plan, and I am glad I did. Every month a small part of my salary goes towards saving. This corpus I can use for anything I might want to plan for the future, from buying a house to planning a vacation. In addition, their call center team and advisors help you get amazing, true insights on how these plans can help you build a good amount for the future.

- Mr Dhiren Valji Varsani

I recommend Kotak Guaranteed Savings Plan to everyone who is planning to invest in a low-risk financial instrument. It offers flexibility in choosing the premium amount, and you can start at low as 2000/month and go as high as ₹10000/month, which is great. Your returns would differ as per the premium you pay. You can check it all on their online portal. You can simply fill in your details, and the portal will open up for you. All the information from premiums to returns and life cover is mentioned there. If you are happy, you can buy it from here. That simple.

- Mr Lingeshwar Hanumanta Machhiwar

Documents required to buy Savings Plan online

When you are prepared to buy a savings plan, make sure you have the following paperwork:

Reasons to Buy a Money Savings Plan

Saving money is a fundamental aspect of financial well-being. Whether you're planning for a secure future, a dream vacation, or unforeseensituations,having a robust savings plan in place is crucial. While there are several avenues for saving money, a dedicated money savingspolicyoffers unique benefits that make it an attractive choice for individuals seeking financial stability.

Cultivating Financial Discipline

Amoney savings planencourages discipline in managing personal finances. By setting aside a fixed amount regularly, you develop a habit of saving, which helps build a strong financial base. This discipline extends beyond your savings plan and positively influences your overall financial behavior, leading to smarter spending decisions and improved money management skills.

Emergency Preparedness

Life is unpredictable, and unexpected expenses cancomeat any moment. A money savings plan acts as a safety net during challenging times, providing a cushion to handle emergencies without resorting to credit cards or loans. By having a dedicated savings fund, you can faceunforeseenevents with confidence and peace of mind, knowing that you have a financial backup.

Achieving Short-Term Goals

Whether you aim to buy a new car, renovate your home, or take a vacation, a money savings plan can help you achieve your short-term goals. By consistently saving a portion of your income, you accumulate funds over time, allowing you to fulfill your aspirations without relying on loans or going into debt. The satisfaction of achieving your goals through your own efforts is immensely rewarding.

Long-Term Financial Security

Investing in a money savings plan is a proactive step towardssafeguardingyour long-term financial stability. By consistently saving and accumulating wealth, you create a financial cushion for retirement, education, or any other long-term goals you may have. The power of compound interest can significantly amplify the value of your savings over time, helping youbuild wealthand enjoy a comfortable future.

Flexibility and Convenience

Money savings plans offer awiderange of options to suit individual preferences and financial circumstances. Whether you choose a traditional savings account, a fixed deposit, or a mutual fund, you have the flexibility to select the investment vehicle that aligns with your risk tolerance and financial goals. Moreover, with the convenience of online banking and mobile apps, monitoringand managingyour savings plan has become more accessible than ever before.

Protection Against Inflation

Inflation erodes the purchasing power of money over time. By investing in a money savings plan, you protect your savings from the effects of inflation. Certain savings options, such as certificates of deposit or inflation-protected securities, offer returns that outpace inflation, ensuring that your money retains its value and maintains its purchasing power.

Invest for a brighter future withKotak Savings Plan.

Factors Impacting Savings Plan Premium

Saving for the future is a crucial aspect of financial planning, and a savings plan can provide a secure and disciplined approach to achievinglong-term financial goals.However, when considering a savings plan, it is essential to understand the factors that influence the premiums associated with such plans. By examining these factors, individuals can make informed decisions and optimize their savings strategies.

Premium Amount

The premium amount and term length selected for a savings plan play a vital role in determining the premium. The amount refers to the total sum assured, which is the amount the insurer pays out in the event of the policyholder's death or the maturity of the plan. Higherfundsgenerally result in higher premiums, as they imply a greater potential payout for the insurance companies.

Gender

Historically, gender has played a role in determining premiums for various insurance products, including savings plans. Actuarial data has indicated that certain health risks and longevity expectations differ between males and females. It isessentialto note that gender-based pricing may still be a factor in some regions, influencing savings plan premiums accordingly.

Flexibility of a Savings Plan

In order to achieve your overarching objectives, it's crucial to opt for a versatile savings strategy. This approach empowers you to address any unforeseen immediate needs while also granting you the adaptability to withdraw from the plan if circumstances demand.

Nonetheless,maintainingthe tax-saving investment savings plan over an extended period is advisable, as it facilitates the attainment of a more favorable rate of return upon maturity.

FAQs

What are Savings Plans?

A savings plan allows you to make systematic deposits into money-making avenues. Thus, such plans enable you to accumulate a corpus over time that you can utilize for your future financial goals. At the same time, such plans offer the benefit of life coverage, protecting your loved ones against economic hardships in your absence. Endowment policies, ULIPs, and money-back plans are a few examples of such plans.

What are Guaranteed Savings Plans?

Aguaranteed savings planoffers the assurance of higher returns. The sum assured is declared upfront. Thus, such plans offer a fail-safe lump sum at the end of the policy tenure.

a.Are the returns guaranteed?

Guaranteed savings plans keep their word and deliver on their promise of guaranteed returns. Despite the continued market turmoil and fluctuations, you earn a standard and stable income rate since you are not susceptible to market volatility. This plan provides a safe location to put money for investors who have a low-risk appetite.

b.Does guaranteed savings plan have tax benefits?

The premiums paid are eligible for a deduction of up to ₹1,50,000 under section 80C of the Income Tax Act, 1961. You can also benefit from a tax-free payout because the maturity benefit is exempt from taxation under Section 10 (10D).

c.How can I compare and choose the best guaranteed savings plan?

To choose the best guaranteed savings plan, you should look at factors like minimum age criteria, maximum age criteria, policy term period, premium payment methods, yearly premiums, sum assured amount and the additional benefits that are being provided. Once all these factors align with your personal requirements, you will know that it is the ideal plan for you.

d.What happens if I discontinue the guaranteed savings plan?

If you choose to discontinue the plan, you will only receive the surrender value of the savings plan. However, this clause will only apply if the policy has been in force for more than three years.

How to determine the perfect savings plans for your needs?

a.Identify your financial needs

b.Select the premium payment terms wisely

c.Consider liquidity

d.Pay attention to the fine print

e.Weigh in tax-savings

You can claim tax deductions under Section 80C of the Income Tax Act, 1961 for the premiums paid towards these plans. Moreover, the maturity benefits, as well as the death benefits, are also tax-exempt, subject to the conditions specified in Section 10(10D).

How much money should I save before investing?

Aim to spend no more than 50% of your take-home pay on necessities, set aside 15% of your pre-tax income for retirement savings, and reserve 5% of your take-home pay for short-term savings. Build the fund up to three months' worth of costs, then divide your money between investments and a savings account until you have six to eight months’ worth saved up. Your funds should then be invested in things that generate higher income than a bank account for retirement and other goals. 15% of your pre-tax income to retirement savings and 5% of your gross income to short-term savings.

What are savings plans and how do they work?

Savings plans are financial products designed to help individuals save money for specific goals or for the future. They work by allowing individuals to regularly contribute a certain amount of money into the savings plan, which is then invested and earns interest over time. The accumulated funds can be used for various purposes such as education, retirement, or emergencies.

When is the right time to begin a savings plan?

The right time to begin a savings plan is as early as possible. Starting early allows you to take advantage of compounding interest and gives your money more time to grow. The earlier you start, the more time you have to save and the more your savings can accumulate over time.

How can a savings plan help me?

A savings plan can help you in several ways. It provides a disciplined approach to saving money regularly, helps you achieve your financial goals by accumulating funds over time, and allows your money to grow through investments and interest. Additionally, savings plans often offer tax benefits and can provide a sense of financial security for the future.

What is the right way to begin with a long-term saving plan?

The finest long-term investing strategies for making big returns over a lengthy period of time are stocks. A systematic investing technique can be used to make long-term investments in equities or mutual funds (SIP).

Is pairing life insurance and saving plan a good idea?

When you require periodic payouts to plan and handle specific goals while maintaining life coverage, combining protection and savings is an excellent solution. Money back plans, a type of life insurance policy, provide you with recurring payouts that aid in the planning of your financial objectives.

Are there any tax benefits to a savings plan?

Yes, there can be tax benefits associated with certain types of savings plans. For example, in some countries, contributions to retirement savings plans may be tax-deductible, meaning you can reduce your taxable income by the amount you contribute. Additionally, some savings plans offer tax-deferred growth, where you don't have to pay taxes on the investment gains until you make withdrawals in the future. However, tax benefits vary depending on the specific savings plan and the regulations in your country.

Who should make traditional planning investments?

Traditional planning investments are suitable for individuals who prefer a more conservative and predictable approach to investing. They are generally recommended for those who have a low tolerance for risk and prioritize capital preservation over high returns. Traditional planning investments often involve fixed-income products such as bonds, certificates of deposit (CDs), or savings accounts.

Is it a good idea to put money aside for retirement?

Yes, it is generally a good idea to put money aside for retirement. By saving for retirement, you can build a nest egg that will provide financial security and support your lifestyle once you stop working. Starting early and regularly contributing to a retirement savings plan can help ensure a comfortable retirement and reduce the reliance on government pensions or other sources of income.

How much should I save each month?

The amount you should save each month depends on your financial goals, income, expenses, and other individual circumstances. As a general rule of thumb, financial experts often recommend saving at least 10-20% of your income. However, it's important to assess your own financial situation, create a budget, and determine a savings amount that is realistic and aligns with your goals.

Should I pick a long-term or a short-term savings Investment plan?

If you want to keep your money secure and are happy with small profits, choose short-term investments. However, you should put money into long-term investment opportunities if you want to make more money.

How much money should I start saving at the young age of 25?

Starting to save at a young age like 25 is a great initiative. The amount of money you should save depends on your income, expenses, and financial goals. A common suggestion is to aim for saving at least 10-20% of your income, but the specific amount will vary based on your circumstances. It's important to create a budget and consider factors such as your desired retirement age, lifestyle expectations, and other financial obligations to determine an appropriate savings goal.

What is the difference between a savings plan and a regular savings account?

A savings plan is a structured financial product designed for specific savings goals or purposes, such as education or retirement. It often involves making regular contributions that are invested to accumulate wealth over time. On the other hand, a regular savings account is a basic deposit account offered by banks where you can deposit and withdraw money at any time. Savings plans usually offer additional features, such as investment options and potential tax benefits, which regular savings accounts may not provide.

Can I have multiple savings plans?

Yes, you can have multiple savings plans. In fact, having multiple savings plans can be a strategic way to save for different goals simultaneously. For example, you might have one savings plan dedicated to retirement, another for education expenses, and another for an emergency fund. By segregating your savings, you can better track your progress towards each specific goal and allocate your funds accordingly.

Can I change the amount of my contribution to a savings plan?

The ability to change the amount of your contribution to a savings plan depends on the specific terms and conditions of the plan. In many cases, you can adjust the contribution amount, either by increasing or decreasing it, according to your financial circumstances or goals. However, it's important to review the terms of your savings plan or consult with the plan provider to understand the options and any associated rules or fees.

What happens if I miss paying the premium to my plan?

Missing premium payments to a savings account may result in various consequences depending on the terms of the account and the policies of the financial institution. If you miss a payment, there might be late payment fees, penalties, or the account could be subject to certain restrictions. In some cases, missing multiple payments may even lead to the account being closed. It is important to review the terms and conditions of your savings account and contact your bank or financial institution to understand their specific policies.

Are savings plans insured by the government?

The insurance coverage for savings plans depends on the country and the specific type of savings plan. In some countries, certain types of savings plan, such as retirement plans or government-sponsored savings schemes, may have government-backed insurance or guarantees. However, it's important to note that not all savings plans have government insurance. It is advisable to check with your financial institution or plan provider to understand the insurance coverage associated with your savings plan.

Can I make withdrawals from my savings plan?

Yes, you can usually make withdrawals from a savings plan, but the accessibility and conditions for withdrawals vary depending on the specific terms of the plan. Some savings plans may allow partial or full withdrawals at any time, while others may have restrictions or penalties for early withdrawals. It's important to review the terms and conditions of your savings plan to understand the withdrawal options and any associated fees or consequences.

What happens if I want to close my savings plan policy before reaching maturity?

If you want to close your savings plan policy before reaching maturity, there may be certain consequences or charges involved, depending on the terms and conditions of the plan. Early termination of a savings plan policy can result in loss of potential returns, penalties, or surrender charges. It's important to carefully review the terms of your savings plan and consult with your plan provider or financial advisor to understand the implications before deciding to close the policy prematurely.

You may avail of tax benefits as per Income Tax Act, 1961, Tax benefits are subject to change as per tax laws. Customer is advised to take an independent view from tax consultant. Goods and Services Tax and Cess as applicable shall be levied over and above premium amount as per applicable tax laws.@Guaranteed benefits due under this plan are available provided premiums are paid regularly for the entire premium payment term and the policy is in force. *Please note that Bonuses are NOT guaranteed and may be as declared by the Company from time to time. Benefits under this plan are dependent upon the performance of the participating Funds. The premium figures are exclusive of Goods and Services Tax and Cess, as applicable. Goods and Services Tax and Cess thereon, shall be charged as per the prevalent tax laws over and above the said premiums.

^The above illustration is for an 18 year old healthy male, non-smoker who is willing to invest Rs 10 000 per month and will pay for 10 years for this policy where the policy term is 20 years, the basic sum assured is Rs 18 97 398 and guaranteed maturity benefit is Rs 29 01 878 The premium is assuming the policy is bought Online The above premium figures are exclusive of Goods and Services Tax and Cess Goods and Services Tax and Cess thereon shall be charged as per the prevalent tax laws over and above the said premiums

&The above illustration is for Male aged 35 years, Premium Rs 1 20 000 p a Premium Payment Term 10 years, Deferment Period 5 years, Policy Term 15 years, Income Benefit Period 25 years Income Benefit Frequency Annual Plan option opted is Long Term Income Income with 100 Returns of Premium for online channel The premium figures are exclusive of Goods and Services Tax and Cess as applicable Goods and Services Tax and Cess thereon, shall be charged as per the prevalent tax laws over and above the said

premiums Guaranteed benefits due under this plan are available provided premiums are paid regularly for the entire premium payment term and the policy is in force

$ The above illustration is for Male aged 18 years, Premium: Rs. 1,00,000 p.a., Premium Payment Term: 10 years, Deferment Period: 1 years, Policy Term: 11 years, Income Benefit Period: 25 years & Income Benefit Frequency: Annual. Plan option opted is Long Term Income – Income Only for online channel. The premium figures are exclusive of Goods and Services Tax and Cess, as applicable. Goods and Services Tax and Cess thereon, shall be charged as per the prevalent tax laws over and above the said premiums. Guaranteed benefits due under this plan are available provided premiums are paid regularly for the entire premium payment term and the policy is in force.

#The above illustration is for an 18-year-old healthy male, non-smoker who is willing to invest Rs. 10,000 per month and will pay for 10 years for this policy; where the policy term is 20 years, the basic sum assured is Rs. 17,42,559 and guaranteed maturity benefit is Rs. 27,16,071. The premium is assuming the policy is bought Online. The above premium figures are exclusive of Goods and Services Tax and Cess. Goods and Services Tax and Cess thereon shall be charged as per the prevalent tax laws over and above the said premiums.

Kotak Guaranteed Fortune Builder,UIN: 107N128V05 Form No: N128. An Individual, Non-Linked, Non-Participating, Savings, Life Insurance Plan. This is a saving and protection oriented plan. For substandard lives, extra premium may be charged based on Kotak Life Insurance’s underwriting policy. This product is available for sale through online mode. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale. For more details on riders please read the Rider Brochure.

Kotak Guaranteed Savings PlanUIN: 107N100V04, Form No: N100. Kotak Term Benefit Rider, UIN: 107B003V03, Form No: B003; Kotak Accidental Death Benefit Rider, UIN: 107B001V03, Form No: B001; Kotak Permanent Disability Benefit Rider, UIN: 107B002V03, Form No: B002; Kotak Life Guardian Benefit Rider, UIN: 107B012V02, Form No: B012; Kotak Accidental Disability Guardian Benefit, UIN: 107B011V02, Form No: B011. This is a non-linked, non-participating endowment plan. This is a saving and protection oriented plan. For more details on risk factors, please read sales brochure carefully before concluding a sale. For more details on riders please read the Rider Brochure.

Kotak Assured Savings PlanUIN: 107N081V06, Form No: N081. Kotak Term Benefit Rider UIN: 107B003V03, Form No.: B003, Kotak Accidental Death Benefit Rider UIN: 107B001V03, Form No.: B001, Kotak Permanent Disability Benefit Rider UIN: 107B002V03, Form No.: B002, Kotak Life Guardian Benefit Rider UIN: 107B012V02, Form No.: B012, Kotak Accidental Disability Guardian Benefit Rider UIN: 107B011V02, Form No.: B011, Kotak Critical Illness Plus Benefit Rider UIN:107B020V01, Form No.: B020. This is a savings-cum-protection oriented non-participating endowment assurance plan. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale. For details on riders, please refer to the Rider Brochure.

Kotak Fortune MaximiserUIN: 107N125V02, Form No: N125. Kotak Term Benefit Rider, UIN: 107B003V03, Form No: B003; Kotak Accidental Death Benefit Rider, UIN: 107B001V03, Form No: B001; Kotak Permanent Disability Benefit Rider, UIN: 107B002V03, Form No: B002; Kotak Life Guardian Benefit, UIN: 107B012V02, Form No: B012; Kotak Accidental Disability Guardian Benefit, UIN: 107B011V02, Form No: B011, Kotak Critical Illness Plus Benefit Rider - 107B020V01, Form No.: B020. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale. For more details on riders, please read the Rider Brochure.

Kotak Sampoorn Bima Micro-Insurance Plan- UIN: 107N092V02, Form No: N092. This is a non-linked non-participating endowment assurance plan. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale.

Kotak Premier Life PlanUIN: 107N096V04, Form No: N096. Kotak Term Benefit Rider - 107B003V03, Form No. B003, Kotak Accidental Death Benefit Rider - 107B001V03, Form No. B001, Kotak Permanent Disability Benefit Rider - 107B002V03, Form No. B002, Kotak Life Guardian Benefit Rider - 107B012V02, Form No. B012, Kotak Accidental Disability Guardian Benefit Rider - 107B011V02, Form B011, Kotak Critical Illness Plus Benefit Rider UIN: 107B020V01, Form NO.: B020. This is a non-linked participating whole life plan. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale. For more details on riders, please read the Rider Brochure. Benefits under this plan are dependent upon the performance of the participating Funds.

Kotak Assured Income AcceleratorUIN No.: 107N089V04, Form No.: N089. This is a non-participating guaranteed income anticipated endowment plan. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale.

Kotak Premier Endowment PlanUIN: 107N079V03, Form No.: N079, Kotak Term Benefit Rider UIN: 107B003V03, Form No.: B003, Kotak Accidental Death Benefit Rider UIN: 107B001V03, Form No.: B001, Kotak Permanent Disability Benefit Rider UIN: 107B002V03, Form No.: B002, Kotak Critical Illness Plus Benefit Rider UIN: 107B020V01, Form No.: B020, Kotak Life Guardian Benefit Rider UIN: 107B012V02, Form No.: B012, Kotak Accidental Disability Guardian Benefit Rider UIN: 107B011V02, Form No: B011. This is a Savings-cum-Protection oriented Participating Endowment Plan. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale. For more details on riders, please read the Rider Brochure. Benefits under this plan are dependent upon the performance of the participating Funds.

Kotak Premier Moneyback PlanUIN: 107N083V02, Form No: N083. This is a participating anticipated endowment plan. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale. Benefits under this plan are dependent upon the performance of the participating Funds.

Kotak Classic Endowment PlanUIN:107N082V02, Form No.: N082. This is a Savings-cum-Protection oriented Participating Endowment Plan. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale. Benefits under this plan are dependent upon the performance of the participating Funds.

Kotak SmartLife PlanUIN: 107N102V03, Form No: N102. This is a Savings-cum-Protection oriented Participating Endowment plan. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale. Benefits under this plan are dependent upon the performance of the participating Funds.

Kotak Premier Income PlanUIN: 107N099V02, Form No: N099. This is a participating anticipated endowment plan. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale. Benefits under this plan are dependent upon the performance of the participating Funds.

Kotak POS Bachat Bima;UIN: 107N117V01, Form No: N117. This is a non-linked, non-participating endowment plan. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale.

Kotak Get Assured Income NowUIN: 107N141V01, Form No: N141, Kotak Term Benefit Rider, UIN: 107B003V03, Form No: B003; Kotak Accidental Death Benefit Rider, UIN: 107B001V03, Form No: B001; Kotak Permanent Disability Benefit Rider, UIN: 107B002V03, Form No: B002; Kotak Life Guardian Benefit, UIN: 107B012V02, Form No: B012; Kotak Accidental Disability Guardian Benefit, UIN: 107B011V02, Form No: B011, Kotak Critical Illness Plus Benefit Rider - 107B020V01, Form No.: B020. This is a savings-cum-protection oriented participating endowment plan. For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale. For more details on riders please read the Rider Brochure. Benefits under this plan are dependent upon the performance of the participating Funds.

Section 41

Extract of Section 41 of the Insurance Act, 1938 as amended from time to time states:

- No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer.

- Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakhs rupees.

Section 45

Fraud and Misstatement would be dealt with in accordance with provisions of Section 45 of the Insurance Act, 1938 as amended from time to time. Please visit our website for more details:

https://www.kotaklife.com/assets/images/uploads/why_kotak/section-38-39-45-of-insurance-act- 1938.pdfKotak Mahindra Life Insurance Company Ltd.

Reg No. 107

CIN : U66030MH2000PLC128503

Regd. Office:

8th Floor, Plot # C- 12, G- Block, BKC,

Bandra (E), Mumbai - 400051

Toll Free: 1800 209 8800

Website: www.kotaklife.com

WhatsApp: 9321003007 | ARN No.: KLI/24-25/E-WEB/175

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

Trade Logo displayed above belongs to Kotak Mahindra Bank Limited and is used by Kotak Mahindra Life Insurance Company Ltd. under license.