Terms and Conditions for ULIPs

*Goods and Services Tax and Cess

The premium figures are net of Goods and Services Tax and Cess, as applicable. Goods and Services Tax and Cess rates are subject to change from time to time as per the prevailing tax laws and/or any other laws.

Tax Benefit

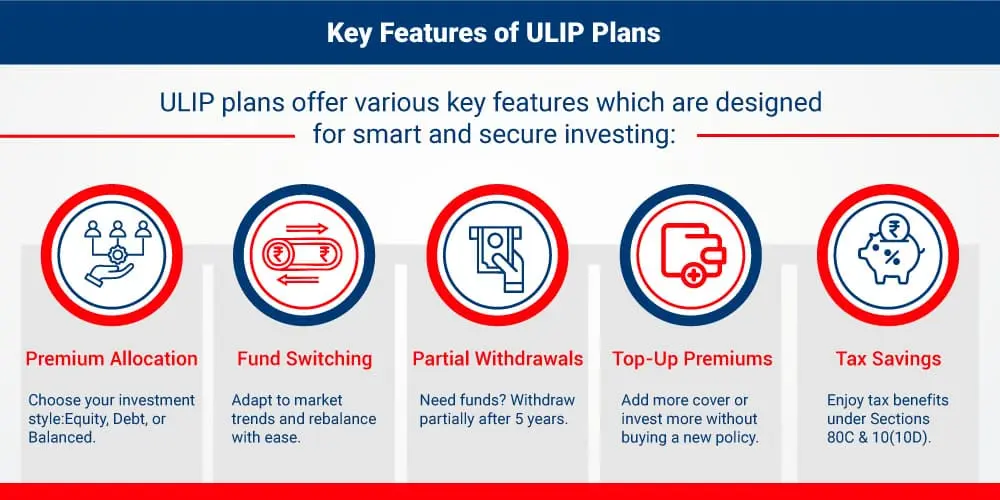

Tax benefits are subject to conditions specified under section 10(10D) and section 80C of the Income-tax Act, 1961. Tax benefits are subject to conditions specified under the Income-tax Act, 1961. Tax laws are subject to amendments from time to time. Customer is advised to take an independent view from tax consultant.

Unit Linked Insurance are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. Kotak Mahindra Life Insurance Company Ltd is only the name of the Life Insurance Company and Kotak e-Invest/ Kotak T.U.L.I.P/ Kotak Invest Maxima/ Kotak Single Invest Advantage / Kotak Platinum/ Kotak Wealth Optima Plan/ Kotak e-Invest Plus/ Kotak Confident Retirement Builder is only the name of the linked insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. Please know the associated risks and the applicable charges, from your insurance agent or intermediary or policy document issued by the insurance company.

Past performance is not indicative of future performance.

This website content is not a brochure and only gives the salient features of the plans. For more details on risk factors, terms and conditions please read the individual products sales brochure carefully before concluding a sale.

Kotak e-Invest UIN: 107L121V02. This is a non-participating unit-linked life insurance individual savings product.

Kotak T.U.L.I.P UIN: 107L131V03. This is a non-participating unit-linked life insurance individual savings product.

Kotak Invest Maxima UIN: 107L073V05. This is a non-participating unit-linked life insurance individual savings product.

Kotak Single Invest Advantage UIN: 107L065V05. This is a non-participating unit-linked life insurance individual savings product.

Kotak Platinum UIN: 107L067V07. This is a non-participating unit-linked life insurance individual savings product.

Kotak Wealth Optima Plan UIN: 107L118V03 This is a non-participating unit-linked life insurance individual savings product.

Kotak e-Invest Plus UIN: 107L137V02. This is a non-participating unit-linked life insurance individual savings product.

Kotak Confident Retirement Builder UIN: 107L136V02 This is a non-participating unit-linked pension individual savings product. This product is available for sale through online mode.

Kotak Confident Retirement Savings Plan UIN: 107N162V01 This is a participating non-linked pension individual savings plan. This product is available for sale through online mode. The risk factors of the bonuses projected under the product are not guaranteed. Past performance doesn’t construe any indication of future bonuses. The products are subject to the overall performance of the insurer in terms of investments, management of expenses, mortality, and lapses. @The assumed non-guaranteed rates of return chosen in the illustration are 4% p.a. and 8% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back as the value of your policy is dependent on a number of factors including future investment performance. The actual experience may be different from the illustrated. Please note that Bonuses are NOT guaranteed and may be as declared by the Company from time to time. Benefits under this plan are dependent upon the performance of the participating funds.

Section 41-

Extract of Section 41 of the Insurance Act, 1938 as amended from time to time states:

(1) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer.

(2) Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakhs rupees.

Section 45-

Fraud Misstatement would be dealt with in accordance with provisions of Section 45 of the Insurance Act, 1938 as amended from time to time. Please visit our website for more details: Read more about section38_39_45_of_insurance_act_1938

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/ FRAUDULENT OFFERS

IRDAI or its officials do not involve in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

Kotak Mahindra Life Insurance Company Limited. Reg No. 107; CIN: U66030MH2000PLC128503; Regd. Office: 8th Floor, Plot # C- 12, G- Block, BKC, Bandra (E), Mumbai – 400051 | Website: https://ddei5-0-ctp.trendmicro.com:443/wis/clicktime/v1/query?url=www.kotaklife.com&umid=8F5A3F9A-4235-E406-9F9C-BB51E6458143&auth=9bbf930103c38bc7dcedd0dacc9bedf6609c7415-9ecd584856fd374e0f8056bebbe488de4cd7245d | WhatsApp: 9321003007 | Toll Free: 1800 209 8800|ARN No. KLI/25-26/E-WEB/1584

Trade Logo displayed above belongs to Kotak Mahindra Bank Limited and is used by Kotak Mahindra Life Insurance Company Limited under license.