हिंदी में पढ़ें

A ULIP, full form- Unit-Linked Investment Plan, is a great investment option since it mixes insurance and investment. A part of the premium amount provides you with insurance coverage, while the remainder is invested in the stock market. Because a portion of the premium is constantly invested in the stock markets over time, the potential for returns is substantially higher than with other investments.

Key takeaways

Types of Funds

- Equity

- Debt

- Liquid Funds

- Balanced Funds

- Cash Funds

Based on the Investment Objectives

- To fund your child’s education

- To build a corpus of funds

ULIP types based on wealth creation

- Single premium and regular premium ULIPs

- ULIPs for different stages of life

- ULIPs with and without guarantees

- To plan for retirement

- To meet medical or personal emergencies

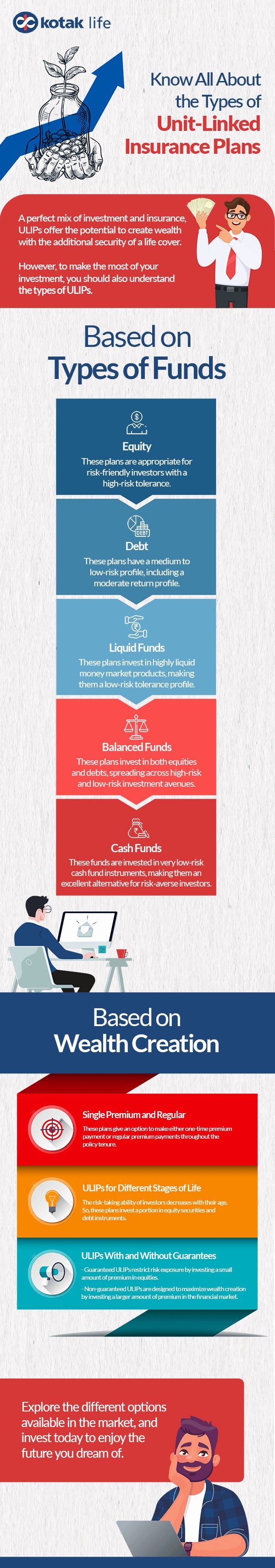

There are different types of ULIPs in India to suit various financial goals and risk profiles. In general, ULIP plans are categorized according to the types of funds in which your premium is invested or their ability to build wealth.

Types of Funds

The most popular types of unit-linked insurance plans in India are briefly described here:

1.Equity

Investors’ money is used to buy equity shares. Since investments in equity are directly linked to financial market changes, they prove to be highly risky. However, the potential for expansion is comparatively larger. Therefore, ULIP plans that invest in equity are appropriate for risk-friendly investors with a high-risk tolerance.

2. Debt

Debentures, corporate or government bonds and securities, and fixed-income bonds are among the debt instruments in which the funds are invested. Though these instruments have a medium to low-risk profile, they also include a moderate return profile.

3. Liquid Funds

These ULIP plans are ideal for reaching short-term financial goals since they invest in highly liquid money market products. These funds have a shorter maturity period (from weeks to months). Most of these ULIP investments have high credit ratings, making them a safe investment option for those with a low-risk tolerance profile.

4. Balanced Funds

Some ULIP plans invest in a combination of equities and debt assets to reduce risk. The risk is effectively spread across high-risk and low-risk investment avenues by allocating a part of the amount to equity and the other part to fixed-income debt instruments.

5. Cash Funds

These funds are invested in very low-risk cash fund instruments. While the profits are the lowest of all the available possibilities, the risk is also the smallest, making them an excellent alternative for risk-averse investors who aim to reduce risk as much as possible.

Based on Wealth Creation

1.Single premium and regular premium ULIPs

The former requires only a single premium payment at the time of purchase. On the other hand, the latter permits you to pay premiums regularly throughout the plan’s life, from purchase through maturity.

2. ULIPs for different stages of life

These are based on the premise that the risk-taking ability of investors decreases with their age. Therefore, a portion of the premium paid is invested in equity securities, while the rest of the amount is invested in debt instruments.

3. ULIPs with and without guarantees

Guaranteed ULIPs are concerned with capital preservation. By investing a small amount of the premium in equities, they restrict the exposure to market risk. However, non-guaranteed ULIPs are designed to maximize wealth creation by enabling investors to invest a larger amount of their premium in the financial market. As a result, non-guaranteed ULIPs have higher returns, but they are more volatile.

4. To plan for retirement

A retirement corpus building Unit-Linked Investment Plan (ULIP full form) can save you if your regular source of income quits and you’ve reached the end of your working years. There are particular ULIP programs created to care for you in your latter years. After the plan expires, they still offer regular payouts, and you will still get enough money to live comfortably. You won’t fully appreciate the advantages of working for money and having money work for you until these payments begin.

5. To meet medical or personal emergencies

There are occasionally significant expenses that we cannot avoid. When you least expect it, unexpected things like medical problems, accidents, legal costs, settlement amounts, debt, etc., can truly hit you hard. There are programmes that assist you in creating a corpus that you can utilise in place of a health insurance policy. The plan enables you to partially withdraw from your greater maturity corpus to cover the urgent expense if you are in the hospital and require rapid cash.

ULIPs Based on the Investment Objectives

1.To fund your child’s education

One of the more well-known advantages of choosing a ULIP is that it satisfies the criteria for protecting your dependents and children from financial hardship in the event of your passing and designs payouts so that they will be used for the appropriate purpose. Once a year, these ULIPs often pay benefits out when they are required for the intended use.

2. To build a corpus of funds

It is one of the most important types of unit-linked insurance plans that can be used to put unused savings to work, and one that also offers the option of life insurance protection effectively kills two birds with one stone. People typically let the insurance company manage their savings rather than going through hell to find the proper investment with the right interest rate and term.

When tackled through the conventional technique of hard labour, building a sizable corpus is a time-consuming endeavour. ULIPs, however, limit your involvement in the administration of money and allow you to share in the profits.

Conclusion

These categorizations convey that you can pick the right type of unit-linked insurance plan that meets your risk tolerance and long-term financial objectives. In addition, you can invest in a ULIP full form (unit-linked insurance plan), which allows you to pick from various funds with varied risk and reward formulae. As a result, they make informed decisions and take advantage of market fluctuations.