Buy a Life Insurance Plan in a few clicks

Insurance and Investment in one plan.

A plan that works like a term plan, and Earns like ULIP Plan

Thank you

Our representative will get in touch with you at the earliest.

Buy a Life Insurance Plan in a few clicks

Insurance and Investment in one plan.

A plan that works like a term plan, and Earns like ULIP Plan

Thank you

Our representative will get in touch with you at the earliest.

In ULIP, the investment risk in the investment portfolio is borne by the policyholder

A Unit-Linked Insurance Plan (ULIP) is a unique financial product that combines life insurance with investment opportunities. ULIPs allow you to invest in a mix of equity and debt funds, helping you grow your wealth while providing life coverage.... A portion of your premium is allocated towards life insurance, while the remainder is invested in market-linked funds, offering both financial security and the potential for investment growth. This dual-purpose approach makes ULIPs an attractive option for individuals seeking comprehensive financial protection and wealth-building in one plan. Read more

In Built Life Cover

Free Fund Switches

Partial Withdrawal

In Built Life Cover

Free Fund Switches

Partial Withdrawal

ULIP is the short form for Unit Linked Insurance Plan. It is a kind of insurance product providing a cover for one's life along with offering an investment opportunity under one single plan. Unlike traditional insurance plans based upon providing a cover for life, ULIP plans pool some amount of the premium towards insurance and invest the rest in market-linked funds.

ULIPs not only help in wealth creation over the long term through market-linked returns but also offer tax benefits under Section 80C and Section 10(10D) of the Income Tax Act, making them a tax-efficient investment option.

With tools like ULIP calculators , individuals can customize their investment and insurance coverage to align with their financial objectives. Overall, ULIPs promote disciplined financial planning by offering protection and growth in a single, adaptable policy.

If you're looking for a product that combines insurance with market-linked returns, ULIP plans are a great choice. Selecting the best ULIP plan for investment can help you achieve your long-term financial goals. These plans invest a percentage of your premium in wealth-generating market-linked tools and the remaining premium amount is used to cover your family. Let's take a glance at other benefits of these plans.

ULIPs combine insurance and investment in a single plan. A part of the premium ensures life cover, securing your family in case of an unfortunate event. The remaining amount is invested in equity, debt, or a mix of both. Thus, allowing your money to grow steadily over time.

ULIPs offer flexibility through multiple fund options aligned with different risk levels. Based on your risk tolerance, you can choose between equity, debt, or balanced funds. The plan also allows switching between these options, which gives you control to adapt your investment strategy as your goals evolve.

ULIPs offer clear transparency on how your money is invested. You can track fund performance regularly and adjust your fund allocation as needed. This control helps you manage risk more effectively and optimize returns based on your evolving financial goals and market conditions.

ULIPs are tax-efficient investment options offering multiple tax benefits. Annual premiums paid are eligible for deductions under Section 80C, up to ₹1.5 lakh per year. Additionally, maturity proceeds and death benefits are tax-free under Section 10(10D), subject to conditions, making ULIPs a smart choice for tax planning.

For example, suppose you invest ₹2.4 lakh annually in a ULIP for 10 years.

Since the annual premium does not exceed ₹2.5 lakh, the maturity proceeds are fully exempt from tax under Section 10(10D), assuming other conditions (sum assured ≥ 10x annual premium) are met.

Result:

ULIPs are ideal for long-term wealth creation. They encourage disciplined investing and utilizing the power of compounding. When invested consistently, they can deliver impressive ULIP returns in 15 years. Perfect for goals like a child’s education or retirement, ULIPs offer a structured path to steady wealth accumulation.

With growing digitization, ULIPs have become more cost-effective than traditional insurance plans. They offer competitive charges, lower administrative costs, and greater value on investments. ULIPs also allow fund switching at no extra cost, providing flexibility and maximizing returns while keeping overall expenses minimal.

A ULIP (Unit Linked Insurance Plan) works by splitting your premium into two key components, offering both financial protection and investment growth. This dual structure ensures that a part of your money goes towards securing your family's future, while the rest is invested to help you build wealth over time. Here's how the two components function:

Component: A portion of your premium is allocated to provide life cover, ensuring financial protection for your family in case of an unfortunate event.

The remaining portion is invested in financial markets, giving you market-linked returns along with the flexibility to choose between equity, debt, or hybrid funds based on your risk appetite. You can also switch between funds to optimize returns as market conditions evolve.

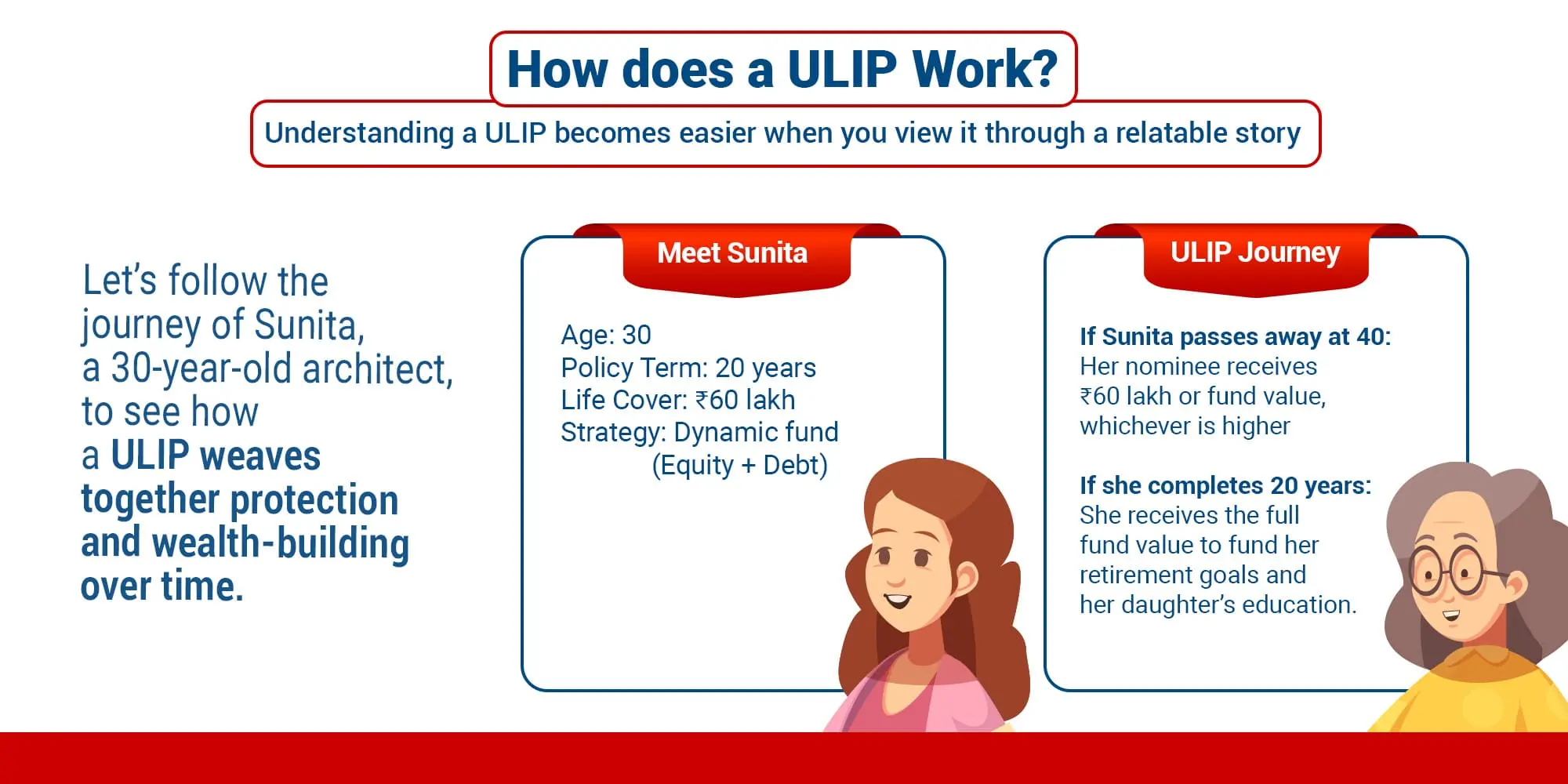

To understand how a ULIP works in real life, let’s look at Sunita’s story. Her example shows how a ULIP can help you grow your money while also giving life cover.

ULIP plans provide a diverse array of investment options that can be customized to meet specific financial objectives, striking a balance between wealth generation and financial security.

| Types of Fund Options | Details |

|---|---|

| Equity-Based ULIP Funds | These funds allocate premiums to equity investments, making them high-risk but high-reward options. They are ideal for investors with a long-term perspective and a high-risk appetite. |

| Hybrid or Balanced Funds | A mix of equity and debt instruments, these funds offer moderate risk and stable returns, making them suitable for investors looking for balanced growth. |

| Debt-Based ULIP Funds | These funds focus on investments in government securities and corporate bonds, providing lower risk with stable but lower returns. They are ideal for conservative investors. |

| Cash Funds | Also known as money market funds, these funds invest in bank deposits and other short-term instruments, making them the safest ULIP fund option. |

| Parameter | Type 1 ULIP Plans(Prioritizes life cover with a higherdeath benefit payout) | Type 2 ULIP Plans(Focuses on maximizing investmentreturns along with death benefit) |

|---|---|---|

| Lock-in Period | 5 years | 5 years |

| Investment Options | Equity, debt, or a mix of both | Equity, debt, or a mix of both |

| Returns | Market-linked returns | Market-linked returns |

| Death Benefit | Offers the higher of the sumassured or the fund value to thenominee. Example: If fund value is₹50L and sum assured is ₹40L,nominee gets ₹50L. | Offers both the sum assured and the fund value together. Example: If fund value is ₹50L and sum assured is ₹40L, nominee gets ₹90L. |

| Objective | Ensures a guaranteed payout to the nominee | Focuses on maximizing payout and investment growth |

| Suitable for | Individuals seeking life cover with steady market-linked growth | Individuals willing to pay higher premiums for greater benefits |

| Sum at Risk | Reduces over time as fund value increases | Reduces over time as fund value increases |

| Purpose-Driven ULIP Solutions | Details |

|---|---|

| ULIP Plans for Wealth Creation | Designed for long-term financial growth, these ULIPs offer the opportunity to build wealth through market-linked investments over time. |

| ULIP Plans for Children’s Education | These plans help parents secure funds for their child's education, ensuring financial stability for higher studies even in unforeseen circumstances. |

| ULIP for Health Benefits | Investors can use ULIP funds for medical emergencies, and some policies allow additional health riders to enhance coverage. |

| ULIP Plans for Retirement | These plans ensure financial security in retirement by building a corpus over the years and providing returns post-retirement. |

ULIPs cater to a diverse range of investors, making them an ideal financial tool for various life stages and financial goals. Here's who can benefit the most from investing in a Unit Linked Insurance Policy:

A ULIP for child education helps secure your child's future by building a strong financial foundation, offering stability even in your absence.

A ULIP helps young professionals start their financial journey by combining life insurance with market-linked investments, ensuring growth and security.

For entrepreneurs, a ULIP offers life cover and investment options, safeguarding both business and family while growing wealth for the future.

Retirees can secure a steady income post-retirement with a ULIP, balancing growth and risk while offering flexibility between equity and debt.

ULIPs allow high earners to save on taxes under Sections 80C and 10(10D) while ensuring solid investment growth and financial stability.

For the self-employed, ULIPs provide market-linked growth without affecting business capital, helping to build a stable financial cushion.

ULIPs offer women financial security, tax savings, and growth potential, empowering them to invest confidently in their future.

First-time investors can gain market exposure and life cover with a ULIP, balancing security and investment growth to meet their financial goals.

Business owners can diversify their investments with a ULIP, offering stable returns and flexibility for active portfolio management.

Fund 5 year Returns

26.5%

Bench Mark 5 year returns

23.2%

Investment objective

Aims for a high level of capital growth for you, by holding a significant portion in large sized company equities.

Fund 5 year Returns

23.8%

Bench Mark 5 year returns

24%

Investment objective

Aims to maximize opportunity for you through long term capital growth, by holding a significant portion in a diversified and flexible mix of large / medium sized company equities.

Fund 1 year Returns

19.5%

Bench Mark 1 year returns

7.5%

Investment objective

Aims to maximize opportunity for long-term capital growth, by holding a significant portion in a diversified and flexible mix of medium and small sized company equities.

Fund returns are as on 31st-March-2025 Click here to view past performance of the funds

Unit Linked Insurance Plans are an alternative to traditional insurance policies, wherein premiums of a policyholder are invested in a fund of the investor's choice, that could be equity, debt, or a mix of both.

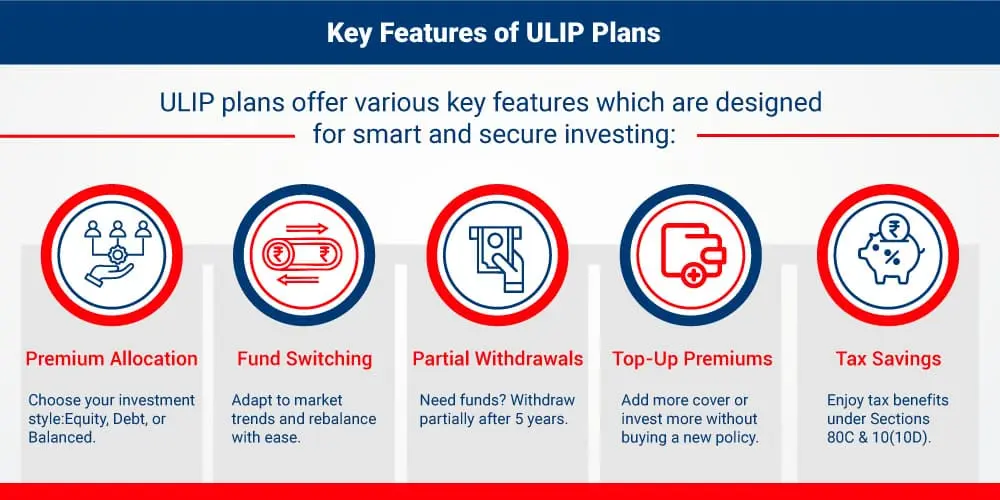

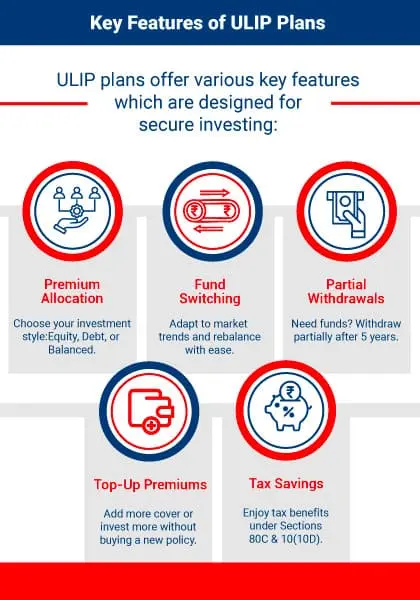

ULIP plans enables you to choose investment channels according to your risk capacity. You may go aggressive with equities, careful with the debt funds, or balanced funds for getting the best of both worlds. Your premiums can also be allocated towards funds of your preference, depending on your risk appetite.

ULIPs offer fund-switching flexibility to manage market volatility. If a ₹5 lakh equity-focused ULIP underperforms, you can shift to debt funds to minimize losses and protect capital. Once markets stabilize, switch back to equity to align with long-term goals. This helps balance risk while aiming for steady, optimized returns.

ULIPs allow partial withdrawals as per policy terms after the five years lock-in period. The insurer sets withdrawal limits and frequency. However, frequent withdrawals may reduce long- term returns and defeat your investment purpose. Use this option only in urgent financial situations when no other alternatives are available.

You have the option to enhance your existing coverage by opting for Top-Up Premiums. By paying a little extra over your premium, you can increase the coverage amount on your unit linked health insurance plan without having to buy a new policy. It’s a cost-effective way to increase protection for medical needs.

ULIPs stand out from all otherlife insuranceinstruments by combining investment, life cover, and tax benefits in one plan. As being a product of life insurance, you get the benefit of tax as well. Tax advantages under Sections 80C and 10(10D) further enhance their appeal, making ULIPs a complete package for protection and growth.

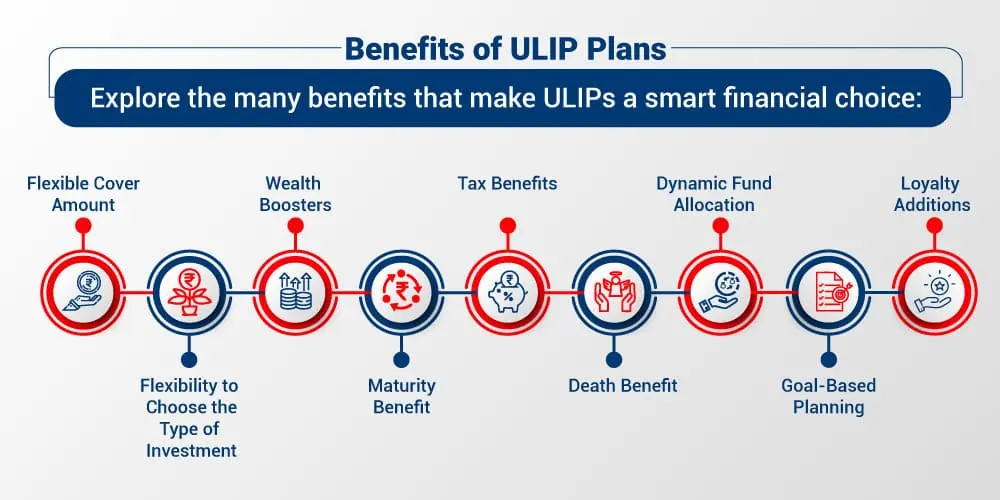

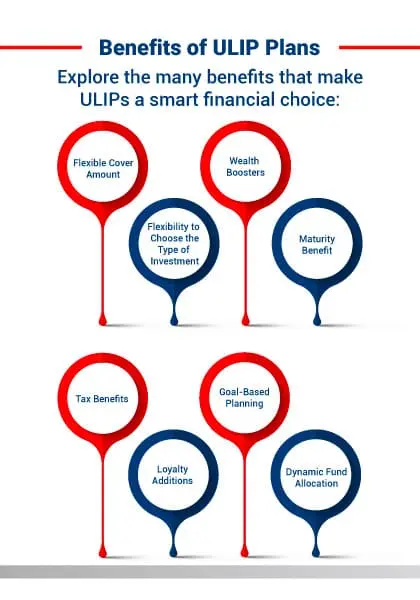

Building a corpus to secure a safe future for you and your loved ones is crucial, and unit linked insurance plans can help you achieve that. Let's take a glance at the benefits of ulip plans.

Unit Linked Insurance Policies permit you to choose whatever amount of Life Cover you want. In most ULIP plans, a minimum life cover has to be provided equal to 7 times your yearly premium. However, depending on the plan you choose you can opt to buy a life cover to the extent of up to 25 times of your yearly premium.

For example, if you invest ₹1 lakh per year in a ULIP, you can choose a life cover ranging from ₹7 lakh (7 times your premium) to ₹25 lakh (25 times your premium), depending on the plan. Suppose you select a life cover of ₹15 lakh (15 times your premium). If an unfortunate event occurs during the policy term, your family would receive ₹15 lakh. This flexibility allows you to adjust the life cover based on your financial protection needs and future goals.

One of the most convincing features of a ULIP is that you are free to choose the type of investment you desire. This flexibility allows investors to tailor their ULIP plans according to their individual needs.

ULIP plans are specially designed to help you meet your financial objectives whether it's increasing your wealth or planning for your retirement. For instance, you can opt for ULIP for child educationto support your children’s future life goals.

When your policy matures, you receive the fund value that has accumulated, which is the result of your paid premiums and market-linked returns.

ULIP plans offer a comprehensive death benefit that guarantees your family's financial well-being in the event of your untimely demise. Your nominees will receive the proceeds basis the terms and conditions of your ULIP policy.

Loyalty additions in ULIP plans are some extra units added on towards your policy at specific intervals and rewards you for staying invested over the years. This not only enhances the growth potential of your investment but also shows how committed an insurer is toward your financial success.

As you continue along on the ULIP journey, you will then come across the wealth boosters. These are additional units allocated to your policy once you have reached some specific milestones such as completion of five years or more of the policy term.

ULIP plans have dynamic fund allocation and hence switching to any fund that is offered by the insurer, such as equity, debt, or balanced funds is quite easy. This flexibility to switch funds helps maximize returns while simultaneously managing risk with changing market dynamics.

ULIPs offer tax benefits at both entry and exit points, as per the Income Tax Act, 1961.

These benefits are subject to market risks and evolving tax laws. Consult a financial advisor to ensure compliance.

Invest in your dreams with Kotak Life Insurance ULIP plans.

Buy NowUnit Linked Insurance Plans (ULIPs) are designed to offer a blend of insurance and investment. However, just like any financial product, ULIPs come with a variety of charges that can impact the overall returns. Understanding these charges is crucial for investors to make an informed decision.

Here’s a detailed breakdown of the key charges involved in ULIPs:

These are regular charges deducted by the insurer to manage your ULIP policy. They cover things like paperwork, record-keeping, and customer service.

This fee is taken for managing the money you invest in ULIP funds, whether it's equity, debt, or balanced funds. It’s usually a small percentage of your fund value.

When you pay your premium, a part of it is deducted upfront to cover expenses like agent commission, distribution, and underwriting. The rest is invested.

This is the cost of life cover included in your ULIP. It’s based on your age, health, and the amount of insurance you’ve opted for.

ULIPs allow you to switch between different funds (like from equity to debt). A few switches are free each year, but if you go beyond the limit, a small fee is charged.

If you choose to exit or close your ULIP before the 5-year lock-in period, you’ll have to pay a surrender charge as a penalty.

After 5 years, you can withdraw part of your money. Some withdrawals are free, but if you exceed the allowed number or amount, a charge may apply.

Kotak Life offers several ULIP plans that best meet your requirements. You can understand the benefits, features, and investment strategies associated with these ULIP plans. The following are our top recommendations.

A ULIP calculator is an online tool provided by insurance companies. Through these calculators, one can get an idea of the returns and premiums these ULIP plans offer for various investment scenarios. The best ULIP plans give an array of options with various features and benefits attached to each. It can become very tough to pick just one. A ULIP calculator really helps in such scenarios by giving clarity on how is CAGR calculated in ULIP.

Investment Amount(Monthly)

Investment Tenure(Years)

Interest Rate(P.A.)

Sensex has given 10% return from 2010 - 2020

Existing Investment(optional)

Periodic Investment(optional)

When evaluating tax-saving investments under Section 80C, it is important to consider their lock-in periods, risk levels, and potential returns. One of the key benefits of ULIP is that it offers both investment growth and life insurance under a single plan. Here’s how ULIPs stack up against ELSS and PPF.

| Particulars | ULIPs | ELSS | PPF |

|---|---|---|---|

| Lock-in Period | 5 years | 3 years | 15 years |

| Tax Benefits | Eligible under Section 80C; maturity amount is tax-free under Section 10(10D) | Eligible under Section 80C | Eligible under Section 80C; maturity proceeds are tax-free |

| Taxation | Depends on underlying assets; equity-heavy funds may attract LTCG | LTCG at 10% on gains exceeding ₹1 lakh per financial year | No tax on interest or maturity amount |

| Underlying Assets | Equity, debt, or hybrid funds | Primarily equity | Government-backed fixed income instruments |

| Risk Profile | Market-linked; relatively higher risk with potential for high returns | Moderate to high risk | Considered safe with guaranteed returns |

| Charges | Includes mortality, premium allocation, switching, surrender, and administration charges | Expense ratio ranges between 1.05% and 2.25% | Minimal charges; one-time account opening fee |

To truly maximize the benefits of your ULIP, it's important to go beyond just investing — you need a smart, long-term strategy. Here are five effective ways to make the most of your ULIP investment and boost both your returns and financial security.

Starting early maximizes ULIP returns through the power of compounding, allowing your investment to grow steadily and generate higher returns over time.

Consistent investments help smooth out market volatility, using rupee-cost averaging for better long-term returns.

Diversifying across equity and debt funds balances risk and reward, helping align your investments with your goals.

Regularly reviewing your portfolio ensures it aligns with your financial goals and allows you to adjust based on market trends. Staying updated with market trends helps make informed decisions during ULIP renewal, allowing adjustments to your investment strategy for better long-term outcomes.

ULIPs offer valuable tax benefits to policyholders. Under Section 80C of the Income Tax Act, premiums paid can be claimed as deductions. Additionally, Section 10(10D) exempts maturity and death benefits from tax, subject to conditions. These benefits help reduce tax liability while enhancing overall returns from your ULIP investment.

Let us now see the power of compounding in different case scenarios:

Do not wait; start growing your wealth with Kotak e-invest plus. Take the first step

When I was planning for my child's future, my friends recommended me about investing in ULIP. The benefits that ULIP offer were very well aligned with my requirements. This is why I started researching and came to know about Kotak e-Invest plan. I went through their online portal and got to know the premiums, returns and everything. I realized that Kotak ULIP plans was the best plan for me, and I bought it.

-Mr. Ambadas Sulakhe

ULIPs are new-age investment instruments that offer tax benefits and market-linked returns. I read about it online and started to think about my investments. I thought this could be a good addition to my financial portfolio. They offer market-linked returns with no Capital gain taxes. And I could easily optimize my returns by choosing the funds wisely. So, I decided to start my Kotak ULIP plan.

- Mr. Darpan V Mehta

Investments have always helped me achieve my difficult life goals. So, I make sure that every month I invest in the right instruments. Just when I was looking for a new investment option, I came across Kotak ULIP plan. They have various plan options; premium payment mode is flexible which is perfect for me. The plan aligned with my requirements and offered excellent returns which makes this one a best ULIP plan for me.

- Ms Munera Janvekar

Kotak ULIP plan is one of the best investment instruments I decided to invest my hard-earned money in. It gives me various fund options that help me manage my portfolio and make sure that my investment is optimized all the time. This way, I can gain returns when the market is high and go for debt funds when the markets go down. A win-win. If you are looking for such a plan, I recommend you to invest in Kotak ULIP plan.

- Mr Sujitbhai Ashokbhai Kanjariya

I was looking for investing a sum of amount that can give me good returns over the long term. I came across Kotak ULIP plan and decided to give it a try. I logged in to understand the plan and their call center executive helped me understand everything about the plan. I went ahead with the plan and the plan is giving me good returns and I can monitor them year on year. If you are looking for a long term investment with solid returns, I recommend you to invest in Kotak ULIP plan.

- Ms Neeti Garg

My friends recommended me to invest in an ULIP plan when they came to know that I am planning to buy a house in the future. I went online, spoke to my friends and came across Kotak ULIP plan. I registered on their portal where they showed me all plans, premiums and returns upfront. I completed the application process upload documents and made my payment. I was happy to make this decision as I can now monitor my returns and make a fund switching decision when required.

- Mr Santosh Kumar

Choosing the best ULIP plan in India involves evaluating your financial needs, risk appetite, and long-term goals. By assessing these factors carefully, you can select a ULIP unit linked insurance plan that aligns with your overall financial strategy and helps you meet your objectives efficiently. Here are key factors to keep in mind:

The best ULIP funds can be chosen according to various factors, like risk tolerance, investment horizon, and financial goals. Here are a few categories of ULIP funds along with their suitability:

Equity funds are for Investors with a high-risk appetite and a long-term investment perspective of at least five to ten years or more. The ups and downs of the market will reflect their performance. You can opt for equity funds if you have a good risk appetite and want to create some wealth in the long term.

Debt funds well suited for conservative investors who want steady returns with lower risk. These invest in government securities, corporate bonds, and other debt instruments. These plan are safer because they offer low to moderate risk levels.

Cash funds are those funds that invest in bank-owned money market funds. They carry a very low-risk profile. As a result, of all the categories of ULIPs, they offer the lowest returns. Risk-averse investors have the option of choosing cash funds ULIPs.

ULIPs also allow investment in equities and debt instruments to ensure a proper mix of risk and return. These are most suitable for investors, who want a good balance between risk and return. Examples of balanced funds could be equity-oriented hybrid funds.

Multiply your wealth with Kotak e-Invest Plus.

Invest todayWhen purchasing a ULIP, it’s essential to ensure that it aligns with your overall financial strategy. While ULIPs offer a unique combination of investment and insurance benefits, avoiding common pitfalls is key to maximizing returns. Here are some mistakes to watch out for:

Purchasing a ULIP plan online with Kotak Life is convenient and straightforward. Follow these simple steps to get started with your preferred unit linked investment plan:

Visit the Kotak Life website and navigate to the ‘ULIP Plans’ section. Check out plans like Kotak Life’s E-Invest Plus and Kotak Life’s TULIP , both designed to offer insurance protection along with market-linked investment opportunities.

Fill in your name, mobile number, and a few basic details to generate a personalized quote tailored to your investment goals.

Evaluate different ULIP options based on fund choices, policy tenure, and expected returns. Select the one that best fits your financial objectives and risk profile.

Choose your investment amount, premium payment frequency (monthly or yearly), and preferred investment strategy. You can also select your investment timeline based on your financial goals, whether you are aiming for ULIP returns in 5 years, ULIP returns in 20 years , or ULIP returns in 40 years . This flexibility helps align your policy with both short-term and long-term objectives. Regularly reviewing your portfolio ensures it aligns with your financial goals and allows you to adjust based on market trends. Staying updated with market trends helps make informed decisions during ULIP renewal, allowing adjustments to your investment strategy for better long-term outcomes.

Provide your personal and financial information, including income details and KYC documents. Submit health declarations as required.

Pay securely using the card, net banking, or UPI. Once verified, you will receive your ULIP policy document via email, marking the beginning of your financial growth journey with Kotak Life.

Kotak Life’s ULIP plans, E-invest plus and TULIP, offer a perfect balance of wealth creation and life protection. Whether you seek zero allocation charges, enhanced life cover, or smart investment options, these plans are designed to maximize your financial growth.

- 2X Return on Premium Allocation Charges – Boost your investment returns

-3X Return of Mortality Charges – Enjoy additional benefits at policy maturity .

- Loyalty Additions – Earn extra rewards for staying invested.

- Flexible Premium Payment – Choose a payment term that aligns with your goals.

Unit linked insurance plans offer a chance to grow your wealth while simultaneously providing cover against financial shocks. Of course, one of the major attractions for joining any ULIP scheme is the tax benefits they provide.

Premiums paid towards ULIP plans qualify for tax deductions underSection 80C of the Income Tax Act, 1961. As per current tax laws, you can claim up to ₹1.5 lakh in a financial year. Note that this deduction applies only to the premium paid, not the total investment amount in the ULIP.

Most importantly, under Section 10(10D) of the Income Tax Act, proceeds at maturity, including investment income, are tax-exempt but subject to conditions specified under the Income Tax Act. To avail this benefit the annual premium should not exceed 10% of the sum assured and Annual aggregate premium should be upto Rs.2.50 lakhs.

This switching flexibility in Unit linked insurance plans also allows an investor to switch between two or more funds depending upon the market situations or investment preferences. The best part, of course, is that such switches are tax-exempt. You can optimize your investment by taking benefits of market movements without incurring any tax consequences.

The policyholder, under ULIP policy, is permitted to withdraw a part of the investment at specific terms and conditions. The amount withdrawn is tax-exempt under section 10(10D) subject to conditions specified under the Income Tax Act.

It is very important to maintain the policy for a minimum period to avail of the tax benefits. Tax benefits availed during the policy period will be added back to taxable income if the policy is discontinued within five years from the date of commencement.

ULIPs have long been a topic of debate in the world of investments. While some investors hail them as a flexible and efficient investment avenue, others harbor skepticism and believe in several myths associated with ULIPs.

One of the most common misconceptions that revolves around ULIP plans is that they are very costly. ULIP plans do carry certain charges associated with them. Many investment options also have charges, for example, mutual funds orportfolio managementservices.

Another commonly believed myth relating to ULIP plans is that they bring about poor returns compared to other investment options, including mutual funds or direct equity. The returns from a ULIP depend on various factors - your investment horizon, the chosen fund options, and the insurer's track record.

With some investors too counting the lack of transparency as one reason to hesitate while actually making investments, ULIP plans are regulated by the IRDAI, ensuring that the insurance company discloses all necessary information relevant to the plan.

Although the minimum lock-in period for ULIP plans under IRDAI regulations is five years, it also gives investors an opportunity to receive compounding powers that work long-term.

ULIP plans indeed provide life insurance, but they are also an investment product. They provide a dual advantage of insurance protection and another of potential wealth creation through market-linked returns.

While ULIPs do carry market-related risks, the level of risk depends on the chosen fund type. Equity-based ULIPs may be volatile but offer higher long-term returns, while debt-based ULIPs ensure stability and capital preservation. Thus, ideal for conservative investors. Diversifying across funds and staying invested long-term helps manage risk and maximize returns effectively.

ULIP Plans

Finding the best ULIP depends on investment objectives, risk appetite, and current financial requirements. You should look out for factors that differentiate one ULIP offering from the other such as fund performance, charges, flexibility, and customer service.

ULIP plans are a solid choice for individuals looking to combine life insurance with market-linked returns. They offer the flexibility to choose funds based on your risk appetite and investment goals, allowing you to align your portfolio with both protection needs and long-term wealth creation.

ULIP plans are best suited for long-term investments, with a minimum lock-in period of five years. Staying invested beyond this period allows you to maximize returns and benefit from the power of compounding. The longer you remain invested, the greater the potential for wealth creation and financial growth.

Yes, you can cancel or surrender a ULIP during the lock-in period. Surrendering a ULIP before the end of the lock-in period will attract charges along with penalties that will impact the surrender value very severely. You can surrender a ULIP after the completion of the lock-in period without paying any charges.

ULIP plans allow taking back any amount from the plan after it has completed its lock-in period, which, in most cases, is for five years subsequent to the date of purchase. Once the lock-in period is over, you may partially withdraw or surrender the ULIP in full without any charges or penalties being levied on you.

Normally, ULIP plans come with a lock-in period of five years from the purchase date. Once the lock-in period expires, you are free to withdraw the amount partially or fully without any charges or penalty.

ULIPs have various charges associated with them. Some common charges include:

It is important to carefully review the policy documents to understand the specific charges applicable to your ULIP plan, as they can vary between insurance providers and policies.

The NAV is calculated by dividing the total net assets of the fund by the number of units outstanding. The fund value of your ULIP plan is determined by multiplying the number of units held in each fund with the respective NAV of those units.

ULIP (Unit Linked Insurance Plan) combines life insurance with investment. Unlike fixed deposits or savings accounts, ULIPs don’t offer a fixed interest rate. Instead, returns depend on the performance of chosen investment funds, which vary based on market conditions. This makes ULIP returns market-linked and dynamic in nature.

Since ULIP plans are market-linked, their returns fluctuate based on market conditions. Equity funds within ULIPs are more sensitive to volatility, while debt funds offer stability. However, long-term investment in ULIPs helps average out market fluctuations and maximize potential growth.

Yes, Kotak Life provides an online portal and mobile app where you can monitor your fund performance, check NAV (Net Asset Value), switch funds, and manage your policy in real time.

No, ULIPs do not provide guaranteed returns, as they are linked to market performance. However, by choosing balanced or debt funds, investors can reduce risk and aim for more stable growth.

If your chosen ULIP fund underperforms, you can:

Yes, ULIPs offer fund switching options, allowing you to reallocate investments between equity, debt, and hybrid funds based on market conditions and risk tolerance. Kotak Life provides multiple free switches per year to help optimize your portfolio.

To maximize ULIP returns:

Withdrawal, Lock-in & Taxation

ULIPs offer several advantages that make them a popular choice for individuals seeking both insurance coverage and investment opportunities:

You can reduce risk on your ULIP investment by considering the following strategies:

ULIP plans (Unit Linked Insurance Plans) and Traditional Plans differ in various aspects:

It is important to evaluate your financial goals, risk tolerance, and preferences before deciding between ULIPs and Traditional Plans.

The minimum premium payable for various ULIP plans differs according to the insurance companies and the particular ULIP product provided. Different ULIP plans have different premium payment options.

Most ULIP plans allow you to increase your premium by making top-up investments, which boost your fund value while enjoying tax benefits. However, decreasing the premium is usually not permitted, as the policy requires a minimum premium to stay active.

ULIP premiums qualify for tax benefits under Section 80C of the Income Tax Act, allowing deductions of up to ₹1.5 lakh annually. Additionally, the maturity proceeds are tax-free under Section 10(10D), subject to conditions on premium-to-sum assured ratio.

ULIP returns are not classified as "interest" but rather market-linked gains. If the annual premium exceeds ₹2.5 lakh, gains from ULIPs are taxed as capital gains. However, if the premium is below this threshold, maturity benefits remain tax-free under Section 10(10D).

ULIPs have various charges, including:

No, ULIPs are transparent, and all charges are disclosed upfront in the policy document. However, investors should review the charge structure to understand deductions and fund value impact over time.

Most ULIPs allow a certain number of free switches per year. Beyond this limit, a nominal charge (typically ₹100-₹500 per switch) may apply. Kotak Life’s ULIPs offer free fund switches up to 4 times per year to help manage investments efficiently.

While mutual funds have lower fund management charges, ULIPs provide dual benefits—investment and life insurance. ULIPs may include mortality and administration charges, but they also offer tax benefits, life cover, and long-term wealth creation, making them a cost-effective choice for disciplined investors.

Investment & Returns Related

Yes, under the facility of switching offered by most of the ULIP plans, you can switch between different funds based on specific investment goals and risk capacity. For most ULIP plans, the policyholder can switch their investments between various available funds offered by the insurance company

If you stop paying your ULIP premium within the 5-year lock-in period, your policy moves into a discontinued fund, where it earns minimal returns until withdrawal is allowed after five years. After the lock-in period, you may surrender or convert it into a paid-up policy with reduced benefits.

Yes, ULIPs offer a death benefit, ensuring financial security for your loved ones. In case of the policyholder’s demise, the higher of the sum assured or fund value is paid to the nominee. Some plans also include additional riders for enhanced protection.

Yes, Kotak Life’s ULIP plans allow you to enhance your coverage by adding riders such as accidental death benefit, critical illness cover, or waiver of premium, offering extra financial protection beyond the base plan.

Surrendering a ULIP before the 5-year lock-in period leads to fund transfer into a discontinued policy fund, subject to charges. The amount is accessible only after the completion of five years. Post lock-in, surrendering gives you the fund value minus applicable charges.

To select the best ULIP plan, consider:

Yes, you can buy a ULIP plan online through Kotak Life’s website. Simply compare plans, calculate premiums, fill in your details, select a fund strategy, complete KYC, and make the payment, all from the comfort of your home.

Yes, ULIPs are regulated by IRDAI, ensuring transparency and investor protection. They offer a mix of market-linked returns and life cover, allowing you to grow wealth while securing your financial future. Plus, flexible fund switching helps manage risk effectively.

Premium & Charges Related

Yes, a few ULIP plans allow the facility to take up a loan against the policy. However, such an option is subject to the discretion of the insurance companies and ULIP products. Normally, such loans can be available as a percentage of the ULIP fund value.

The ULIP plan’s proceeds received at maturity along with extra benefits are exempt from tax under Section 10(10D) of the Income Tax Act, subject to conditions specified under the Income Tax Act. Consult a tax consultant who will provide you with taxation details based on your case.

Yes, partial withdrawals are allowed after the 5-year lock-in period. Most ULIPs allow withdrawals up to a certain percentage of the fund value, ensuring you have liquidity while keeping your policy active.

To withdraw funds from your ULIP plan:

Under the new tax regime, ULIP premiums exceeding ₹2.5 lakh per year are subject to capital gains tax on maturity proceeds. However, policies with lower premiums still enjoy tax-free benefits under Section 10(10D). Death benefits remain tax-exempt regardless of the premium amount.

Yes, if you withdraw before 5 years, your funds will be moved to a discontinued policy fund, where they earn a minimum guaranteed return. You can access the amount only after the lock-in period ends, and surrender charges may apply.

Yes, you can reinvest your ULIP maturity amount into another ULIP or investment plan to continue wealth creation and insurance benefits. Kotak Life offers multiple ULIP options to suit different financial goals, ensuring your money keeps growing.

ULIP plans combine insurance with investment, allowing you to invest in various fund options while enjoying life cover. SIPs, on the other hand, are purely investment-focused, involving regular contributions to mutual funds. While SIPs offer benefits like rupee cost averaging and compounding, ULIP plans provide the added advantage of insurance protection alongside wealth creation.

You may avail of tax benefits under Section 80C and Section 10(10D) of Income Tax Act, 1961 subject to conditions as specified in those sections. Tax benefits are subject to change as per tax laws. Customer is advised to take an independent view from tax consultant.

The calculation is generated on the basis of information provided and does not constitute an offer or solicitation for the purpose of purchase or sale of any product. Further customer is the advised to go through the sales brochure before conducting any sale.

Some ULIP instruments offer you an option of partial withdrawals. There are various conditions under which this can be done, but it varies from product to product.

Applicable Rider Charges will be deducted from the Fund value if the Riders are chosen. There are different rider options that can enhance your protection and it is recommended that you check them out.

If the policyholder does not agree to the terms and conditions mentioned in the policy document, he/she can always return the policy. This can only be done within 30 days of accepting the policy depending on the channel through which the policy was bought. This period is called free-look period and the insurance company should refund the premium to the policyholder.

There are a few charges which can be deducted before the refund-

The premium figures are net of Goods and Services Tax and Cess, as applicable. Goods and Services Tax and Cess rates are subject to change from time to time as per the prevailing tax laws and/or any other laws.

Tax benefits are subject to conditions specified under the Income-tax Act, 1961. Tax laws are subject to amendments from time to time. Customer is advised to take an independent view from tax consultant.

The Unit Linked Insurance Products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender /withdraw the monies invested in Unit Linked Insurance Products completely or partially till the end of the fifth year from inception. Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. Please know the associated risks and the applicable charges (along with the possibility of increase in charges), from your Insurance agent / Corporate Agent / Insurance Broker / Intermediary or policy document of the insurer. The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. All benefits payable under the Policy are subject to the Tax Laws and other financial enactments, as they exist from time to time.

This website content is not a brochure and only gives the salient features of the plan.

Kotak e-InvestUIN – 107L121V02, Kotak e-Invest; UIN – 107L121V02. This is a non-participating unit-linked life insurance individual savings product. Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. For more details on risk factors, terms and conditions please read the sales brochure carefully before concluding a sale.

Kotak T.U.L.I.PUIN: 107L131V02. This is a non-participating unit linked Life Insurance Individual Savings Product.

Kotak Invest MaximaUIN: 107L073V05. This is a non-participating unit linked Life Insurance Individual Savings Product.

Kotak Single Invest AdvantageUIN: 107L065V05, This is a Non-Participating Unit-Linked Life Insurance Individual Savings Product.

Kotak PlatinumUIN No.: 107L067V07. This is A Non-Participating Unit-Linked Life Insurance Individual Savings Product.

Kotak Wealth Optima PlanUIN: 107L118V03 This is a non-participating unit-linked life insurance individual savings product. For more details on risk factors, terms and conditions, please read sales brochure carefully before concluding a sale.

The assumed non-guaranteed rates of return chosen in the illustration are 4% p.a. and 8% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back as the value of your policy is dependent on a number of factors including future investment performance. The actual experience may be different from the illustrated. Please note that Bonuses are NOT guaranteed and may be as declared by the Company from time to time.

Kotak e-Invest Plus;UIN - 107L137V02. This is a non-participating unit-linked life insurance individual savings product.

Kotak Confident Retirement Savings Plan – UIN: 107N162V01 This is a participating non-linked pension individual savings plan. For more details on risk factors, terms and conditions, please read the sales brochure carefully before concluding a sale. This product is available for sale through online mode. Benefits under this plan are dependent upon the performance of the participating Funds. Please note that Bonuses are NOT guaranteed and may be as declared by the Company from time to time. The risk factors of the bonuses projected under the product are not guaranteed. Past performance doesn’t construe any indication of future bonuses. These products are subject to the overall performance of the insurer in terms of investments, management of expenses, mortality, and lapses.

Kotak Confident Retirement Builder – UIN: 107L136V02 This is a non-participating unit-linked pension individual savings product. For more details on risk factors, terms and conditions, please read the sales brochure carefully before concluding a sale. This product is available for sale through online mode.

Section 41-

Extract of Section 41 of the Insurance Act, 1938 as amended from time to time states: (1) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer. (2) Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakhs rupees.

Section 45-

Fraud Misstatement would be dealt with in accordance with provisions of Section 45 of the Insurance Act, 1938 as amended from time to time. Please visit our website for more details: Read more about section38_39_45_of_insurance_act_1938

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/ FRAUDULENT OFFERS

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

Regd. Office: Kotak Mahindra Life Insurance Company Ltd. Reg No. 107; CIN : U66030MH2000PLC128503; Regd. Office: 8th Floor, Plot # C- 12, G- Block, BKC, Bandra (E), Mumbai – 400051 | Website: www.kotaklife.com |

WhatsApp: 9321003007 | Toll Free: 1800 209 8800 | ARN No. KLI/25-26/E-WEB/468

Trade Logo displayed above belongs to Kotak Mahindra Bank Limited and is used by Kotak Mahindra Life Insurance Company Ltd. under license.

Grow your wealth effortlessly with our ULIP plan options now!